That is a section from the 0xResearch e-newsletter. To learn full editions, subscribe.

When Trump mentioned “tariff” became once the most luminous note within the dictionary, he neglected to mention that beauty is subjective.

Since Trump’s “reciprocal” tariff announcements on April 2, the S&P 500 is down about 10.6%.

Even gold, generally regarded as to be uncorrelated with equities, took about a 6.4% dive on the tariff news.

Crypto markets held up over the weekend, critical to each person’s surprise.

Many theories had been equipped for clarification.

Some suggested crypto resources showed resistance on anticipated price cuts and quantitative easing; some mentioned the equities selloff on Friday became once simply institutional outflows; and Galaxy’s Alex Thorn posited that BTC became once simply “tariff-proof.”

Yet, after this transient flirtation with the postulate that crypto resources would decouple from equity markets, it grew to alter into out to be pure hopium.

As the weekend drew to a terminate, bitcoin took a 6% nosedive on noon Sunday from $82.5k to its most up-to-date trading ranges of $77.2k. In the the same interval of time, ETH took a more durable tumble of 15.7%.

Down, nonetheless now not a anxiousness but, in accordance to CF Benchmarks’ head of product Thomas Erdösi. He notes that “CME basis stays agency above 6%, and the ask for shy away protection, as seen within the 25-delta skew, underscores cautious sentiment with out signaling anxiousness.”

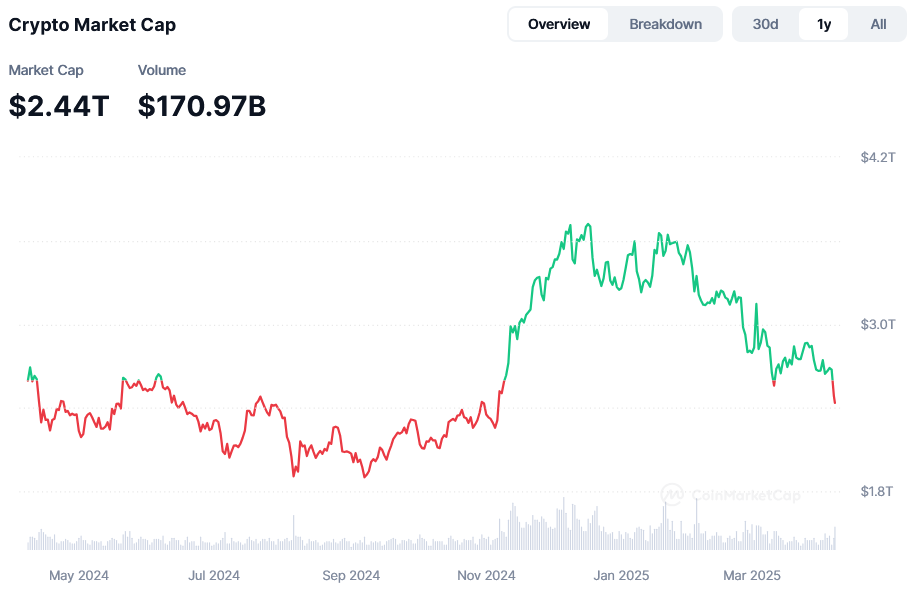

Total crypto market cap wiped to this point? About $0.23 trillion, or 8.6%.

At bitcoin’s most up-to-date value of $77k, that is about a steep 27.2% drawdown from January’s all time-highs of $106k, nonetheless silent a lovely gentle drawdown compared to past years. The pink part of the Glassnode chart demonstrates the outdated day’s drawdown relative to the closing cycle.

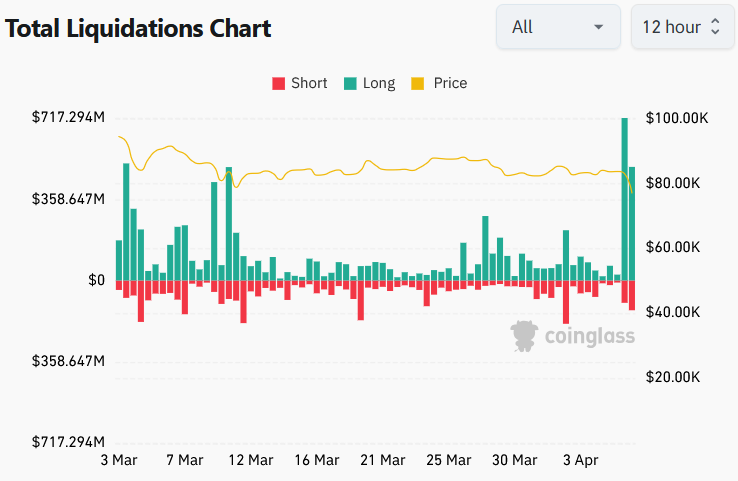

In accordance to CoinGlass recordsdata, complete estimated liquidations of crypto resources within the closing 24 hours equaled to about $1.42 billion. BTC saw about $479 million whereas ETH saw $418 million in liquidations.

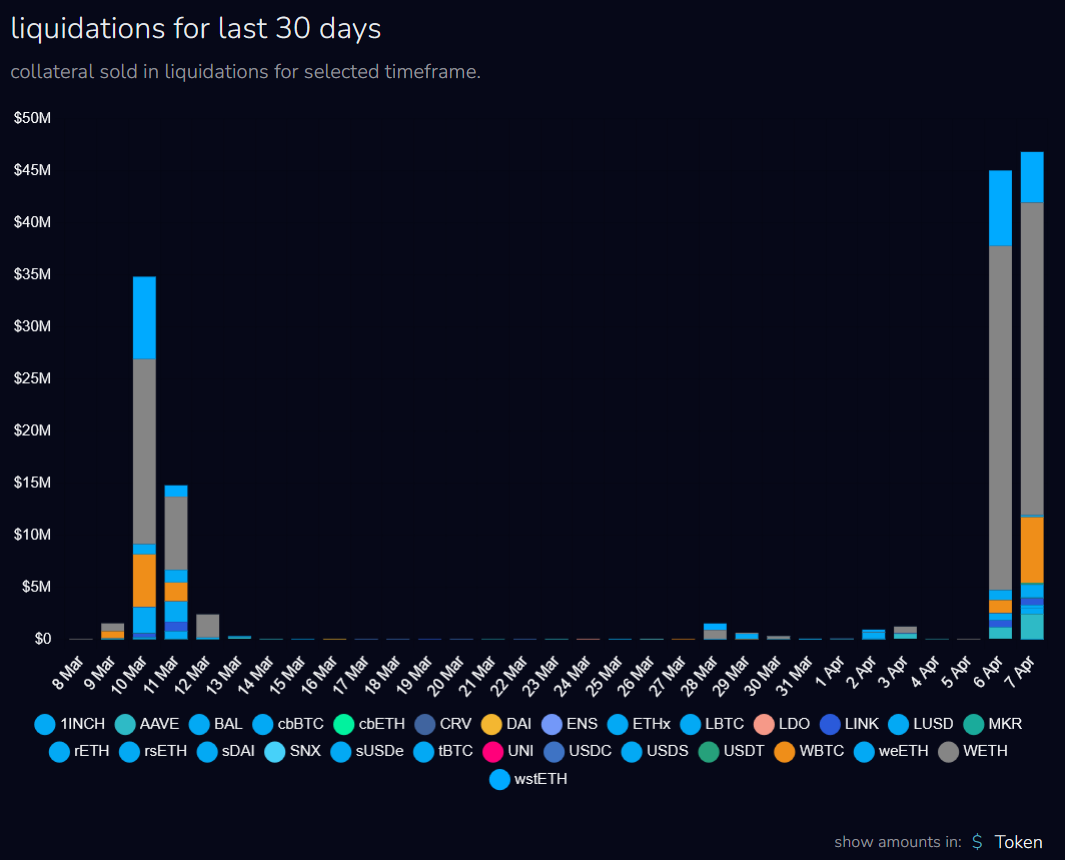

On the April 6 and 7, Aave v3 on Ethereum saw a total $91.85 million in liquidations and accumulated zero terrifying debt, in accordance to Blockanalitica recordsdata.