Switzerland has delayed imposing guidelines that may maybe maybe robotically exchange crypto narrative knowledge with in one more country tax agencies except 2027 and is serene deciding which worldwide locations this may maybe maybe fragment data with.

Crypto-Asset Reporting Framework (CARF) guidelines will serene be enshrined into guidelines on Jan. 1, 2026, as within the starting build deliberate, however may maybe even no longer be utilized except on the least a 365 days later, the Swiss Federal Council and Recount Secretariat for International Finance acknowledged on Wednesday.

It added that the Swiss authorities’s tax committee “suspended deliberations on the partner states with which Switzerland intends to exchange data in accordance with the CARF,” as the aim on the back of the extend.

The Organisation for Financial Co-operation and Pattern (OECD) authorised CARF in 2022 as share of a world push to fragment crypto narrative data with partnered governments in a affirm to curb tax evasion by strategy of crypto platforms.

The Swiss authorities’s announcement also highlighted a series of amendments to native crypto tax reporting guidelines, and transitional provisions “aimed at making it simpler” for domestic crypto corporations to comply with CARF guidelines.

In June, the Swiss Federal Council had moved forward with a invoice to undertake the CARF guidelines in January 2026, and acknowledged on the time that the first exchange of crypto narrative data would happen in 2027, however it absolutely’s now unclear when it plans to exchange knowledge.

75 worldwide locations signed up to CARF

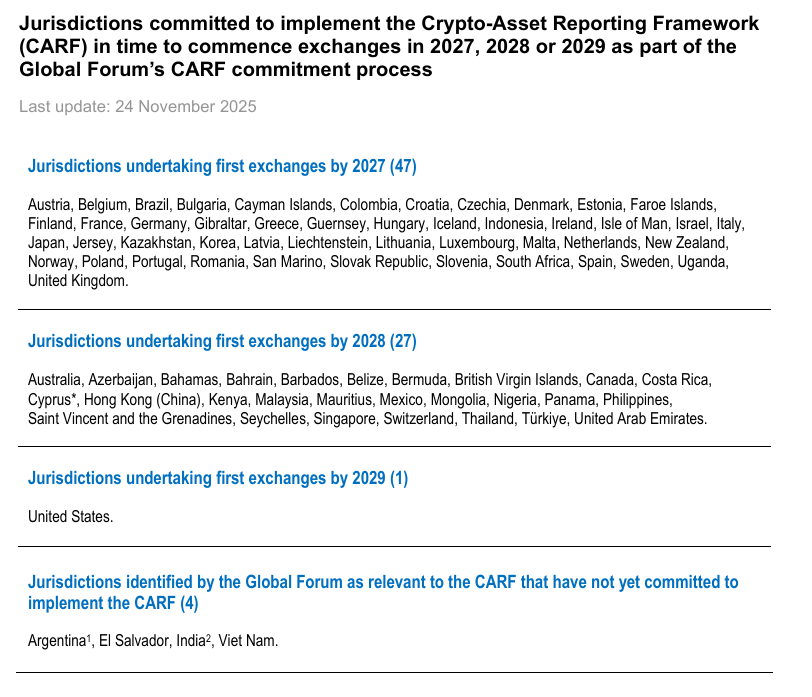

OECD documents allege 75 worldwide locations, including Switzerland, which enjoy signed on to create CARF over the subsequent two to four years.

Within the intervening time, it has earmarked Argentina, El Salvador, Vietnam and India as worldwide locations which enjoy yet to designate on.

Earlier this month, Reuters reported that the Brazilian authorities was as soon as weighing up a tax on world crypto transfers as share of push to align domestic guidelines with CARF standards.

Within the intervening time, the US White Home also no longer too long within the past reviewed the Interior Earnings Provider’s proposal to join CARF as share of a push to create extra stringent capital positive aspects tax reporting guidelines for American taxpayers using foreign exchanges.