At some level of the intraday procuring and selling session on June 2, Sushi’s (SUSHI) Age Consumed metric rose to a seven-day excessive, suggesting that beforehand dormant tokens own begun to commerce fingers.

This surge was followed by a rally within the altcoin’s assign, signaling that a assign bottom is presumably in.

Sushi Dormant Addresses On the Transfer

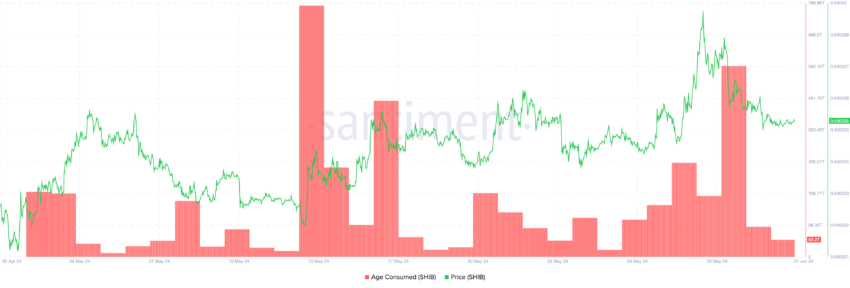

On-chain knowledge confirmed that on June 2, 196,000 dormant SUSHI tokens own been moved, as indicated by the spike within the altcoin’s Age Consumed metric.

This metric tracks the breeze of its long-held coins. It is a necessity because it affords insight into the behavioral shifts of an asset’s long-timeframe holders. This neighborhood of traders infrequently strikes their dormant coins round. Then all over again, it is great after they attain because it recurrently precedes a shift in market developments.

When the metric rises, it capability that many tokens are changing fingers after being left untouched for an prolonged duration. Conversely, when it falls, it capability that indolent coins are left unmoved.

The metric is seen as a decent marker of an asset’s local assign bottom, in particular when a spike in its price is followed by a surge in its assign.

This has performed out in SUSHI’s case, because the altcoin’s price has surged by 5% since it bottomed at $1.11 for the duration of the procuring and selling session on June 2. As of this writing, SUSHI exchanged fingers at $1.16.

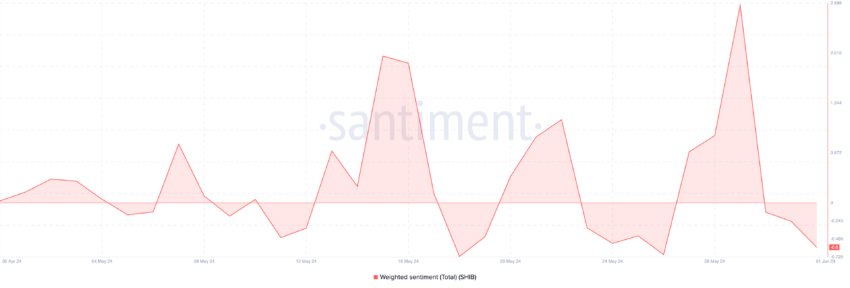

While this can even own offered a procuring for opportunity, bearish sentiments continue to recede SUSHI. As of this writing, the token’s weighted sentiment was -0.516.

Learn more: How To Expend SushiSwap: A Step-by-Step E book

This implies that most social media discussions round SUSHI are scandalous by a negative bias toward the altcoin.

SUSHI Designate Prediction: Now Would possibly presumably well also No longer Be The Time

Moreover to to SUSHI’s negative weighted sentiment, readings from its key technical indicators confirmed the bearish outlook.

As an illustration, its assign on the second trades below its 20-day Exponential Transferring Moderate, signaling a consistent decline in procuring for tension.

When an asset’s assign falls below this key bright average, it trades at a level lower than its average assign within the previous 20 days.

Confirming the decline in SUSHI procuring for tension, its Relative Power Index (RSI) was 49.65, below its 50-neutral assign. At this price, this momentum indicator suggested that SUSHI traders favored selling their present holdings in preference to procuring for new tokens.

If this selling style continues, SUSHI could perhaps lose its most fresh positive factors and descend below $1 to commerce fingers at $0.88.

Then all over again, if this is invalidated and procuring for tension picks up momentum, the token’s assign could perhaps climb toward $1.22.