SUI blockchain has been gaining traction in fresh weeks, and its market cap is now drawing near $7 billion. Fueled by meme coin recount and rising DeFi engagement, the network has viewed a essential leap in DEX volume and technical momentum.

While indicators worship RSI and EMA traces demonstrate early indicators of a likely pattern shift, total strength stays blended. SUI sits at a key crossroads—supported by non everlasting excitement however soundless desiring stronger confirmation to self-discipline high-tier chains.

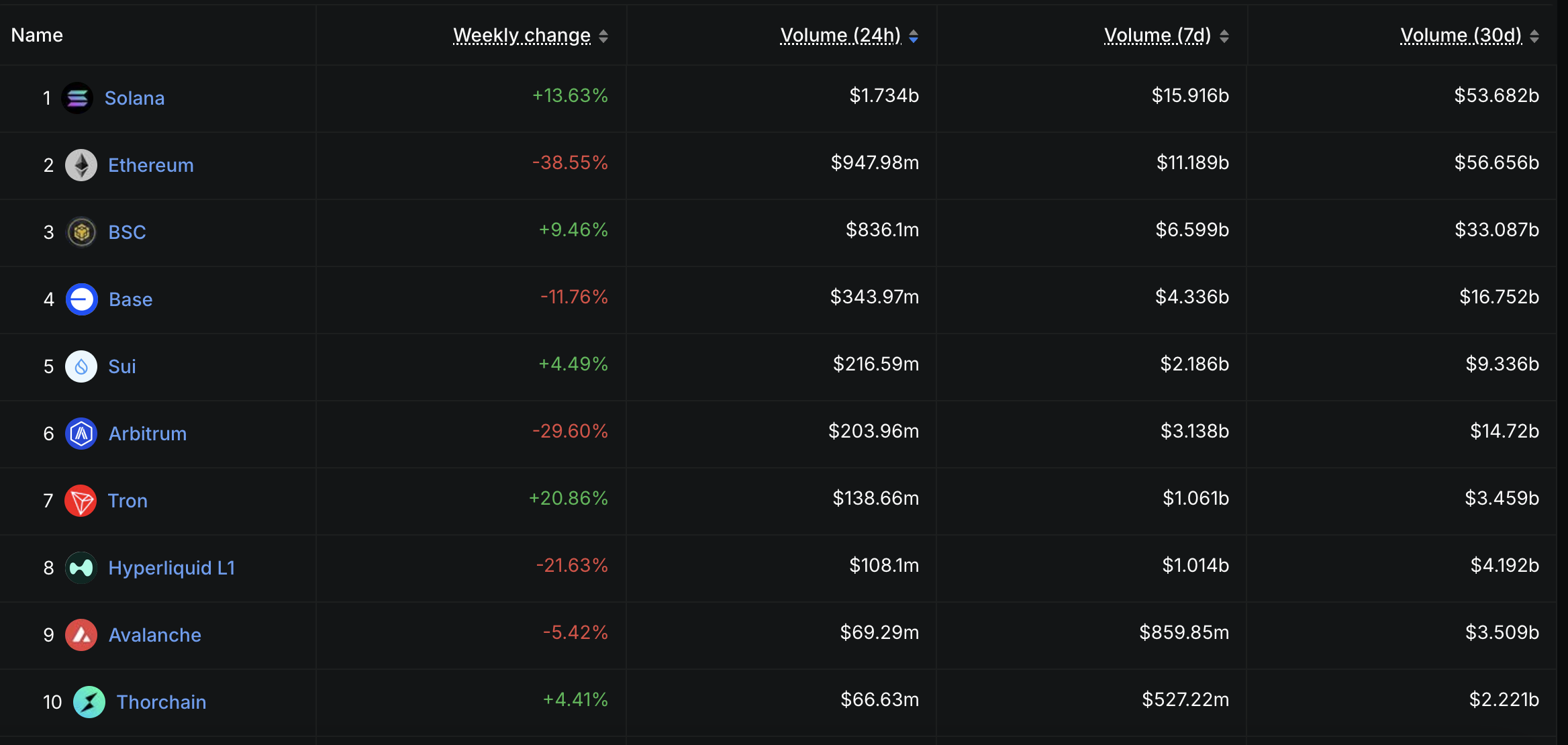

SUI Surges to 5th in DEX Volume, But Serene Trails Top Chains

SUI’s fresh surge in DEX recount has grabbed attention, largely fueled by rising hobby in meme coins and speculative trading on its ecosystem. Over the last seven days, SUI’s DEX volume hit $2.1 billion, marking a 4.49% develop and continuing its staunch upward pattern.

This momentum has helped SUI outperform a range of ecosystems, most notably surpassing Arbitrum within the past 24 hours to turn out to be the fifth-largest chain by DEX volume.

However, no topic the non everlasting gains, SUI soundless trails effectively within the advantage of high-tier networks worship Terrible, BNB Chain, Ethereum, and Solana in total DEX recount.

These established ecosystems proceed to dominate via liquidity, user unpleasant, and total transaction volume.

While SUI’s rise is essential, in particular given its fairly new procedure within the DeFi ecosystem, this can want to withhold this enhance and diversify beyond meme coin hype to in fact self-discipline the main players.

For now, it stays an exhilarating underdog with momentum—however no longer yet a critical contender.

SUI Momentum Rebuilds, But Model Remains Susceptible

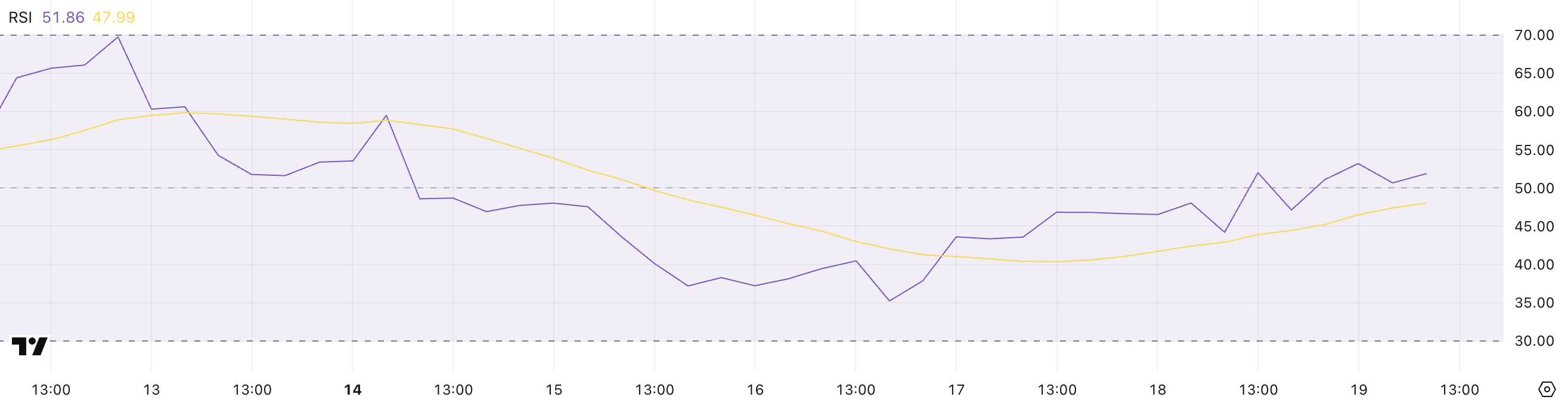

SUI’s RSI is now at 51.86, up from 35.22 fair three days ago. This implies shopping rigidity has returned after a non everlasting dip, serving to stabilize mark action.

The Relative Strength Index (RSI) measures momentum on a scale from 0 to 100. Readings above 70 are thought about overbought, whereas those below 30 demonstrate oversold stipulations.

Sitting advance the midpoint, SUI’s RSI capabilities to neutral momentum. It hasn’t crossed above 70 in almost a month, exhibiting that bullish strength has remained dinky.

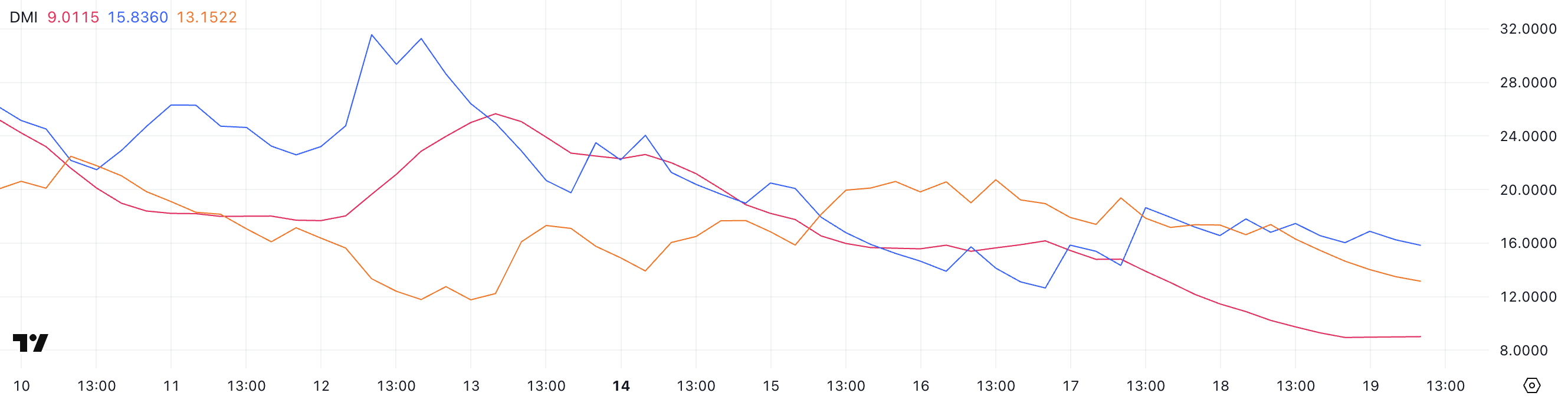

In the meantime, SUI’s DMI (Directional Fade Index) presentations that its ADX is down to 9 from 14.Seventy 9 fair two days ago. The ADX measures pattern strength, and the relaxation below 20 signals a passe or nonexistent pattern.

The +DI is at 15.83 whereas the -DI is at 13.15, which advance investors bear a little edge—however the low ADX means that edge isn’t strong. There’s no obvious pattern dominating the market correct now.

Together, the RSI and DMI indicate that SUI is in a consolidation section. Investors are exhibiting some recount, however no longer ample to believe a mighty, sustained pattern—at the very least for now.

EMA Setup Serene Bearish, But SUI Bulls Checklist Signs of Life

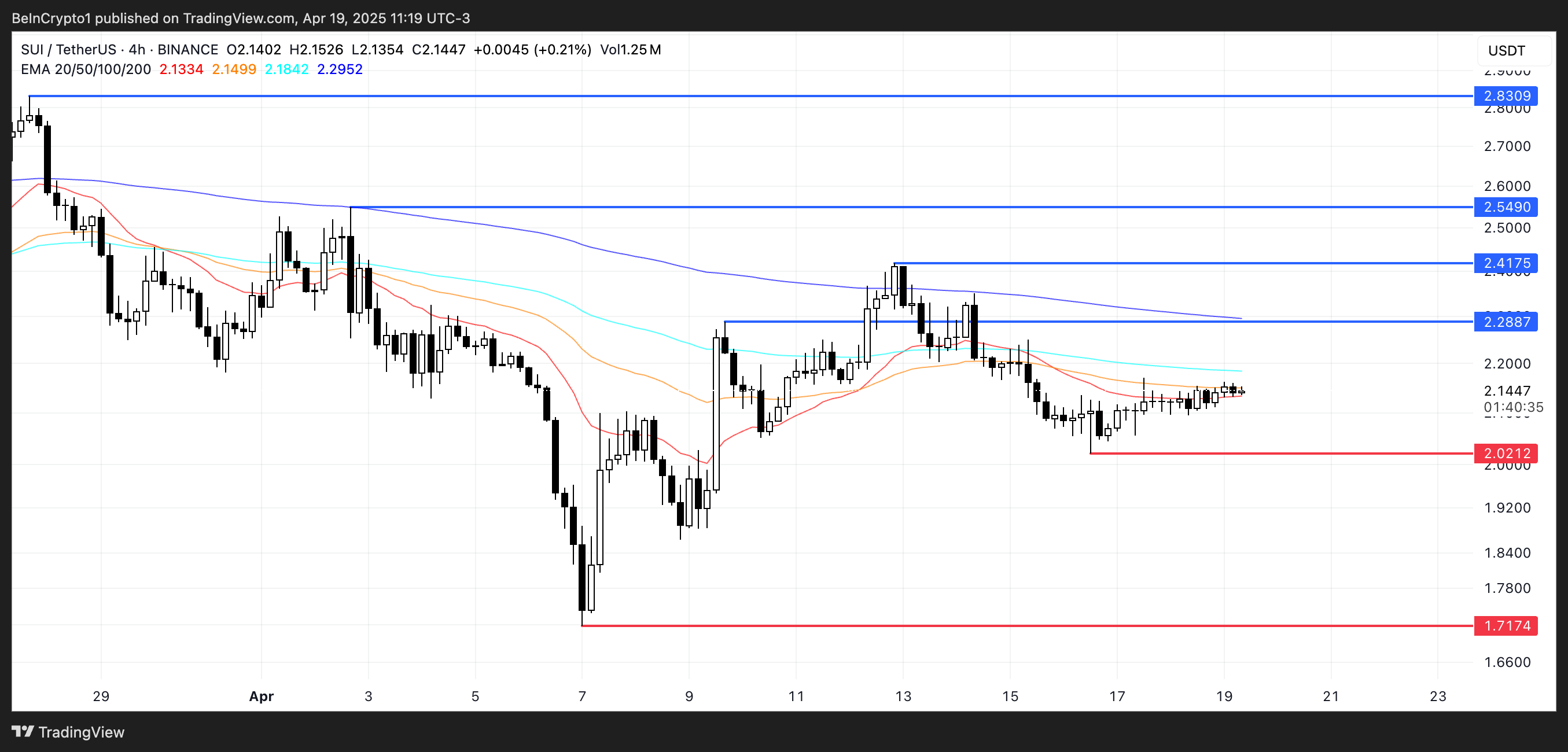

SUI’s EMA traces are soundless exhibiting a bearish setup, with non everlasting averages sitting below the prolonged-time length ones. However, the outlet between them has narrowed, and a likely golden immoral will be forming.

A golden immoral occurs when a non everlasting EMA crosses above a prolonged-time length one, generally viewed as a bullish signal. If this plays out, SUI could likely create momentum and push toward the $2.28 resistance level.

Breaking above that could likely open the path toward $2.41 and $2.54. If bullish momentum builds additional, SUI blockchain could likely even take a look at the $2.83 level—its absolute best since early March.

But when the market fails to defend latest levels and promoting rigidity returns, a correction could likely open up. If that is so, it could most likely well likely plunge advantage to take a look at the $2.02 reinforce.

Losing that reinforce could likely bring deeper map back, doubtlessly pushing SUI toward $1.71. For now, mark action is at a serious level, with both breakout and breakdown eventualities on the desk.