SUI label is trading at $2.8 amid a broader market retracement, however analysts and on-chain files counsel the token is forming a attainable reversal sample.

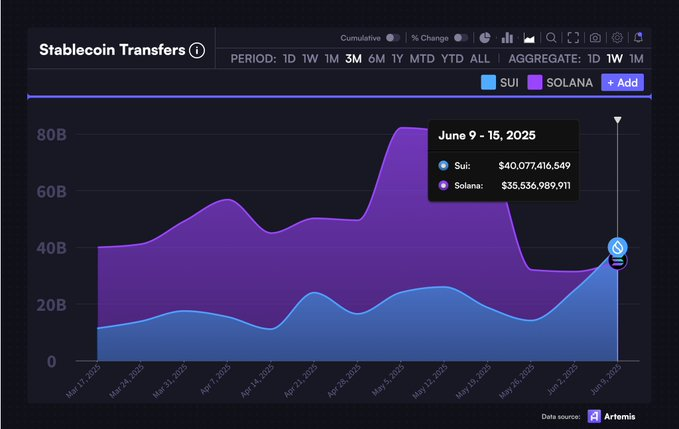

With stablecoin transaction quantity hitting a brand new high and outperforming Solana closing week, SUI coin would be positioned for renewed bullish momentum if fresh crimson meat up phases retain.

SUI Label Assessments Key Give a increase to Zone

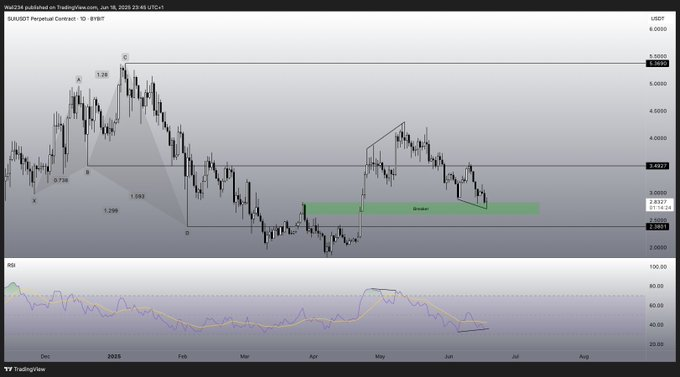

SUI label fresh constructing is pulling aid toward a severe Fibonacci crimson meat up zone. Analyst Man of Bitcoin has identified a 1-2 setup, which would possibly well perhaps imply that the asset is at a corrective stage sooner than a that probabilities are you’ll well perhaps presumably maintain of impulsive leg up.

His chart indicated the price scaling into an subject of $2.62 and 1.87, with the pause of invalidation at 1.718.

This sample finds crimson meat up at diverse Fibonacci retracement phases, in particular 0.618 to 0.786 bands regularly considered as high-probability soar zones. SUI coin label is already reaching that low volatility, quantity compression subject, indicating that probabilities are you’ll well perhaps presumably maintain of accumulation.

Nonetheless, failure to spoil below the $1.718 makes the constructing proper. Ought to the crimson meat up retain, then the next wave would possibly well perhaps purpose at phases closer to $3.40 and per chance previous.

The new style in prices mirrors the first quarter of 2024, the save the altcoins with basically the most productive prices started a reversal in a identical subject and recorded a upward thrust of 40% over two weeks.

SUI Label Breaker Block Validates Zone

In conjunction with to this configuration, analyst Waleed Ahmed pointed to a prolonged-length of time breaker block of $2.30 to $2.80. SUI label is at this time resting on the tip of that block, which in March 2025 had served as resistance. This zone is now being retested as crimson meat up.

The on daily basis RSI has dipped below 40, historically marking reversal positive aspects in prior SUI coin label cycles. As prolonged as a label stays with this breaker block and RSI recovers above the 50 line, it would possibly well perhaps trigger the next impulsive motion.

Volume indicators also repeat diminishing rigidity in the sell facet, which is continuously an indicator of a style reversal. Ought to the bulls re-enter round $2.70, then a circulation to the $3.40 resistance line is a feasible target.

SUI Surpasses Solana in Weekly Stablecoin Transfers

Beyond technical prognosis, on-chain metrics repeat proper underlying development. Per Artemis files, SUI processed $40.07 billion in stablecoin transfers from June 9–15, overtaking Solana’s $35.fifty three billion for the identical length. This marks the first time SUI has led on this class.

Stablecoin transfer quantity is basically the most necessary metric that measures true network utilization. Sui upward thrust is a signal of an increasing hobby in its DeFi makes use of and high-velocity Layer 1 network.

Liquidity is being progressively moved to SUI by builders as the expenses and gentle throughput are bright.

This on-chain energy supports label steadiness even at some level of corrections. A increased utilization of stablecoin positive aspects to an expand in TVL price in protocols in retaining with the Sui network.

This, blended with a roadmap of scaling, will build apart SUI in a aggressive residing as a Layer 1 at some level of the next bullish cycle.

Market Metrics Show Resilience

Meanwhile, SUI coin reached the 12th residing in market capitalization to $9.57 billion, and 24-hour commerce quantity portions to $965.8 million.

Its totally diluted valuation (FDV) stands at $28.17 billion, with a circulating provide of 3.39 billion out of 10 billion whole tokens. A Vol/Mkt Cap ratio of 10.18% signifies that there is realistic valuation trading yelp.

Even supposing the SUI label fell by 16% in the closing 7 days, it’s aloof contained within the longer-length of time consolidation vary.

SUI label reached a high of over $4.40 in April 2025, on the opposite hand it’s at this time at a that probabilities are you’ll well perhaps presumably maintain of retracement stage and exhibiting signs of re-accumulation.