- Sui has hit a $14.8 billion monthly DEX quantity no subject build stagnation.

- The $223 million Cetus exploit has shaken Sui’s market self perception.

- The value of SUI is for the time being struggling to spoil past the $3.87–$4.13 resistance range.

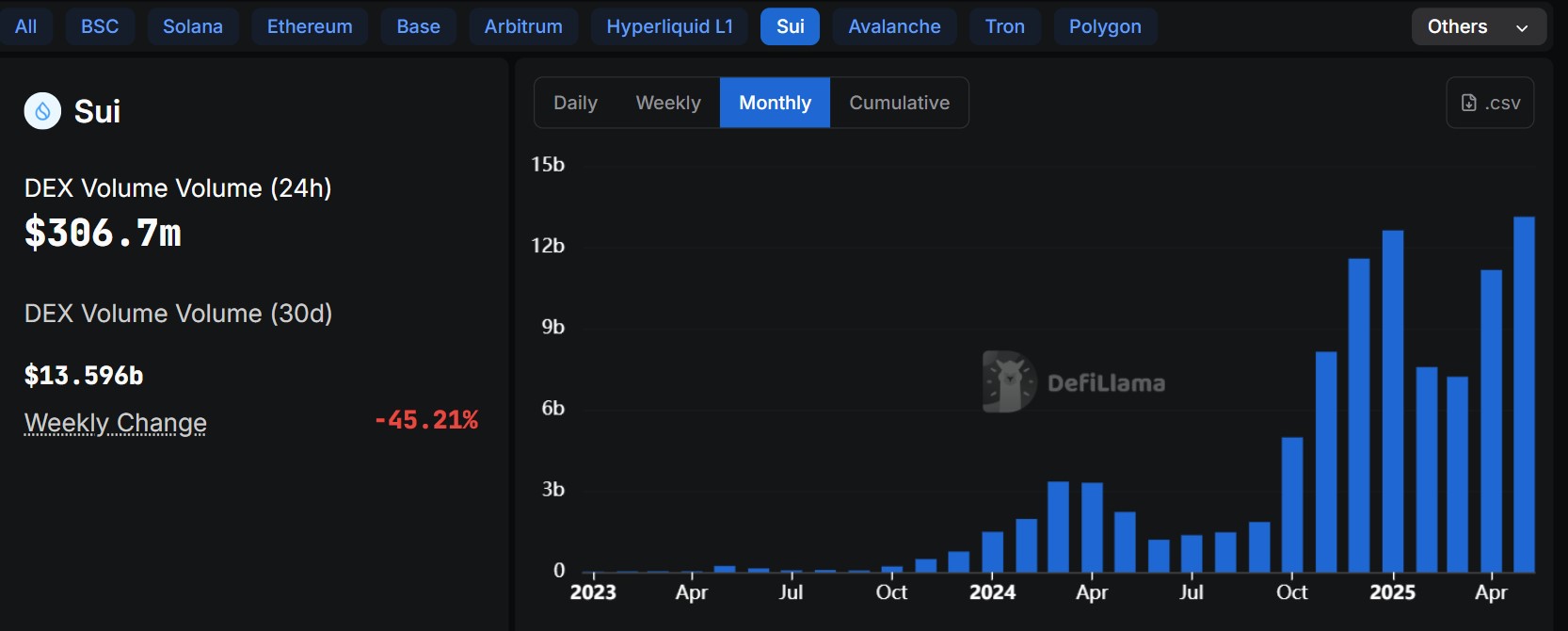

No subject a weekly tumble of forty five.21%, Sui has reached a historical milestone, recording its perfect-ever monthly decentralised commerce (DEX) quantity at $13.596 billion, even because the Cetus security exploit solid a shadow over Sui’s surging DeFi momentum.

The unparalleled spike in trading activity in Would possibly well also, which marked nearly about a fourfold amplify from Sui’s historical monthly practical of $3.93 billion, signals intensifying hobby in its rising ecosystem and the strength of its DeFi protocols.

SUI build analysis amid the Cetus hack aftermath

No subject this mighty metric, SUI’s build failed to have a study swimsuit, struggling to spoil past a key resistance zone and closing in consolidation just staunch beneath the $3.87 stage.

Impress efficiency has lagged even amid in actual fact handy on-chain signals, suggesting that merchants remain cautious following the most traditional Cetus Protocol exploit that shook self perception in the ecosystem.

The exploit, which focused Cetus Protocol—a leading DEX on the Sui network—seen attackers manipulate build oracles to extract roughly $223 million value of resources from liquidity pools.

Following the breach, emergency measures had been without note enacted, along with halting affected tidy contracts and freezing roughly $162 million in stolen funds across the blockchain.

Even supposing an even portion of the funds used to be successfully frozen, attackers laundered the remainder by method of somewhat just a few bridge pathways, complicating recovery efforts.

In response, the Sui Foundation prolonged a secured monetary mortgage to Cetus, permitting the protocol to launch up compensating affected customers while making prepared a broader restitution framework.

This compensation initiative, while timely, hinges on a personnel governance vote that will resolve whether or no longer the frozen funds may per chance well moreover be repurposed toward beefy user recovery.

Because the personnel awaits the pinnacle consequence of the vote, the exploit has solid a shadow over Sui’s broader DeFi sector, sparking renewed scrutiny of oracle mechanisms and audit standards across protocols.

Meanwhile, the native CETUS token plunged nearly about 40% in the aftermath of the exploit, as frightened investors exited positions amid shaken self perception and broader market dismay.

Even so, Sui’s Complete Cost Locked (TVL) surged to $2.406 billion, rising 2.51% in precisely 24 hours, which implies that longer-term participants are persevering with to inject capital into Sui-essentially based completely protocols.

Predicament float knowledge moreover printed snug accumulation behaviour, with procure inflows of $1.31 million hinting that some investors are positioning for an extended-term rebound no subject shut to-term volatility.

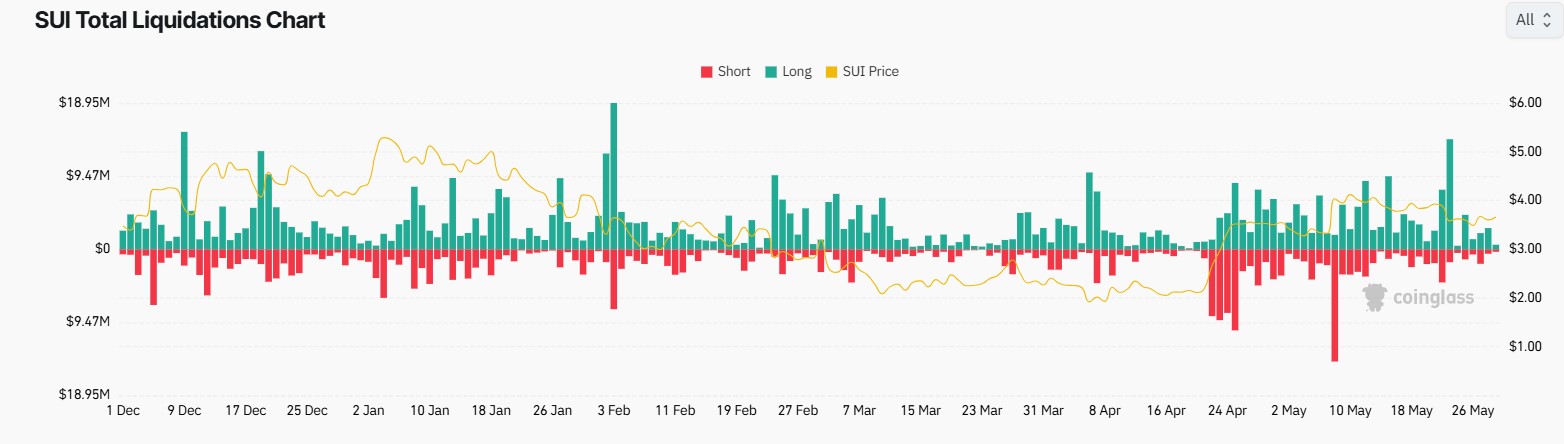

However, launch hobby has dropped by 1.58% to $1.77 billion, signalling that speculative merchants are stepping help, probably reducing leverage or taking profits amid risky immediate-term conditions.

SUI build forecast

Technically, SUI has struggled to preserve bullish momentum, with the MACD indicator reflecting a weakening construction as histogram bars go and signal lines converge shut to impartial territory.

The value hovered spherical $3.69 at press time, but it remained boxed within the $3.87 to $4.13 Fibonacci resistance zone—a unfold it has failed to spoil for several weeks.

On shorter timeframes, the token has re-entered a descending wedge sample, while exponential interesting averages between $3.59 and $3.62 are now acting as immediate-term resistance parts.

Ought to accrued the build tumble beneath $3.50, scheme back targets shut to $3.30 or $3.20 may per chance well become extra and extra probably, in particular if selling tension intensifies from liquidation clusters.

CoinGlass knowledge highlighted dense liquidation zones between $3.60 and $3.87, creating friction parts that in most cases stop in resistance as merchants defend against compelled liquidations.

Alternatively, if bulls build of living up to spoil by method of this zone, the chance of a immediate squeeze may per chance well propel the build without note toward greater Fibonacci phases, presumably shut to $4.97.

Now not at once, no subject the Cetus setback, the fundamentals underpinning Sui’s bellow remain intact, as evidenced by its soaring DEX quantity, rising TVL, and ecosystem resilience.

However, unless SUI convincingly clears the $3.87–$4.13 resistance range with solid quantity, the build may per chance well remain range-journey no subject the checklist-breaking metrics.

As governance discussions proceed and the market processes the aftermath of the exploit, all eyes will be on whether or no longer sentiment can get better like a flash ample to maintain the chain’s DeFi momentum.