Judging by rising institutional ardour and capital influx, Sui (SUI) will be a ‘core pillar’ of the upcoming bull cycle, basically basically based on cryptocurrency analyst Michaël van de Poppe.

Accordingly, van de Poppe argued on June 9, that is handiest a subject of time until we explore a original all-time excessive for SUI.

“SUI remains to be one amongst the core pillars of the upcoming bull cycle… It’s a subject of time until this one continues to rally in opposition to a original ATH.” — Michaël van de Poppe.

As per CoinMarketCap, SUI now ranks as the ninth perfect blockchain by whole rate locked (TVL). Suilend, a decentralized lending protocol built on Sui, has also considered a minimal of a 90% enlarge in TVL over the final month, locking in a whole of $700 million.

Likewise, Bitcoin (BTC)-linked resources now legend for over 10% of SUI’s TVL, while a whole lot of monetary establishments personal filed for a SUI-basically basically based substitute-traded fund (ETF).

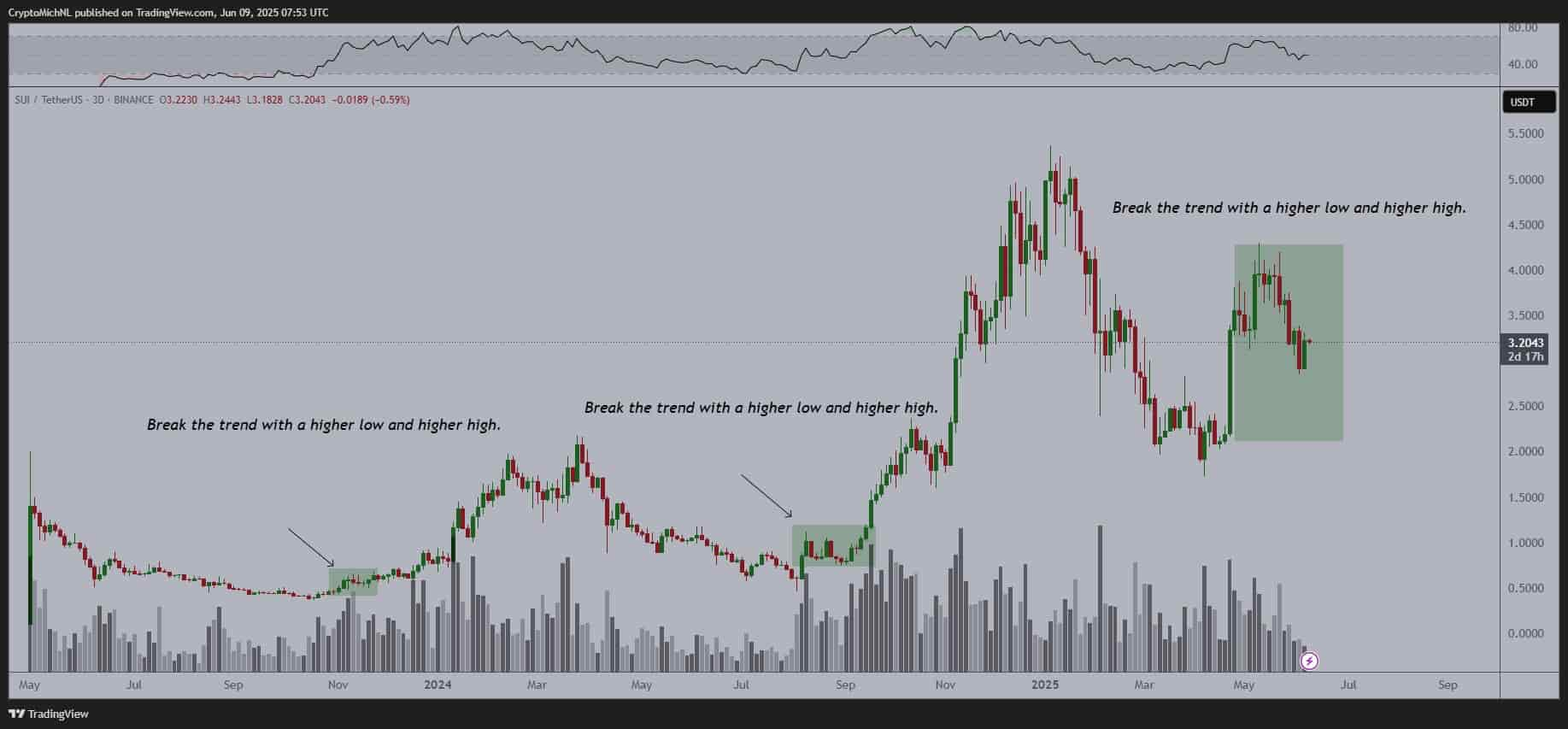

SUI efficiency

While a gigantic share of Sui’s enhance is attributable to BTC-pegged resources and protocols love Babylon and Lombard, the community also boasts over $1.1 billion in circulating stablecoins. The relative strength indicator (RSI) remains just at 44.

Moreover, its weighted funding rate has remained certain for 9 consecutive days, and the SUI token is breaking out of a long wedge pattern. Each these facts repeat a consistent bullish pattern.

Plot more notably, SUI has currently proven a golden immoral pattern. That’s, its short-time duration (50-day) shifting moderate crosses above the longer-time duration (200-day) shifting moderate. This pattern is broadly actually apt an early indicator of a sustained uptrend. In 2024, it preceded SUI’s 380% rally.

On the different hand, traders would possibly additionally level-headed live cautious. Regulatory uncertainty around the delayed SUI ETF approval, as an illustration, remains a conclude to-time duration possibility. What’s more, the golden immoral pattern is rarely any longer an infallible benchmark.

Featured image by Shutterstock