Between July 2023 and January 2024, the focus of bitcoin and ethereum in institutional digital asset portfolios elevated from 50% to 80%, the latest Bybit particular person asset allocation advise has proven. Correct thru this era, establishments perceived to be extra bullish on ethereum than bitcoin, a sentiment that contrasted with that of retail merchants.

Stablecoins and Altcoins Comprise One-Fifth of Institutional Digital Asset Portfolios

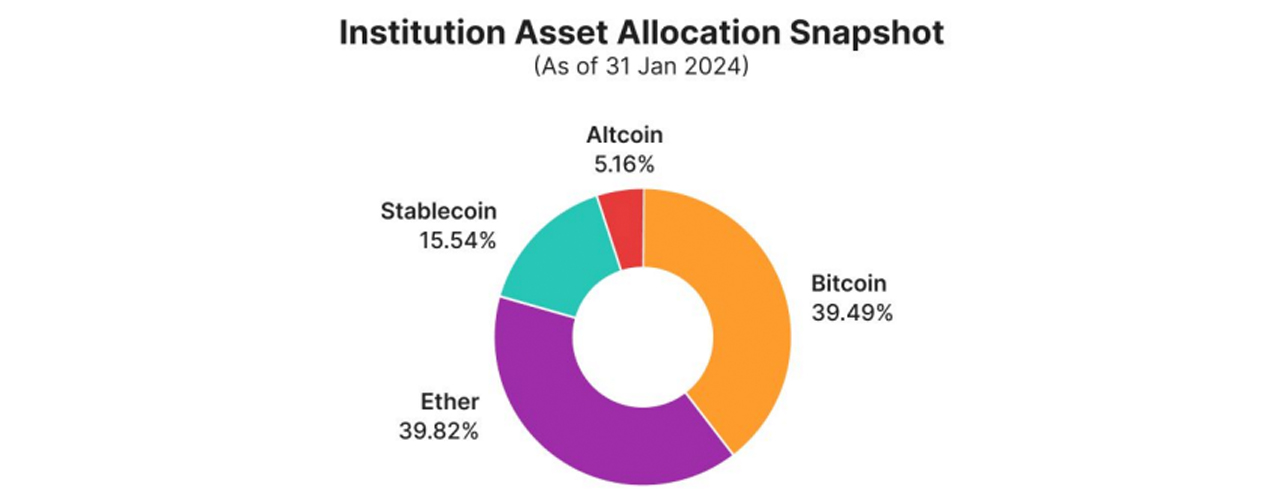

In accordance with the digital asset exchange Bybit’s latest particular person asset allocation advise, between July 2023 to Jan 2024, the proportion or focus of bitcoin (BTC) and ether (ETH) in establishments’ digital asset portfolios grew from 50% to 80%. The info indicates that every of these cryptocurrencies accounts for half of of this latest allocation figure, with stablecoins and altcoins making up the supreme 20%, at 15% and 5% respectively.

While the elevated focus of BTC and ETH in institutional portfolios would be interpreted as a bullish sentiment in direction of these main crypto resources, the crypto exchange platform’s 2024 advise suggests the pendulum is exciting from bitcoin to ether.

“Institutions are making a wager immense on ether. The pattern begins in September 2023 and speeds up in January 2024 to round 40%. Ether is the single largest retaining by INS [institutions] as of 31 Jan 2024. The over-allocation to ether might presumably well prefer to discontinuance with establishments’ anticipation of the sure impact of the Dencun give a clutch to on Ethereum in the context of the relative underperformance of ether in 2023,” the advise concluded.

The advise also highlights the seemingly approval of situation ethereum exchange-traded funds (ETFs) as a contributing element to establishments’ rising curiosity in the crypto asset. On the alternative hand, the reduction in bitcoin allocation by these establishments, which seemingly began in early December 2023, coupled with an amplify in their ETH holdings, appears to be like to aid the advise’s claims.

Institutions Simply about Exit All Positions in Meme and AI Tokens

In distinction to their institutional counterparts, retail merchants’ focus in BTC and ETH finest averaged 35% as of Jan. 31, 2024. In accordance with the advise, the sort of focus aligns with the “distinct investment vogue” of retail merchants, which appears to be like to prioritize altcoins and cash or stablecoins.

No subject their lower common BTC and ETH focus, retail merchants are then again extra bullish on bitcoin than ethereum, the advise acknowledged.

Turning to establishments’ allocation of capital to meme tokens, synthetic intelligence (AI) tokens, and BRC-20 tokens, files from the Bybit peep indicates that establishments had “nearly completely exited positions in these extremely unstable token categories.”

What are your thoughts on this account? Enable us to know what you suspect in the feedback share beneath.