The sports actions change is in a speak of pains following the arrest of bigger than 30 of us eager with the Nationwide Basketball Affiliation (NBA).

The investigation, described as “thoughts-boggling” by the FBI Director Kash Patel, has spanned 11 states and includes millions of dollars allegedly made by unlawful making a guess and game rigging one day of the 2023–2024 season.

In accordance to the prosecutors, the plan eager insider recordsdata and organized crime activity, unfavorable the recognition of the league on quite loads of fronts.

Given the scope of the subject, the request for consumers with exposure to the sports actions change is easy: What stocks to leer after the NBA’s making a guess scandal?

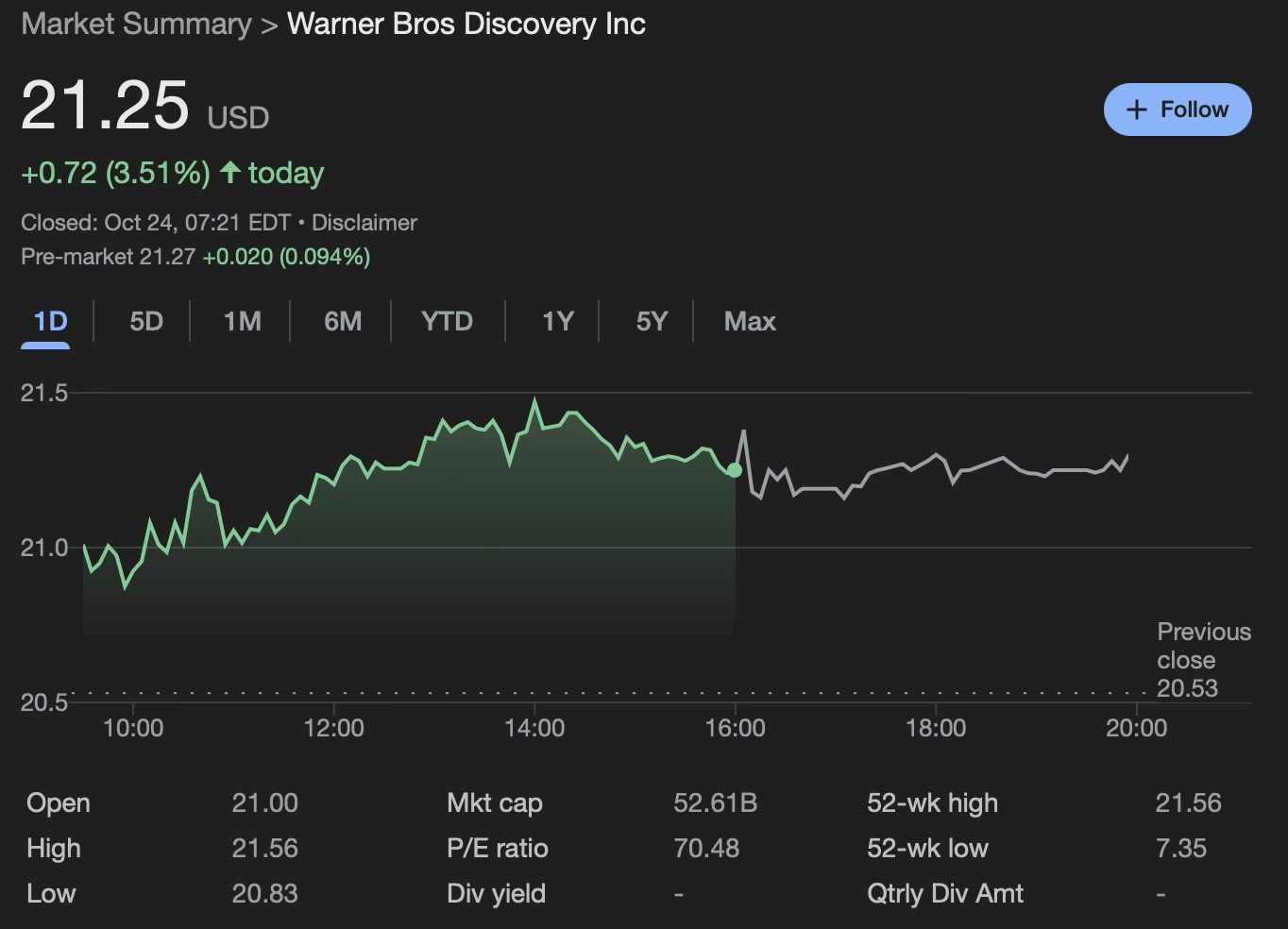

Warner Bros (WBD)

Even handed one of many NBA’s essential broadcasting companions, Warner Bros (NASDAQ: WBD) appears to be like totally unshaken by the federal probe. On the contrary, it has been posting nothing but beneficial properties this year, its stock having nearly doubled since January and trading at $21.25 on the time of writing, up one other 3.5% on the each day chart.

Alternatively, the firm’s future trajectory now lies in a steadiness, as quite loads of candidates are reportedly having a focus on about to buy a half or all the firm. For instance, Warner Bros has already rejected three Paramount Skydance takeover affords, the final of which came in at moral below $24 per share.

The administration told CNBC on Tuesday, October 21, that it would proceed reviewing all coming bids, while on the identical time enchanting ahead with the fresh plans to separate into two separate entities, namely a streaming and studios business platform and a world networks business.

This diagram, stated CEO David Zaslav, will enable the media huge “to establish the preferrred direction forward” and “unlock the elephantine value of our sources.” No subject the future might possibly well maybe furthermore carry, WBD is thus no doubt worth keeping an thought on.

Madison Sq. Garden Sports (MSGS)

Madison Sq. Garden Sports (NYSE: MSGS) is a number one sports actions keeping firm managing the Original York Knicks. Whereas no longer as robust as Warner Bros, MSGS has furthermore been on an upward pattern, the stock climbing nearly 18% over the past six months and trading at $226.16 at press time, up 0.29% on the day and zero.24% in pre-market.

MSGS is a critically sharp case as its Q3 earnings file is immediate imminent, scheduled for November 7. Whereas the Knicks don’t look like focused on the making a guess controversy straight, a perceived decline in self belief toward the league at broad might possibly well maybe furthermore theoretically stress the stock, as might possibly well maybe furthermore any novel, possibly detrimental discoveries on the investigators’ half.

Alternatively, it is a long way furthermore worth noting that the crew’s efficiency this season has no longer in fact affected the manager’s stock that grand. Namely, the Knicks saw their first Jap Conference Finals look in 25 years, but even with the 2026 title now in play, Madison Sq. Garden Sports shares occupy finest climbed 3.4% over the past year.

What’s more, the running margins remain slim. The firm reported a blended $22.6 million loss on the cease of the old fiscal year, despite playoff income. Also, the two groups are worth around $13.5 billion in total, while MSGS trades at finest $6.6 billion in project value.

That is, MSGS affords exposure to the NBA at a deep cut again model, and the share costs might possibly well maybe furthermore high-tail up if the hole between public and interior most valuations manages to terminate, critically if the desires of a novel title are realized, but there are a form of components at play now, making it hard to foretell how the plan back might possibly well maybe furthermore originate. Nonetheless, the stock is worth looking out at in the weeks to return.

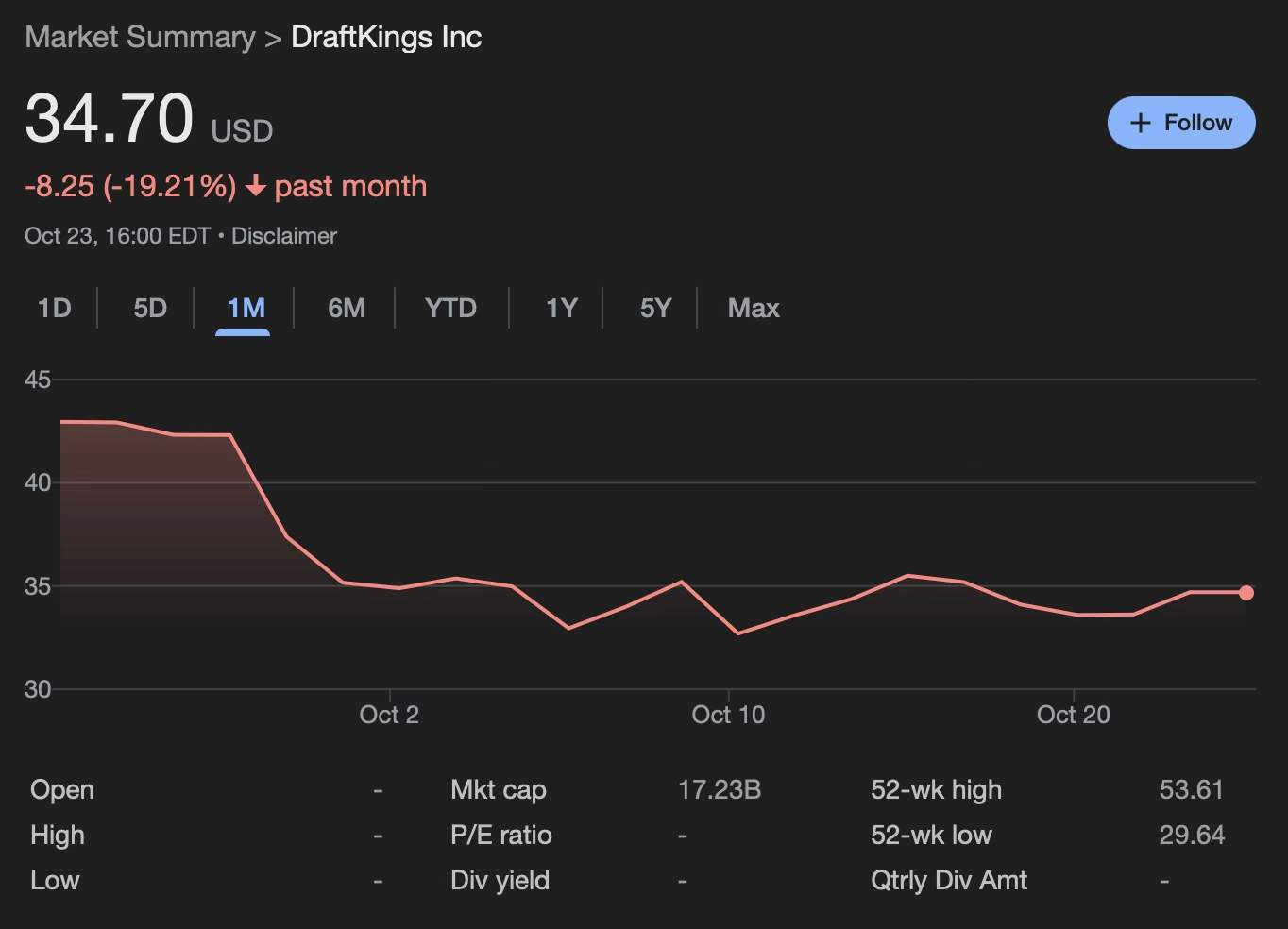

DraftKings (DKNG)

DraftKings (NASDAQ: DKNG), a favored Boston-basically basically basically based making a guess firm preserving the NBA and a form of essential American sports actions leagues, has been struggling in fresh weeks, its stock plummeting nearly 20% on the month-to-month chart and trading at $34.70 at e-newsletter time.

With the integrity of sports actions making a guess now severely impacted, DraftKings finds itself in an essential more precarious residing, its shares being in threat of further losses. Nonetheless, some fresh strikes are drawing renewed investor attention, most critically the firm’s first essential foray into prediction markets by a strategic partnership with Polymarket.

Congrats to @DraftKings on their acquisition of @RailbirdHQ.

We’re proud for Polymarket Clearing to be their designated clearinghouse as they enter the prediction market dwelling.

— Shayne Coplan 🦅 (@shayne_coplan) October 22, 2025

Extra precisely, DraftKings plans to open its novel DraftKings Predictions mobile app in the arriving months, preserving markets across finance, culture, and leisure. Polymarket itself is for the time being in early talks to take capital at a $12–15 billion valuation, a substantial enlarge from the June 2025 valuation of $1 billion. Expectedly, existing backers and possible novel consumers alike are paying terminate attention to the making a guess platform.

Featured image by Shutterstock