By Jamie Crawley (All conditions ET unless indicated in every other case)

Bitcoin BTC$87,469.59 confirmed signs of a Thanksgiving week rally on Monday, nearly reclaiming $90,000 and offering a ray of hope that the weekend’s recovery from beneath $85,000 can also change into something barely more sustained. The optimism modified into once short-lived, with BTC losing attend to $87,000 all around the European morning Tuesday.

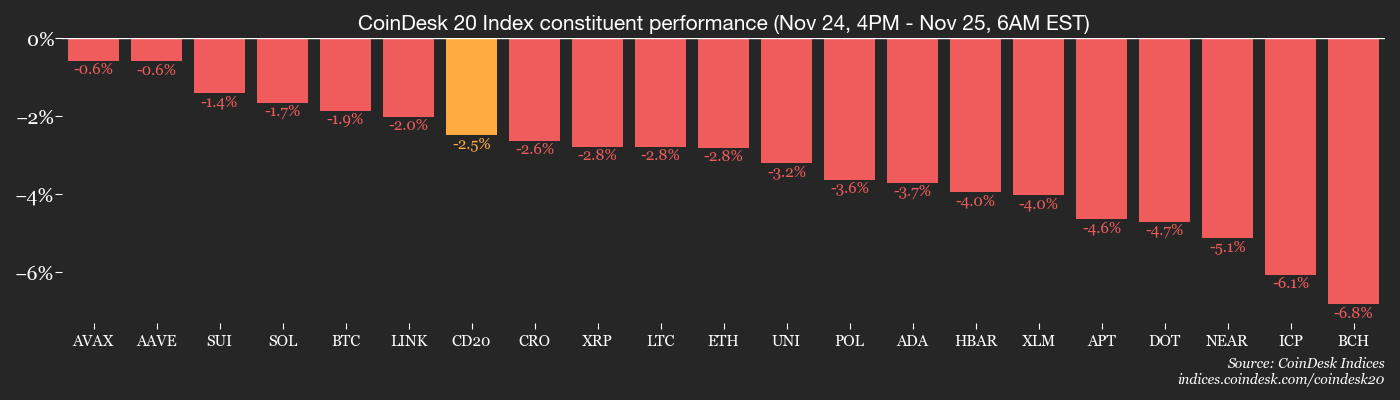

The CoinDesk 20 Index (CD20) also gave the look of it modified into once going in the commute spirit rising nearly to a few,000 earlier than taking flight around 3% to 2,485.84, showing that all around the crypto market, traders are running with caution barely than conviction.

Allotment of the clarification for this sedate temper can also in the U.S. vacation duration. With Thanksgiving two days away, liquidity can even be anticipated to dry up and threat-taking to cut attend, fixed with Emir Ibrahim, an analyst at Australian digital asset funding firm Zerocap.

Ibrahim worthy that all over closing week’s volatility, crypto traded as a high-beta proxy to weak spot in the U.S. tech replace.

“The important thing dynamic is that every of BTC’s weekly adversarial PNL came from the U.S. trading session, while APAC and EU’s hours had been largely flat-to-shuffle,” he wrote in an emailed comment, the use of an acronym for income and loss. “That leaves dinky doubt that every the worldwide credit crunch and the U.S. fairness unwind are utilizing the creep.”

A long way from setting up itself as a haven from broader financial choppy waters, as its moniker as “digital gold” would perhaps original, bitcoin is all all over again resembling the anxious younger sibling of the U.S. tech replace.

The Crypto Fear & Greed Index remains firmly in the “homely fear” cellar on a ranking of 15, albeit a cramped improvement from the previous day’s 12. It fell to a yearly low of 10 on Saturday. This circulate does no longer guarantee that the bottom is in, nonetheless it completely reinforces that the subsequent directional strikes are inclined to be more about macro shifts than dealer vibes.

One other trigger for bulls to placed on a mettlesome face can also lie in the practical funding price, a measure of the worth of holding each long and short positions. This slipped adversarial for the predominant time in a month and signifies an overabundance of bearish bets and which means that reality the aptitude for a conventional short squeeze.

This can even spell a persisted mark recovery as we head into December, supplied macroeconomic stipulations don’t atomize it. Protect alert!

Read more: For evaluation of right this moment’s project in altcoins and derivatives, glance Crypto Markets At the moment

What to Center of attention on

For a more total list of occasions this week, glance CoinDesk’s “Crypto Week Ahead.”

- Crypto

- Nothing scheduled.

- Macro

- Nov. 25, 7 a.m.: Mexico Sept. Retail Gross sales YoY (Prev. 2.4%), MoM (Prev. 0.6%).

- Nov. 25, 8:15 a.m.: ADP Employment Replace Weekly (Prev. -2.5K).

- Nov. 25, 8:30 a.m.: U.S. Sept. PPI. Headline YoY Est. 2.7%, MoM Est. 0.3%. Core YoY Est. 2.7%, MoM Est. 0.3%.

- Nov. 25, 8:30 a.m.: U.S. Sept. Retail Gross sales YoY (Prev. 5%), MoM Est. 0.4%.

- Earnings (Estimates based on FactSet records)

- Nothing scheduled.

Token Events

For a more total list of occasions this week, glance CoinDesk’s “Crypto Week Ahead.”

- Governance votes and calls

- ADA$0.4154 is voting on on registering the .ada and .cardano net domains with ICANN.

- Unlocks

- Plasma XPL$0.1926 to unlock 4.74% of its circulating provide worth $16.96 million.

- Token Launches

- FLUID$3.2181, WMTX$0.1035 to list on Coinbase with USD pairs.

Conferences

For a more total list of occasions this week, glance CoinDesk’s “Crypto Week Ahead.”

- Day 1 of 3: Finance Magnates London Summit 2025

Market Actions

- BTC is down 1.72% % from 4 p.m. ET Monday at $87,240.Forty eight (24hrs: +1.34%)

- ETH is down 2.22% at $2,893.fifty three (24hrs: +3.34)

- CoinDesk 20 is down 2.12% at 2,858.Forty eight (24hrs: +3.54%)

- Ether CESR Composite Staking Charge is up 3 bps at 2.84%

- BTC funding price is at 0.0064% (6.9894% annualized) on Binance

- DXY is down 0.11% at 100.03

- Gold futures are up 0.ninety 9% at $4,171.90

- Silver futures are up 1.10% at $51.52

- Nikkei 225 closed unchanged at Forty eight,659.52

- Hang Seng closed up 0.69% at 25,894.55

- FTSE is up 0.04% at 9,538.59

- Euro Stoxx 50 is unchanged at 5,524.56

- DJIA closed on Monday up 0.44% at 46,448.27

- S&P 500 closed up 1.55% at 6,705.12

- Nasdaq Composite closed up 2.69% at 22,872.01

- S&P/TSX Composite closed up 1.47% at 30,604.35

- S&P 40 Latin The US closed up 0.59% at 3,054.47

- U.S. 10-Year Treasury price is down 0.5 bps at 4.031%

- E-mini S&P 500 futures are down 0.2% at 6,707.75

- E-mini Nasdaq-100 futures are down 0.36% at 24,858.25

- E-mini Dow Jones Industrial Reasonable Index are down 0.16% at 46,441.00

Bitcoin Stats

- BTC Dominance: 58.78 (+0.02%)

- Ether-bitcoin ratio: 0.03315 (-0.89%)

- Hashrate (seven-day transferring practical): 1,060 EH/s

- Hashprice (location): $36.01

- Total bills: 2.58 BTC / $225,616

- CME Futures Start Passion: 132,395 BTC

- BTC priced in gold: 21.1 oz.

- BTC vs gold market cap: 5.84%

Technical Diagnosis

- The chart shows hourly changes in bitcoin’s mark since Nov. 17. The lower pane shows changes in originate hobby in USDT and USD-denominated perpetual futures listed on predominant exchanges, including Binance, Bybit, Deribit and others.

- While prices gain bounced since Friday, originate hobby is mild falling.

- The divergence between the two signifies that spinoff traders are but to be a half of the recovery rally.

Crypto Equities

- Coinbase Global (COIN) closed on Monday at $255.97, (+6.47%), -1.75% at $251.50 in pre-market

- Circle Recordsdata superhighway (CRCL) closed at $72.74, (+1.98%), -1.09% at $71.95

- Galaxy Digital (GLXY) closed at $24.78, (+5.81%), -1.78% at $24.34

- Bullish (BLSH) closed at $41.50 (+7.51%), -1.05% at $41.08

- MARA Holdings (MARA) closed at $11.21, (+11.32%), -2.14% at $10.97

- Rebel Platforms (RIOT) closed at $13.88, (+9.21%), -0.94% at $13.75

- Core Scientific (CORZ) closed at $15.75, (+6.92%), -1.21% at $15.56

- CleanSpark (CLSK) closed at $11.Forty eight (+17.ninety 9%), -1.13% at $11.35

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI) closed at $38.04, (-1.91%)

- Exodus Stream (EXOD) closed at $15.18, (+3.62%)

Crypto Treasury Companies

- Technique (MSTR): closed at $179.04 (+5.01%), -2.6 % at $174.38

- Semler Scientific (SMLR) closed at $20.88, (+9.72%)

- SharpLink Gaming (SBET): closed at $10.08 (+5.88%), -2.98% at $9.78

- Upexi Inc (UPXI) closed at $2.81, (+11.51%)

- Lite Technique (LITS) closed at $1.83 (+7.65%)

ETF Flows

Assign BTC ETFs

- Day-to-day salvage flows: -$151 million

- Cumulative salvage flows: $57.47 billion

- Total BTC holdings ~1.31 million

Assign ETH ETFs

- Day-to-day salvage flows: $96.6 million

- Cumulative salvage flows: $12.75 billion

- Total ETH holdings ~6.17 million

Provide: Farside Investors

While You Had been Sound asleep

- Fed Chair Powell’s Allies Present Opening for December Charge Slit (The Wall Avenue Journal): Comments from New York Fed President Williams and San Francisco’s Daly mark make stronger for Powell’s threat-management diagram, boosting odds of a December price cut no topic divisions inner the FOMC.

- Bitcoin Faces Rapid Squeeze Ache Above $87K as Funding Charges Hint Native Backside (CoinDesk): A cluster of short positions end to $87,000 faces liquidation threat, while adversarial funding rates demonstrate bearish overcrowding — each elevating the percentages of a short squeeze if bitcoin breaks increased.

- Bitcoin Merchants Stare Signs of Sell-Off Easing as Token Steadies (Bloomberg): Falling query for diagram back protection, real ETF holdings and a key technical mark are fueling cautious optimism that bitcoin’s brutal correction can even gain ended.

- Monad’s Debut Presentations Why FDV Forecasts Broke as Bitcoin Fell (CoinDesk): Monad’s MON originate shows how restricted drift and locked provide can inflate completely diluted valuations, creating the appears of solid query even when real liquidity and market appetite are skinny.

- Forex Merchants Bet Against Sterling Earlier than Budget (Monetary Conditions): CME Community records shows sterling save volume outpacing calls 4-to-1 sooner than Rachel Reeves’ worth range, with traders positioning for frail development tied to tax hikes and the Labour Celebration’s unsure fiscal stance.