Stellar lumens payment formed a God candle and soared to its most sensible level over a week as numerous cryptocurrencies retreated.

Stellar (XLM) rose to $0.3822, up by over 22% from its lowest level this month, bringing its valuation to over $11 billion.

This rally took blueprint as the firm’s utility persisted this week. In a show on Tuesday, the builders introduced a partnership with Fonbnk, a resolution that enables frictionless on-ramp resolution for digital banking in Africa. It lets any individual with a mobile SIM card to rep entry to digital banking solutions utilizing Stellar’s technology.

Stellar’s recovery also took blueprint on legend of of its halt relationship with Ripple (XRP), which has formed a bullish pennant sample, pointing to more features. The 2 coins will likely aid when Donald Trump is inaugurated as the President of the United States later this month.

Ripple hopes that the conclude of Gary Gensler’s erawill bring in a original duration of friendly regulations within the crypto change. One doable victory would possibly maybe be the conclude of the SEC’s allure againsta ruling whereby a deem ruled that XRP turned into no longer a security.

There are also odds that the SEC, below Paul Atkins, will approve a space XRP alternate-traded fund later this twelve months. WisdomTree, a firm with over $100 billion in sources, has already filed for one.

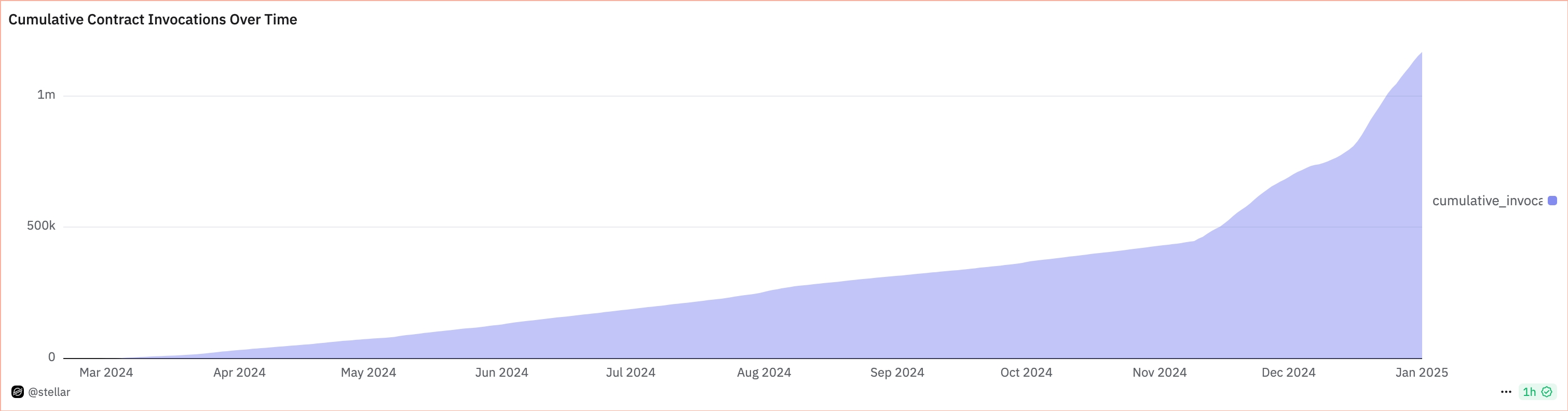

In the interim, Stellar’s blockchain is restful rising. In accordance to Dune, its network has handled over 1.16 million trim contract invocations, up from almost zero within the identical duration remaining month. It has completed that without needing any hiccups.

Stellar payment has bullish technicals

The day-to-day chart shows that the XLM payment rebounded after forming key bullish patterns. It formed two doji candlestick patterns, a favored reversal signal. A doji is a candlestick sample made up of a exiguous body and an greater and lower shadow, signaling that it opened and closed on the identical level.

Most severely, Stellar has been forming a falling wedge chart sample. This sample is made up of two falling converging trendlines and continuously outcomes into a bullish breakout when the two traces near their tip.

Due to the this truth, the breakout and the following plod above the 50-day transferring common and the 50% Fibonacci Retracement, sides to more features. Which methodology that the coin would perchance maybe soar to the relaxation twelve months’s excessive of $0.6400, which is ready 63% above the original level.