How abolish the investment developments in Q1 2024 vary between gentle startups and crypto tasks?

Global startup funding has experienced a considerable decline lately. In accordance with Crunchbase, despite an improvement over Q4 2023, first-quarter startup investment in 2024 reached its 2nd-lowest level since 2018.

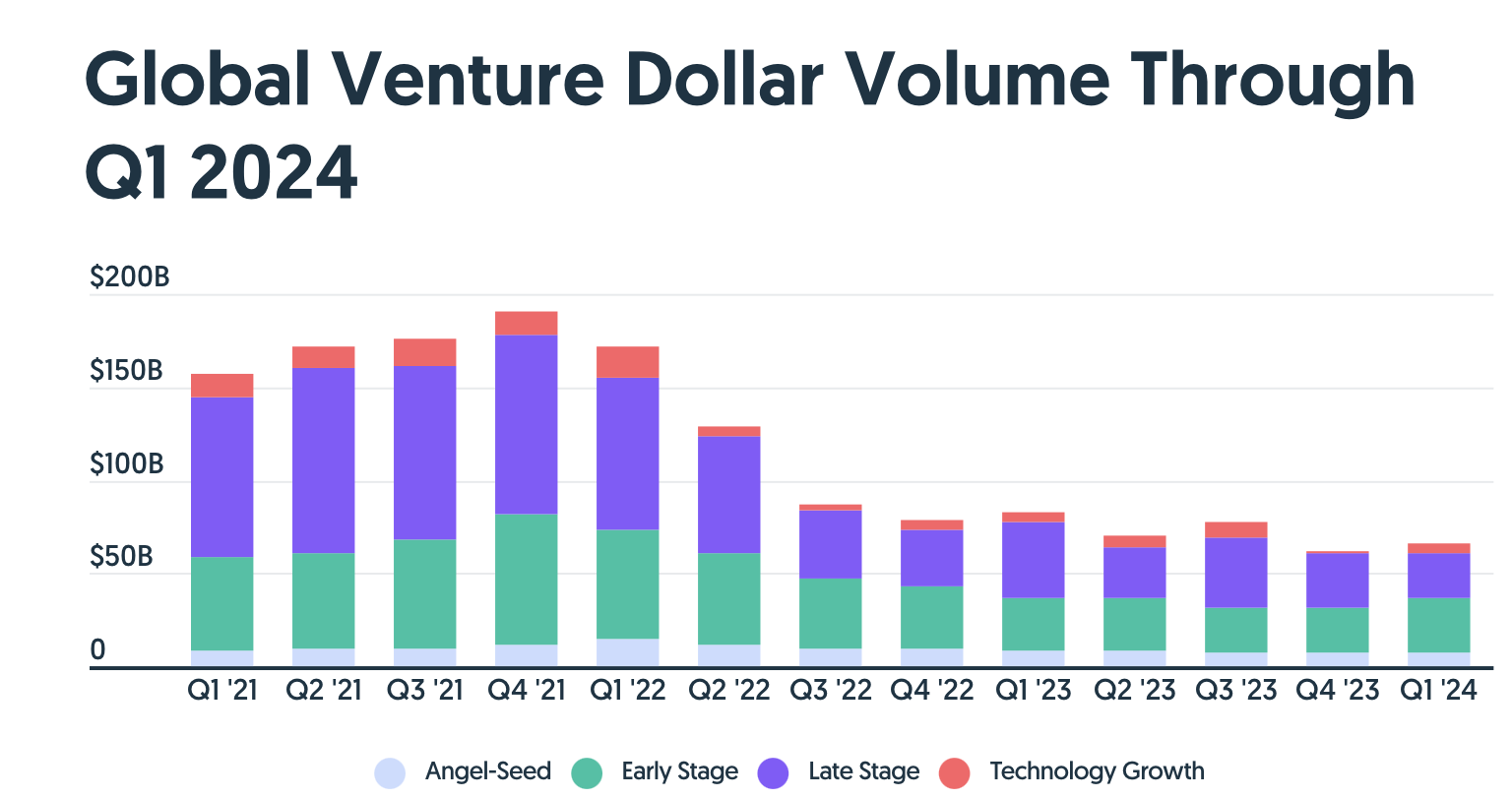

For context, in Q1 2022, world startup funding became as soon as $171.4 billion. By Q1 2023, this settle had plummeted to $82.4 billion. The decline persevered into Q1 2024, with funding dropping extra to $66.1 billion. This decline interprets to a 52% tumble from 2022 to 2023 and an extra 19.7% decline from 2023 to 2024.

The downward pattern is critically evident in North The US, the splendid market for startup investments, reflecting a broader slowdown in enterprise capital actions.

Despite the broader tech sector experiencing funding slumps, the myth within reason a total lot of in the crypto sector.

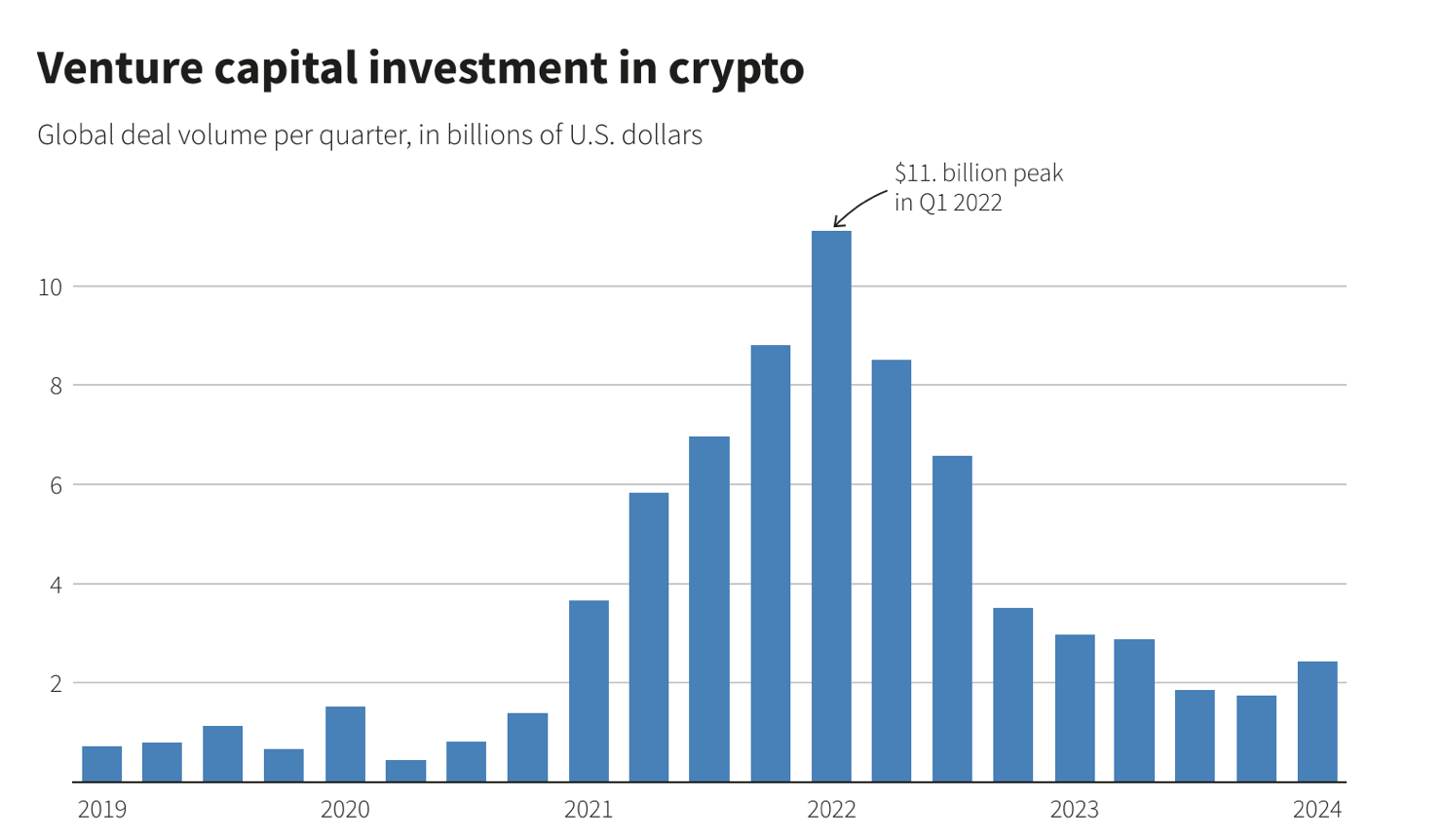

Records from PitchBook shows that in Q1 2024, crypto startups raised $2.4 billion all the contrivance through 518 provides. This marks a 40.3% amplify in invested capital and a 44.7% upward push in deal volume when compared to Q4 2023.

Interestingly, while crypto enterprise capital flows peaked at $11.1 billion in Q1 2022, the sphere confronted seven consecutive quarters of decline, hitting a low of $1.7 billion in Q4 2023. The hot uptick suggests renewed investor self belief in the crypto spot.

This begs the quiz: why is there a rising interest in crypto while gentle startup investments are dwindling? Is this a non eternal shift or a demonstration of a longer-term pattern? Let’s delve deeper to search out out.

A deep dive into Q1 2024’s investment developments

Within the foremost quarter of 2024, crypto funding has been notably fervent in modern and infrastructure-driven tasks.

London-primarily based mostly Exohood Labs, as an illustration, raised $112 million in a seed round for an AI mission utilizing quantum computing and blockchain, valuing the corporate at $1.4 billion.

Similarly, Together AI, which develops an birth-source, decentralized cloud platform for astronomical foundation models, secured $106 million in an early-stage round led by Salesforce Ventures, with a pre-cash valuation of $1.1 billion.

Infrastructure startups maintain also been a hit in securing funding. EigenLayer, primarily based mostly in Seattle and specializing in an Ethereum (ETH) restaking platform, raised $100 million in a Series B round.

Zama, a platform fervent in completely homomorphic encryption (FHE) construction, secured $73 million in a Series A round.

Valuations all the contrivance through all stages in the crypto sector maintain surged when compared to fleshy-twelve months 2023.

The median pre-cash valuation for pre-seed/seed stages reached $21.8 million, marking an 85.5% twelve months-over-twelve months amplify. Early-stage valuations soared by 148.3% to $72.0 million, while slack-stage valuations saw a extra modest amplify of seven.6%, reaching $51.1 million. Interestingly, early-stage provides are if truth be told commanding bigger valuations than slack-stage ones.

Deal sizes maintain also elevated, with median figures at $2.7 million for pre-seed/seed stages, $5.0 million for early stages, and $5.8 million for slack stages. These signify will increase of 24.9% and 25.0% for pre-seed/seed and early stages, respectively, even though slack-stage provides saw a 9.7% decrease.

Crypto Koryo, a prominent crypto analyst, grand a shift in the sources of funding. Unlike earlier quarters, the set banks and non-crypto enterprise capital firms led the investments, Q1 2024 saw a surge of interest from crypto-focused enterprise firms.

🔸 High Traders 🔸

When compared to closing quarters the set banks and non-crypto VCs were leading, we’re seeing this quarter crypto VCs dominating the investments.

@a16zcrypto is leading.

Followed by @OKX_Ventures, @multicoincap, @paradigm, and @polychain pic.twitter.com/fjAWIdjnKs— Crypto Koryo (@CryptoKoryo) April 4, 2024

High merchants this quarter included prominent crypto-native enterprise capital firms corresponding to Andreessen Horowitz Crypto (a16z), OKX Ventures, Multicoin Capital, Paradigm, and Polychain.

The thrill in the crypto investment circles

The main quarter of 2024 has injected a plot of optimism into the crypto enterprise capital market, corresponding to the bustling tempo considered in 2021, in step with David Nage, portfolio manager at Arca.

Nage mentioned that his agency tracked over 690 provides throughout Q1, marking a 30 to 40% amplify from the lows of 2023.

Alex Felix, co-founder and chief investment officer at CoinFund, described the Q1 2024 scenario as “cautiously optimistic,” marking a rebound from the now no longer easy fundraising atmosphere of the previous two years.

Despite a 65% twelve months-over-twelve months decrease in each and each VC and crypto funding in 2023, there is now a noticeable uptick in deal-making exercise, Felix added.

Just a few issues maintain contributed to this resurgence. Upright victories by Ripple (XRP) and Grayscale in 2023, alongside with sure sentiments around decentralized finance (DeFi) on Solana (SOL), maintain played a characteristic.

Additionally, approving web page Bitcoin ETFs in the U.S. has boosted query for crypto sources, extra stimulating investor interest.

Mike Giampapa, widespread accomplice at Galaxy Ventures, predicts persevered development in crypto enterprise capital, driven by a bullish macroeconomic backdrop.

He expects the originate of crypto ETF products, the Bitcoin halving, and projected price cuts in the U.S. forward of the upcoming presidential election to extra gas this development.

PitchBook anticipates that with sure investor sentiment returning to crypto and barring any most critical market downturns, the volume and tempo of investments will proceed to amplify throughout the twelve months.

Meanwhile, stakeholders and crypto tasks are optimistic about the long flee, with many anticipating total capital raised in 2024 to exceed the $10 billion vary and doubtlessly reach as excessive as $16.2 billion.