Starknet (STRK) goal no longer too lengthy ago launched the necessary fragment of its staking program, triggering a 10% trace surge in only finally. This sudden trace circulate has attracted the attention of traders, because the token approaches key resistance ranges. No matter the excellent momentum, technical indicators are portray a combined characterize of the asset’s outlook.

The Relative Strength Index (RSI) is signaling an overbought situation, which suggests that STRK could per chance perchance also fight to preserve its upward trajectory. At the same time, the Chaikin Money Waft (CMF) exhibits only practical buying power, elevating questions regarding the sustainability of the unique rally.

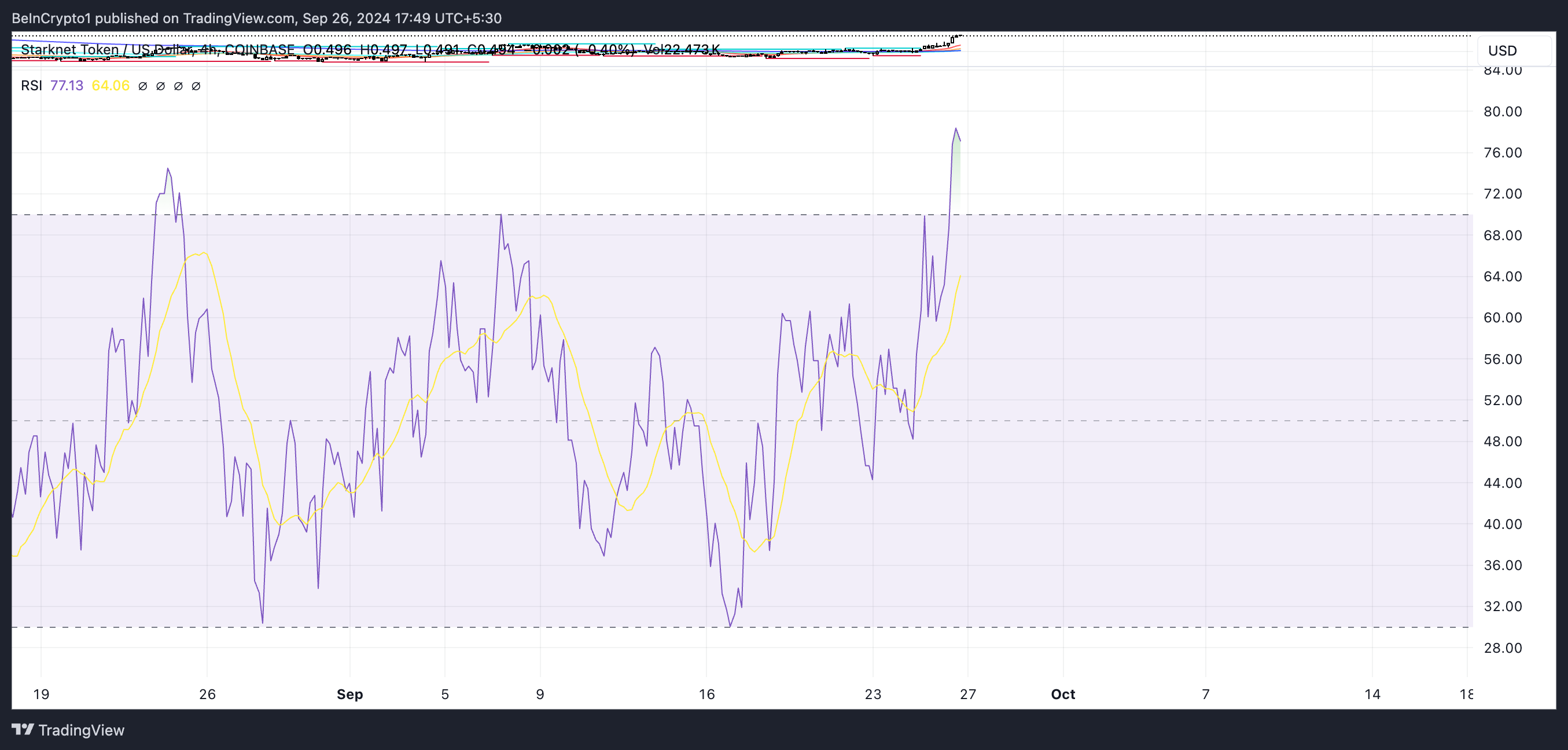

Starknet RSI Is Showing an Overbought Deliver

Starknet’s RSI has surged to 77, up from forty eight sparkling two days ago, indicating that the price has seen a necessary amplify in a snappy length. This intelligent upward push suggests that Starknet is now in overbought territory, doubtlessly signaling a trace correction.

RSI, or Relative Strength Index, is a technical indicator that measures the lope and magnitude of trace changes. It operates on a scale of 0 to 100, with ranges above 70 regarded as overbought and ranges under 30 regarded as oversold.

Learn extra: A Deep Dive Into Starkware, StarkNet, and StarkEx

If Starknet’s RSI decreases from its fresh stage, it could most likely perchance also present a cooling-off length, giving the price room to stabilize and doubtlessly entice unique patrons at lower ranges. Alternatively, if the RSI stays at 77 or above 70, it could most likely perchance level to that buying power has peaked, which could per chance restrict further upward circulate and even urged a sell-off.

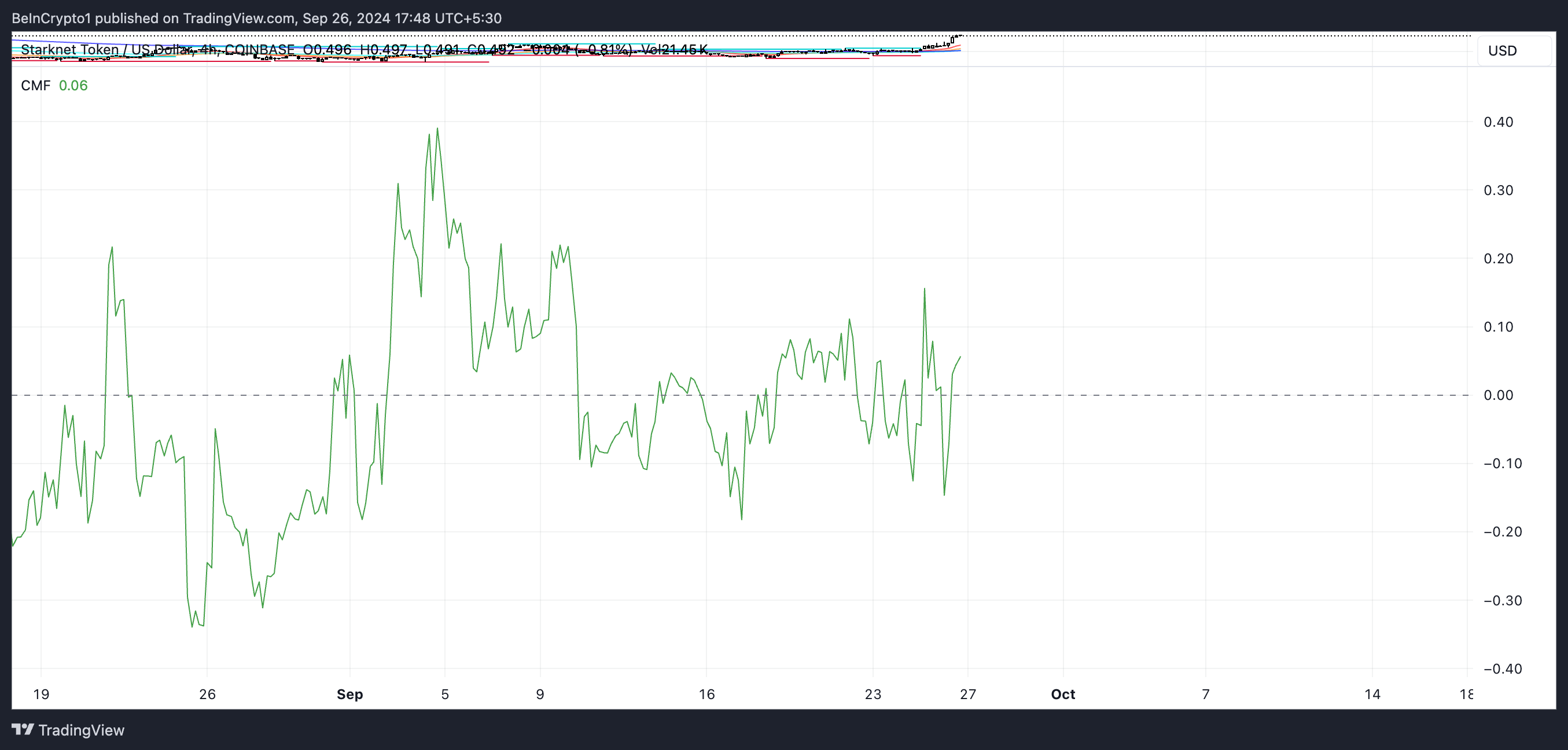

STRK Chaikin Money Waft Is Currently Somewhat Positive

STRK Chaikin Money Waft (CMF) is currently at 0.06, exhibiting a gentle but noticeable certain buying power. While this implies that there is a couple of hobby within the asset, the buying power isn’t in particular great, that implies the influx of capital is inconspicuous.

The CMF is a broadly dilapidated technical indicator that combines each trace and quantity knowledge to resolve whether or no longer cash is flowing into or out of an asset. It operates on a scale from -1 to +1, with values above 0 exhibiting acquire buying power and values under 0 indicating acquire promoting power.

A reading nearer to +1 indicators great buying hobby, whereas nearer to -1 suggests predominant promoting. With STRK’s fresh CMF at 0.06, the market is exhibiting some make stronger from patrons, but it absolutely’s no longer overwhelmingly bullish.

For STRK trace to preserve an on a usual basis amplify and even proceed rising an excellent deal, stronger buying power would on the total be well-known. A CMF price of 0.06 could per chance perchance also level to that whereas there is a couple of quiz, it’s no longer ample to gasoline a breakout or provide protection to the price from falling if promoting power begins to upward push.

Starknet Value Prediction: Sturdy Resistance Ahead

There are great resistance ranges for Starknet (STRK) at $0.51 and $0.59, where a necessary determination of addresses are conserving tokens at higher prices, doubtlessly leading to promoting power.

If these resistance zones are broken, STRK could per chance perchance also search an upward transfer toward the next necessary resistance at $0.91, where fewer addresses are conserving coins taking into consideration the replacement of a sooner trace upward push if buying power continues.

Learn extra: What Is Crypto Staking? A Files to Earning Passive Earnings

The Global In/Out of the Money metric affords a beneficial search of the addresses conserving STRK at diversified income ranges. Addresses labeled as “In the Money” (conserving STRK at a income) have a tendency to rob earnings when the price rises, contributing to resistance at key trace ranges. On the diversified hand, addresses “Out of the Money” (conserving STRK at a loss) could per chance perchance also amplify promoting power as they search to reduce their losses.

On the shrink back, the make stronger zone between $0.41 and $0.45 is relatively former, suggesting this stage could per chance perchance also very smartly be examined soon. If patrons don’t step in to make stronger the price on this vary, STRK could per chance perchance also journey an additional tumble, doubtlessly as miniature as $0.38, where a stronger focus of holders is present. This cluster could per chance perchance also act as a extra unswerving make stronger stage, offering some steadiness if the price retreats.