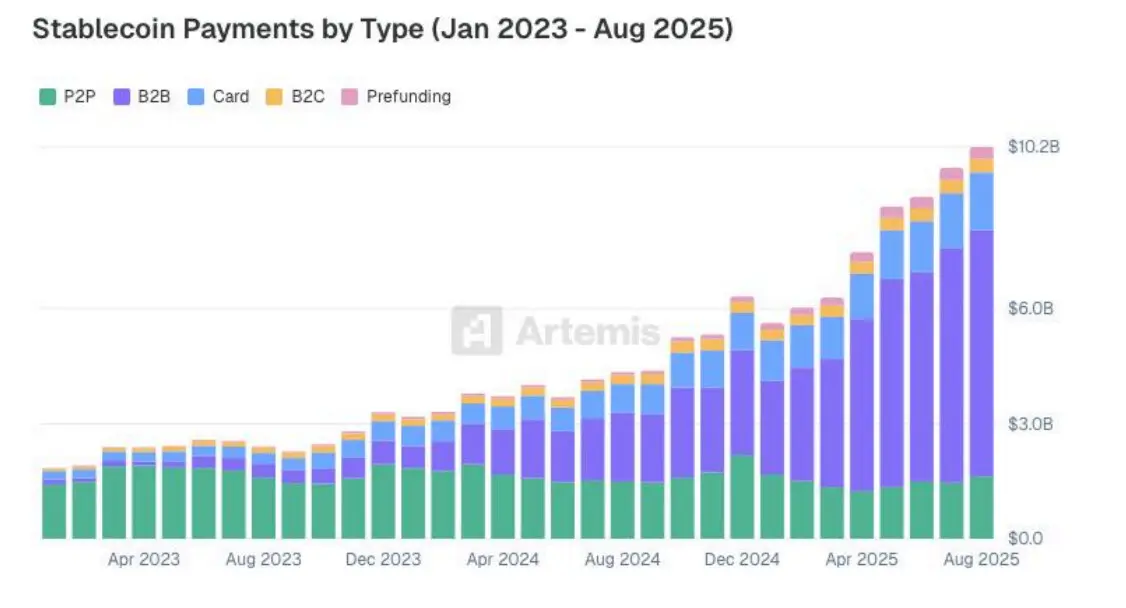

Stablecoin payments expanded in 2025, with a increasing fragment of B2B transfers. Consistent with Artemis, the tokens noticed 70% more utilization as a price blueprint since February.

In 2025, stablecoin payments expanded by over 70% since February. The fiat-pegged market evolved, with payments turning into one among the most important vectors of trend, with Circle’s USDC main the trend.

Artemis, one among the main crypto recordsdata hubs, tranquil recordsdata from 22 crypto price companies to estimate the precise-lifestyles utilization of stablecoins. A further 11 startups have been interviewed for additonal recordsdata, coming from B2B, P2P, B2C, card price, and prefunding payments.

The guidelines sequence tracked $136B in payments between companies, settled between January 2023 and August 2025. The duration of time already showed the evolution of the stablecoin market, as trends persevered into Q3, with expanded provide and filled with life customers.

B2B payments dominated the market

Artemis came across B2B payments have been the excellent boost to project, as the property allow tremendous, permissionless settlements. This form of payments reached $76B annualized, while P2P payments came second with $19B per twelve months.

Crypto playing cards adopted in repute, with $18B in annual settlements. B2C payments have been at $3.3B, while prefunded price solutions settled $3.6B.

No matter the increasing impact of USDC, Tether’s USDT turn out to be once composed the most smartly-favored token veteran by companies. USDT had a 85% market fragment by volume, with Circle coming second. TRON carried the excellent stablecoin volumes, adopted by Ethereum, BNB Chain, and Polygon.

The United States, Singapore, and Hong Kong posted the excellent switch volumes for payments.

Rate solutions boosted stablecoin utilization

One of many elements for the elevated utilization of stablecoins have been the price apps built by centralized exchanges. Most particularly, Bybit Pay and Binance Pay emerged as project hubs, tapping their substitute customers with extra switch tools.

BVNK also emerged as a price gateway, with infrastructure linking banks and blockchains. BVNK specializes within the scalability complications of companies. The job of BVNK is to permit companies to make exercise of fiat, then total the stablecoin transactions on the backend, utilizing the speedy, with out boundaries infrastructure.

Stablecoin playing cards have been the diversified recount to steal mass adoption. With clearer regulations, card utilization expanded since its baseline ranges in 2023. Crypto card volumes reached over $1.5B in month-to-month settlements as of August 2025.

Cards linked to stablecoin balances are attempting to provide a seamless journey based mostly totally on standard card utilization patterns. The boost of crypto playing cards assign price suppliers love Exa and Gnosis Pay in step with passe credit ranking and debit card utilization. The moderate dimension of payments for Exa turn out to be once similar to US debit card spending.

P2P payments did no longer look any giant changes or new trends. These varieties of payments had a lower moderate transaction dimension. The moderate dimension of P2P payments turn out to be once lower when put next to Zelle and Venmo. General, P2P is amongst the riskiest usages for stablecoins, as customers flocked to curated apps.

Stablecoins are composed broadly veteran in scams, and handiest a fraction of the stolen funds is frozen or returned.