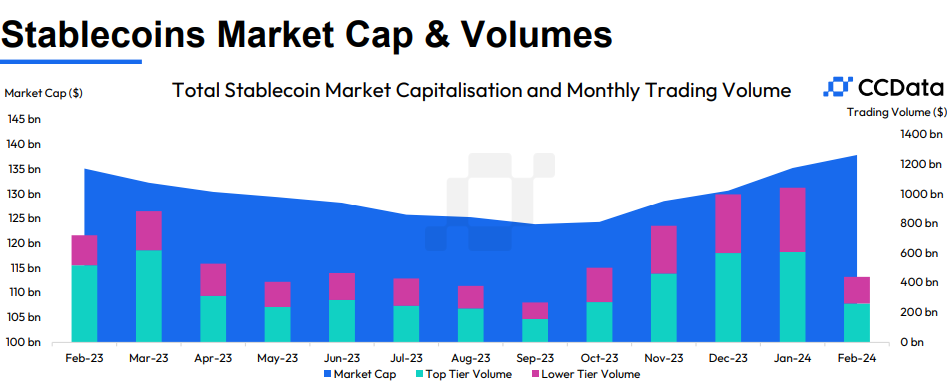

The stablecoin market capitalization has soared 1.95% to hit $138 billion in February recording a fifth consecutive monthly development since September 2023.

A novel market memoir by cryptocurrency analytics firm CCData displays a stablecoin market capitalization and procuring and selling quantity rise.

Stablecoin quantity on CEXs rose 4.54% to $1.05tn in January, its top doubtless degree since December 2021.

Severely, $FDUSD’s market fragment persisted to rise in January, reaching 15.6%, aided by the repute of the BTC-FDUSD pair on Binance.

Tubby Document: https://t.co/uR1uf3BuaZ pic.twitter.com/zs2LxbkFGz

— CCData (@CCData_io) February 22, 2024

Primarily based on the originate, the stablecoin market capitalization breached $138 billion as of February 16, with indices showing a stronger efficiency in direction of the pause of the month.

The expansion marks a fifth consecutive month raise since the pause of Q3 2023 with excessive inflows into the cryptocurrency market. This inflow has pushed stablecoins to their top doubtless level since the originate of 2023.

On the identical time, stablecoin procuring and selling quantity grew in the principle two months of 2024. Procuring and selling volumes hit 1.04 trillion in January, marking the top doubtless quantity level on centralized exchanges (CEX) since December 2021.

Stablecoin Dominance Descend Continues

The memoir hinted at a increased settle this month as a results of $440 billion in procuring and selling quantity recorded as of February 16. Though stablecoins saw rising figures and activities, their total market dominance plunged from 8.15% to 7.09% this month.

The decline in dominance in February is its sixth straight month of diminished total market power when compared with other cryptocurrencies. This came on the heels of the big inflow into other cryptocurrencies, rising their market cap to $1.97 trillion as institutional inflows came into the market.

Tether (USDT) maintains its lead on the stablecoin market with its market cap hitting $97.3 billion, a 1.23% rise in the final 30 days. This development locations USDT dominance at 70.6%, followed by USDC and DAI.

“The market capitalization of USD Coin (USDC) rose for the third consecutive month, rising 5.34% to $26.9bn, recording the top doubtless market capitalization since June 2023. Meanwhile, the market capitalization of First Digital USD (FDUSD) rose 12.5% to $2.44bn, recording a brand novel all-time excessive for the stablecoin,” the memoir illustrious.

CBDC Development Grows Alongside Stablecoin Market Capitalization

Because the stablecoins market capitalization rose, exhaust cases for Central Monetary institution Digital Currencies (CBDC) grew, with passion recorded in numerous jurisdictions.

Countries with existing pilot initiatives also explored novel exhaust cases. On January 31, the Monetary institution of Japan held the principle digital yen assembly, with extra activities in other regions.

“Meanwhile, the Sri Lankan Central Monetary institution introduced plans to get a CBDC to present a elevate to the country’s financial inclusion and complement money exhaust, with executives eyeing the pause of 2024 as a capability originate date,” the memoir added.

Several justifications get hold of been given for CBDCs, alongside side to present a elevate to injurious-border funds amid the mass adoption of cryptocurrencies, in the previous two years. Nonetheless, many of us and organizations get hold of flagged privateness concerns in most CBDC fashions.

Remaining 365 days, two European Union recordsdata privateness companies warned of a seemingly risk appealing CBDCs, fit instance. Though government officers downplayed complications, protection watchers get hold of also raised equivalent concerns globally.