CCData stands at the forefront of the digital asset data quandary, serving as fundamental useful resource for somebody navigating the cryptocurrency market. Their core focal level lies in gathering complete market data from an infinite network of world crypto exchanges. This entails real-time pricing, buying and selling volumes, articulate book recordsdata, and varied valuable metrics for a colossal preference of digital assets. Beyond merely accumulating data, CCData transforms it into actionable insights. They meticulously arrangement and calculate a broad sequence of extremely granular crypto indices, providing benchmarks that illuminate varied segments of the market. These indices note transparent, solutions-primarily based fully fully methodologies to construct distinct accuracy and reliability.

CCData’s skills extends to supporting the state of modern investment products. They collaborate with monetary institutions to license their indices for use in ETFs, derivatives, and extra. This opens doors for merchants seeking structured ways to invent publicity to explicit areas of the crypto market. Additionally, CCData affords grand APIs and customised data alternate recommendations. Traders, researchers, and institutions can seamlessly integrate real-time and historical market data into their platforms and tools using these grand interfaces. Through its dedication to reliable data, transparent indices, and accessible data alternate recommendations, CCData fuels told decision-making, fosters market conception, and plays a extraordinarily valuable feature within the evolving cryptocurrency ecosystem.

Stablecoins hold obtained prominence within the previous year. These cryptocurrencies, designed to protect up a safe price thru their peg to a fashioned asset, play a fundamental feature in digital asset buying and selling and bringing fiat currencies into blockchain systems. Then all once more, most fresh controversies surrounding Tether’s collateral and the TerraUSD crumple elevate questions for merchants and regulatory bodies.

CCData’s Stablecoins & CBDCs Represent goals to illuminate key tendencies within this sector. Their prognosis breaks down stablecoins in response to their collateral form, the pegged asset, market capitalization, and buying and selling volumes. This month-to-month document serves a broad target audience – from crypto fans seeking a market overview to merchants, analysts, and regulators requiring extra detailed data.

Earlier this week, CCData released the February 2024 edition of its “Stablecoins & CBDCs” study document.

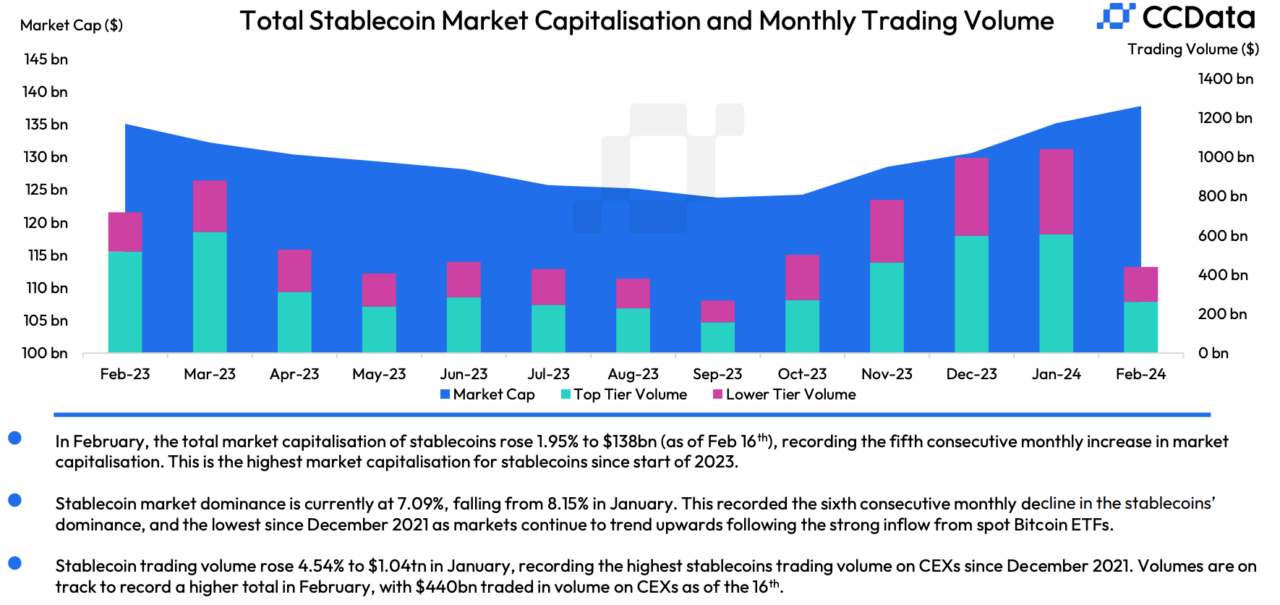

Stablecoin quantity on CEXs rose 4.54% to $1.05tn in January, its most practical seemingly stage since December 2021.

Particularly, $FDUSD’s market allotment persevered to upward thrust in January, reaching 15.6%, aided by the recognition of the BTC-FDUSD pair on Binance.

Fat Represent: https://t.co/uR1uf3BuaZ pic.twitter.com/zs2LxbkFGz

— CCData (@CCData_io) February 22, 2024

Below are highlights from this document:

Continued Divulge in Market Capitalization

CCData’s February document notes a 1.95% magnify within the total market capitalization of stablecoins, reaching $138 billion. This marks the fifth consecutive month of state, achieving the most practical seemingly give up-of-month market capitalization since December 2022. Regardless of this state, the market cap dominance of stablecoins dipped to 7.09%, the bottom since December 2021, indicating a transferring panorama at some level of the broader cryptocurrency market.

The MIM Stablecoin Depeg Incident

A significant occasion reported became once the de-pegging of the Magic Information superhighway Money (MIM) stablecoin, which fell to as low as $0.86 following a shipshape contract exploit of its issuer, Abracadabra Money, ensuing in an absence of nearly about $6.50 million. Regardless of this setback, MIM’s market capitalization has remained safe at spherical $60.2 million, with the stablecoin present process a v3 give a enhance to and expanding its integration with original chains cherish Blast and Berachain.

Surge in FDUSD Trading Volume

Following the approval of a location Bitcoin ETF, the buying and selling quantity of FDUSD pairs on centralized exchanges seen a outstanding 51.1% magnify to $122 billion, positioning it as the second most traditional buying and selling pair after USDT. The BTC-FDUSD pair on Binance emerged as primarily the most traded, with a month-to-month quantity of $80.8 billion. Similtaneously, FDUSD’s market capitalization rose by 12.5% to $2.44 billion, surroundings a brand original all-time high.

Ethena USDe’s Market Cap Divulge

Ethena Labs’ announcement of its public mainnet launch, enabling safe entry to to its yield-bearing stablecoin USDe, led to a significant market cap magnify. By depositing liquid staking tokens (LSTs), ETH, or USDC, customers can now interact with USDe, which seen its market capitalization leap by $47 million, reaching a brand original all-time high of $227 million in February.