Ethereum (ETH) has been experiencing volatility mainly because of the its alignment with broader market traits.

No matter the approval of plan ETH ETFs, the occasion has no longer yet impacted the cost. Nonetheless, this can also switch within the shut to future.

Obtain Ethereum ETFs Hold a Knowing Future?

Achieve ETF movements would possibly well considerably affect Ethereum’s mark within the impending few months. Earlier this week, the US Securities and Alternate Price (SEC) authorized checklist plan ETFs by the originate of July. This has increased traders’ expectations massively.

“We question the web inflows into ETH ETFs to be 20-50% of the web inflows into BTC ETFs over the first 5 months, with 30% as our goal, implying $1 billion/month of web inflows,” Galaxy Learn Crew’s Vice President Charles Yu said.

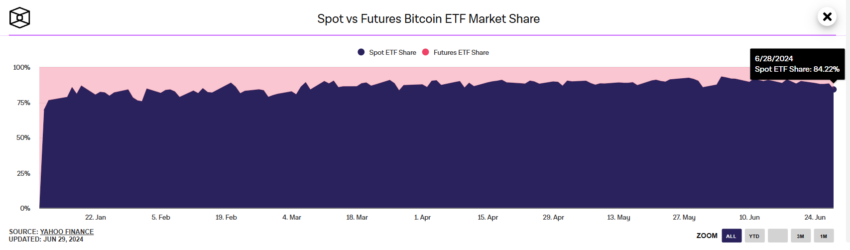

Nonetheless, this optimistic forecast does no longer see fully life like. To do it into point of view, plan Bitcoin ETFs hang entirely considered $857 million in inflows as of June 21, without reference to retaining 84% of the total ETF market share, with futures ETFs accounting for correct 14%. This raises doubts about whether plan Ethereum ETFs will assemble $1 billion in monthly inflows.

Learn extra: Ethereum ETF Outlined: What It Is and How It Works

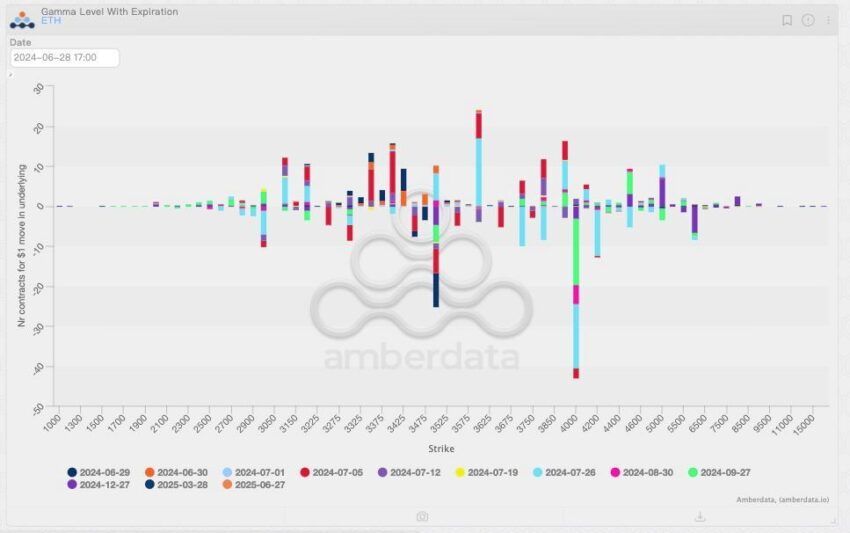

The uncertainty concerning the success of ETH ETFs in a slightly bearish market can also result in a surge in market makers’ premiums. Gamma distribution possibility, sharp the sensitivity of recommendations to mark modifications, makes market makers adjust their ideas. With the added uncertainty of ETH ETFs, they are at possibility of elevate premiums to conceal doubtless impolite mark swings.

“ETH can restful create effective enhance from market makers hedging on the downward route. As one of many choices to the above-mentioned gamma distribution possibility, market makers hang also a tiny bit raised their pricing for tail possibility. As a result of the further uncertainty brought by ETH ETFs, the pricing for ETH tail possibility is comparatively excessive,” Griffin Ardern, Head at BloFin Learn & Alternatives, told BeInCrypto.

Achieve merely, market makers can also price extra to narrative for the likelihood that the cost of ETH will be struggling from something very irregular and impolite. This implies traders want to pay extra to hedge their bets, that would possibly well presumably also merely discourage excessive speculation and minimize volatility.

Learn More: Easy methods to Make investments in Ethereum ETFs?

No matter the truth the active possibility management can aid stabilize its mark by providing enhance and mitigating well-known mark drops, Ethereum’s mark would possibly well fight to help right a ways from the originate of plan ETFs.

ETH Mark Prediction: Eyeing Fresh Highs

Ethereum’s mark of $3,395 is method from setting up a brand new all-time excessive. The 2d-greatest cryptocurrency rallied by over 30% following the approval of plan ETH ETFs, however nearly half of this was once wiped out when ETH fell by 13% originally of the month. The uncertainty surrounding the originate drove the cost down, in conjunction with the bearish broader market cues.

The peril can also shift because the market approaches the originate of ETFs. Bitcoin’s mark began to trend upward following the introduction of its plan ETFs, and a an analogous is anticipated for Ethereum.

Must restful Ethereum’s mark manage to capitalize on the potential bullishness and upward push to flip $3,829 into enhance, it would hang managed to flip the 61.8% Fibonacci Retracement into enhance. This line, is also named the bull market enhance floor, would translate to ETH’s further beneficial properties.

Learn More: Ethereum (ETH) Mark Prediction 2024/2025/2030

Whereas a brand new all-time excessive is restful a ways-off, ETH is just not any longer going to no longer up to hang a shot at making an strive its hand at breaching $4,000. A profitable breach will be key in pushing the altcoin further upwards.

But when this fails to happen, Ethereum’s mark would be inclined to closing consolidated below $4,000. The seemingly enhance degree can also stand between $3,700 and $3,800. Losing this would invalidate the bullish thesis.