Position Bitcoin ETFs salvage entered one other disturbing pattern, recording outflows for one week straight. These outflows salvage coincided with the decline in the Bitcoin designate, suggesting that the promote-offs would be in an instant linked to institutional promote-offs, as smartly as miner promote-offs. The funds salvage now completed seven consecutive days of outflows, so this chronicle takes a watch at what passed off the closing time that the outflows were this excessive.

Position Bitcoin ETFs Lose Cash For 7 Straight Days

In accordance with records from Coinglass, Position Bitcoin ETFs salvage now marked their Seventh consecutive day of outflows. A interesting reality about the outflows is that they’ve averaged around $100 million on a typical basis, main to around $1.2 billion pulled out from the funds to this level.

While the recent pattern is alarming, it is now not the necessary time that Position Bitcoin ETFs shall be bleeding for a chunky week. Aid in April-Would possibly possibly simply 2024, these funds bled for 7 consecutive days, to an even higher level than what is being experienced now. Moreover, the greatest single-day outflow used to be recorded in the identical month, when the funds misplaced $563.7 million on Would possibly possibly simply 1.

This outdated pattern may also lend some perception into what is currently taking place and what may happen subsequent. Aid in Would possibly possibly simply, after seven consecutive days of outflows, the funds were to ogle upside, recording inflows for two days before seeing outflows but again.

Nonetheless, this used to be handiest the beginning place of the recovery as institutional traders began to throw their hats in the ring all over but again. Starting from Would possibly possibly simply 13, the inflows moved fleet, recording 19 consecutive days of inflow, and atmosphere a brand unique chronicle.

If the outdated pattern is anything to creep by, then the Position Bitcoin ETFs would be seeing a turnaround quickly, in particular with the recovery in the Bitcoin designate. A repeat of the Would possibly possibly simply pattern would assign off inflows of legend proportions, that would also drive prices because the ask grows.

BTC On The Charts

The Bitcoin designate, despite losing to $60,000, is restful trading smartly above its 200-day shifting reasonable of $50,613. This implies that the fee remains to be bullish in the lengthy speed, in particular as traders decide to help rather than promote.

Nonetheless, on the shorter timeframes, the pioneer cryptocurrency is performing poorly, falling below its 50-day and 100-day shifting averages of $65,403 and $63,928, respectively, each and every of that are valuable for the short and mid-term performance of the digital asset.

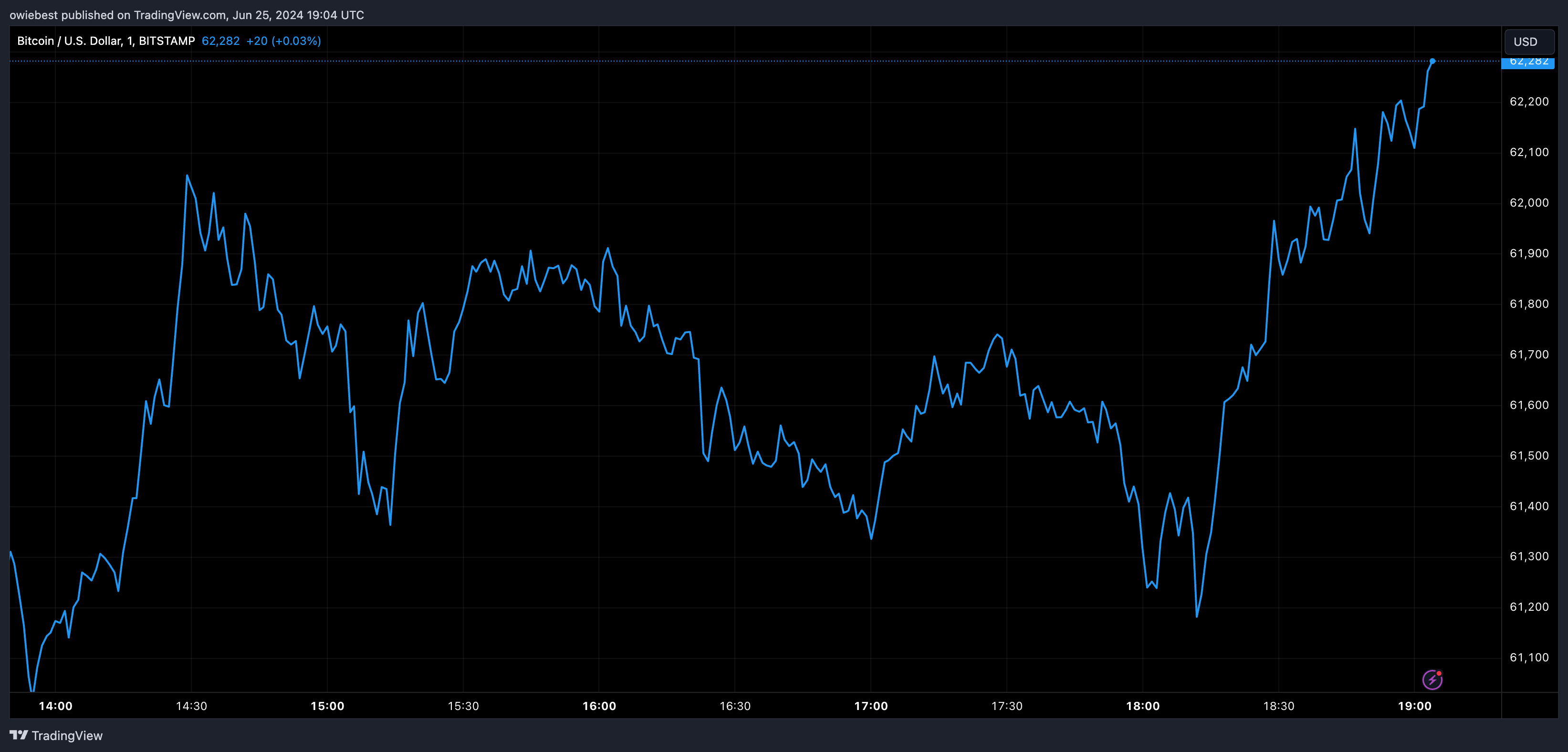

On the on a typical basis chart, even supposing, Bitcoin is beginning to ogle some upside. Its on a typical basis trading quantity is up 35% and its designate has recovered above the $61,000 resistance all over but again.