A Spanish public research institute is preparing to promote its long-forgotten Bitcoin stash, price over $10 million, which changed into once at the origin purchased for factual $10,000 in 2012 as portion of a blockchain research mission.

The Institute of Technology and Renewable Energies (ITER), overseen by the Tenerife Island Council, received 97 Bitcoin (BTC) higher than a decade ago to seem blockchain technology. The council is now finalizing plans to divest the holdings, according to a characterize from Spanish-language newspaper El Día.

Juan José Martínez, Tenerife’s innovation councillor, told the outlet that the council is working with a Spanish financial institution licensed by the Bank of Spain and the Nationwide Securities Market Commission (CNMV) to facilitate the sale.

Most banks in Europe silent refuse to address Bitcoin transactions which ability of regulatory and volatility risks, complicating the approach for the research center to dump its Bitcoin holdings.

Connected: Bitcoin reveals exhaustion as analysts speak $125K purpose no longer going in 2025

Tenerife Council to reinvest proceeds into quantum research

Martínez acknowledged he expects the transaction to be performed in the approaching months, with proceeds reinvested into ITER’s comprise research programs, alongside with fields such as quantum technologies. He added that the 2012 indulge in changed into once never supposed as an investment but rather as portion of an experimental mission aimed at realizing blockchain infrastructure.

“It changed into once one in all the masses of research projects ITER has undertaken to explore and experiment with gentle technological methods,” Martínez acknowledged.

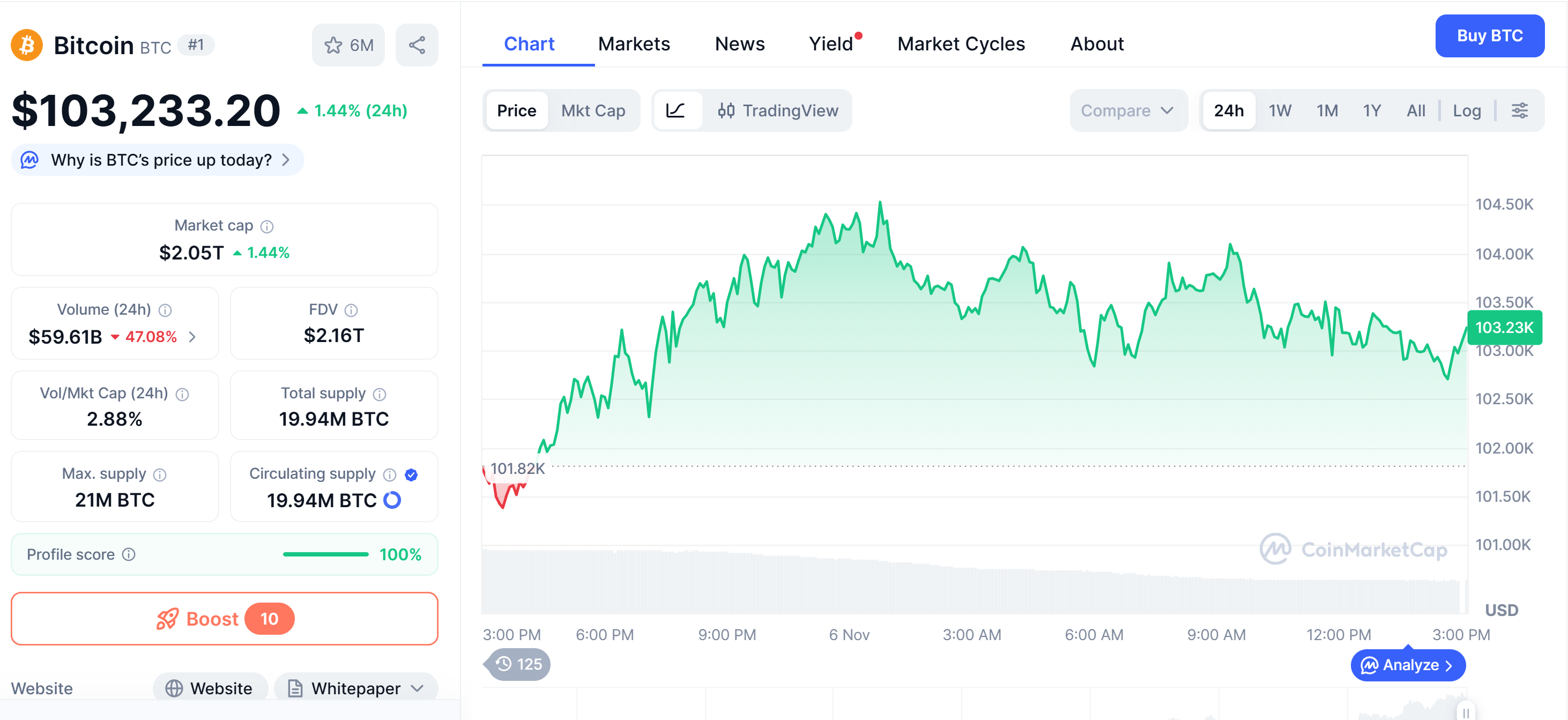

With BTC currently trading at around $103,200, ITER’s Bitcoin holdings are price over $10 million. The stash changed into once price higher than $12 million in early October as Bitcoin reached its all-time excessive of around $126,198, according to recordsdata from CoinMarketCap.

Connected: French Gov’t Space to Evaluate Lunge to ‘Embody Bitcoin and Cryptocurrencies’

Spanish financial institution wide BBVA companions with Binance to custody person funds

In August, Spanish banking wide BBVA partnered with Binance to abet as an fair custodian for customer funds. The deal enables Binance customers to custody sources backed by US Treasurys held at BBVA, which the change accepts as margin for trading.

The partnership came after BBVA instantaneous its affluent purchasers to speculate between 3% to 7% of their portfolio into crypto and Bitcoin.

Journal: Bitcoin OG Kyle Chassé is one strike faraway from a YouTube permaban