Spain’s monetary market regulator has added extra than a dozen contemporary names to its warning checklist, at the side of the YouTube and Telegram channel of 1 influencer, “Crypto Victor”. Alternatively, with only a handful of social followers, the influencer appears to be a knockoff of yet every other accepted crypto figure on the web.

Pushing Money Multiplication Schemes

The “Crypto Victor” yarn flagged by the Comisión Nacional del Mercado de Valores (CNMV) has only 70 followers on YouTube and 532 subscribers on Telegram. Alternatively, the YouTube channel has simply two movies available. Whereas the YouTube channel became as soon as created in 2015, the Telegram channel has existed since September 2020.

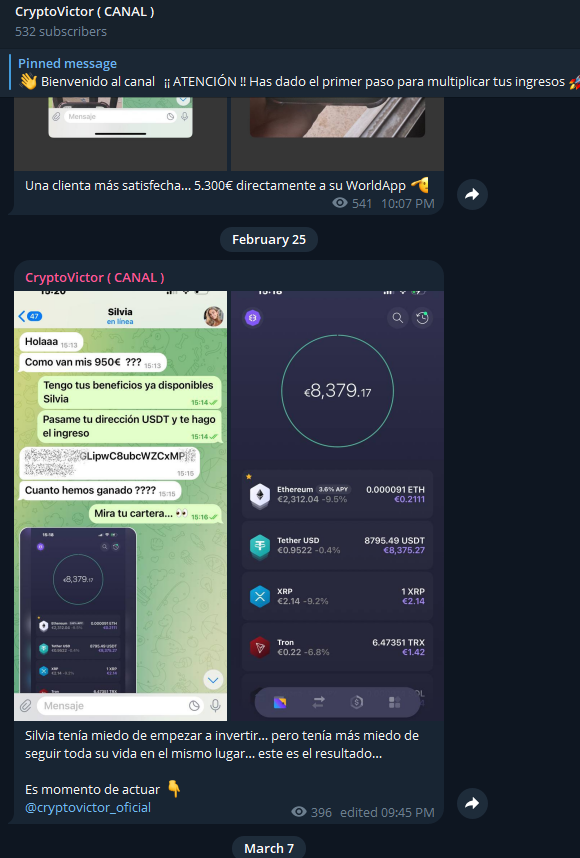

Every the YouTube and Telegram accounts of “Crypto Victor” point of curiosity on one ingredient, as beneficial by a message in its Telegram bio (translated from Spanish): “For many who will occupy WorldCoins and desire to multiply them… you doubtlessly can occupy simply referring to the coolest build.”

You’ll be able to also like: “20,000+ Hours of Cell phone Calls, Camouflage Recordings Show Two Big Boiler Room Operations”

The Telegram channel comprises just a few screenshots of buyer chats and examples of how they occupy multiplied their WorldCoins, which appears very suspicious. A message posted earlier this month on the Telegram channel additionally claims that “Crypto Victor” is a “verified, licensed stockbroker”, the authenticity of which could be very questionable. Furthermore, no licence number or jurisdiction the build it is regulated is talked about.

Now, the CNMV’s warning in opposition to this channel confirms that the yarn is offering shady products and companies.

A Regulated Name in the List

The warning additionally listed 18 other names, most of which appear to be false web sites claiming to produce international exchange and cryptocurrency buying and selling products and companies. Alternatively, the inclusion of Vida Markets, a contracts for variations (CFDs) broker regulated in South Africa, drew further attention.

Finance Magnates reached out to Vida Markets nonetheless had no longer got a response on the time of publication.

Alternatively, it will not be any longer extra special for brokers regulated in one jurisdiction to be flagged by authorities in yet every other. This assuredly occurs when brokers promote their merchandise or settle for purchasers in countries the build they set no longer appear to be licensed and the build native authorisation is required, in most cases triggering regulatory warnings.

“In step with CNMV records, these institutions are no longer registered in the corresponding registry of this Commission and, subsequently, are no longer licensed to produce investment products and companies or other activities enviornment to the CNMV’s supervision,” the Spanish regulator’s warning checklist talked about.

Spain additionally launched strict restrictions on the selling and distribution of retail CFDs in 2023, which has impacted the operations of many brokers in the nation.