Solayer (LAYER) is below intense stress after a sudden 45% break worn out weeks of bullish momentum. Once up 460% since February, the token trades below $1.70 as traders experience to achieve what resulted in the give plot.

The altcoin misplaced practically $350 million in market cap on this break. With volatility rising and the long/instant ratio now at 1.45, the market appears divided between these gazing for a rebound and these bracing for additional downside.

Solayer Loses Nearly $350 Million Market Cap – What’s In the support of the Tumble?

LAYER has plunged roughly 35% in upright 24 hours, falling from practically $3.10 to $1.90, leaving the community scrambling for solutions. This entertaining tumble comes despite Solayer’s sturdy fundamentals—it’s the first hardware-accelerated blockchain designed to dump operations onto programmable chips, aiming for over 1 million TPS and 100 Gbps bandwidth.

The mission additionally supplies real-world utility by its Solayer Emerald Card, which lets in customers to employ USDC seamlessly by job of Visa, with support for Apple Pay and Google Pay.

From February 18 to Would possibly maybe maybe additionally 5, LAYER surged 460%, making it one of the most handiest-performing altcoins of the 300 and sixty five days—till the sudden break disrupted momentum.

Honest now, confusion reigns. Some blame market makers for triggering a cascade of liquidations, others accuse the founders of shady practices, while just a few show the each day 110,600 LAYER token unlocks.

However, these each day unlocks anecdote for upright $219,000 in value—hardly ample to justify a $250 million+ loss in market cap. What’s extra referring to is the upcoming major unlock on Would possibly maybe maybe additionally 11, when 26.5 million LAYER (value about $51 million) will be released.

If market sentiment doesn’t accumulate better sooner than then, this influx of present may maybe perchance well intensify selling stress and doubtlessly push the value even lower.

LAYER Fracture Deepens: $3.2 Million in Long Liquidations Gasoline Terror

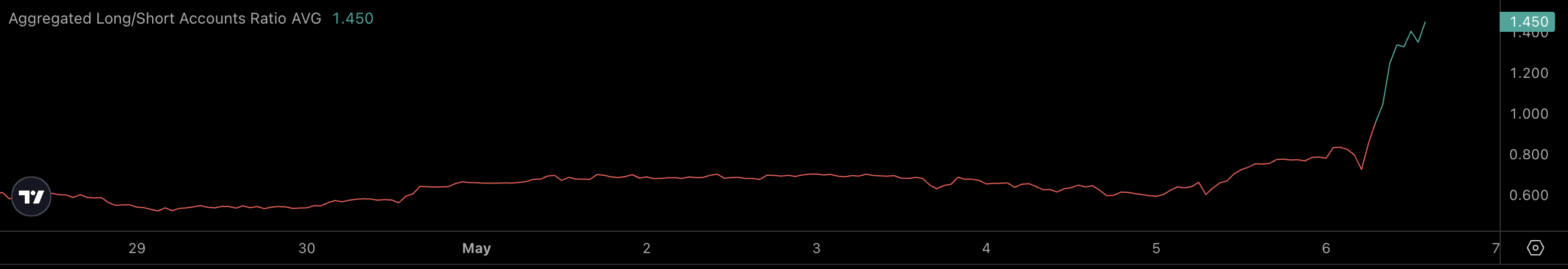

LAYER’s long/instant ratio sat at 0.78 all over the final 24 hours, with 56.14% of traders positioned instant—reflecting rising bearish sentiment.

Round $3.2 million in long liquidations had been resulted in, better than double the $1.5 million in temporary liquidations. This compelled selling likely accelerated the tumble from $3.10 to $1.90, as liquidation cascades compounded the stress.

With the upcoming Would possibly maybe maybe additionally 11 token unlock, the unwind of leveraged positions change into a key driver of the break.

While the long/instant ratio has since flipped to 1.45—indicating that extra traders for the time being are positioning for a rebound—the dearth of repeat e book depth remains a enviornment. In such environments, price volatility can stay elevated no matter whether sentiment shifts support to bullish.

Longs Pile In as LAYER Struggles Under $1.90

LAYER’s outlook remains extremely unsure as its price struggles to defend above $1.90 following a steep decline.

Merchants and traders are serene in search of clarity on the clarification for the break, while sentiment remains fragile before the Would possibly maybe maybe additionally 11 token unlock.

In this context, the fresh long/instant ratio of 1.45 shows a truly necessary shift—extra traders for the time being are making a guess on a rebound, with 59.2% of positions long versus 40.8% instant.

This rising long bias may maybe perchance well additionally counsel that some judge the worst is over, especially after an aggressive selloff.

However, it additionally introduces fresh probability: if LAYER fails to construct up better and drops additional, these newly opened long positions will be liquidated upright love sooner than—doubtlessly atmosphere off one other wave of compelled selling.