Solana (SOL) impress has fallen 20% within the final seven days, bringing its market cap down to $85 billion. Technical indicators love the Ichimoku Cloud and DMI highlight proper bearish momentum, with SOL trading below serious ranges and facing intense promoting rigidity.

If the mute downtrend continues, SOL dangers checking out helps at $159 and $147, with a doable tumble to $133, marking a 22.6% correction. On the opposite hand, a restoration would possibly well perchance gaze SOL danger resistance at $183 and, if damaged, target a rebound to $203, offering hope for bullish momentum to approach.

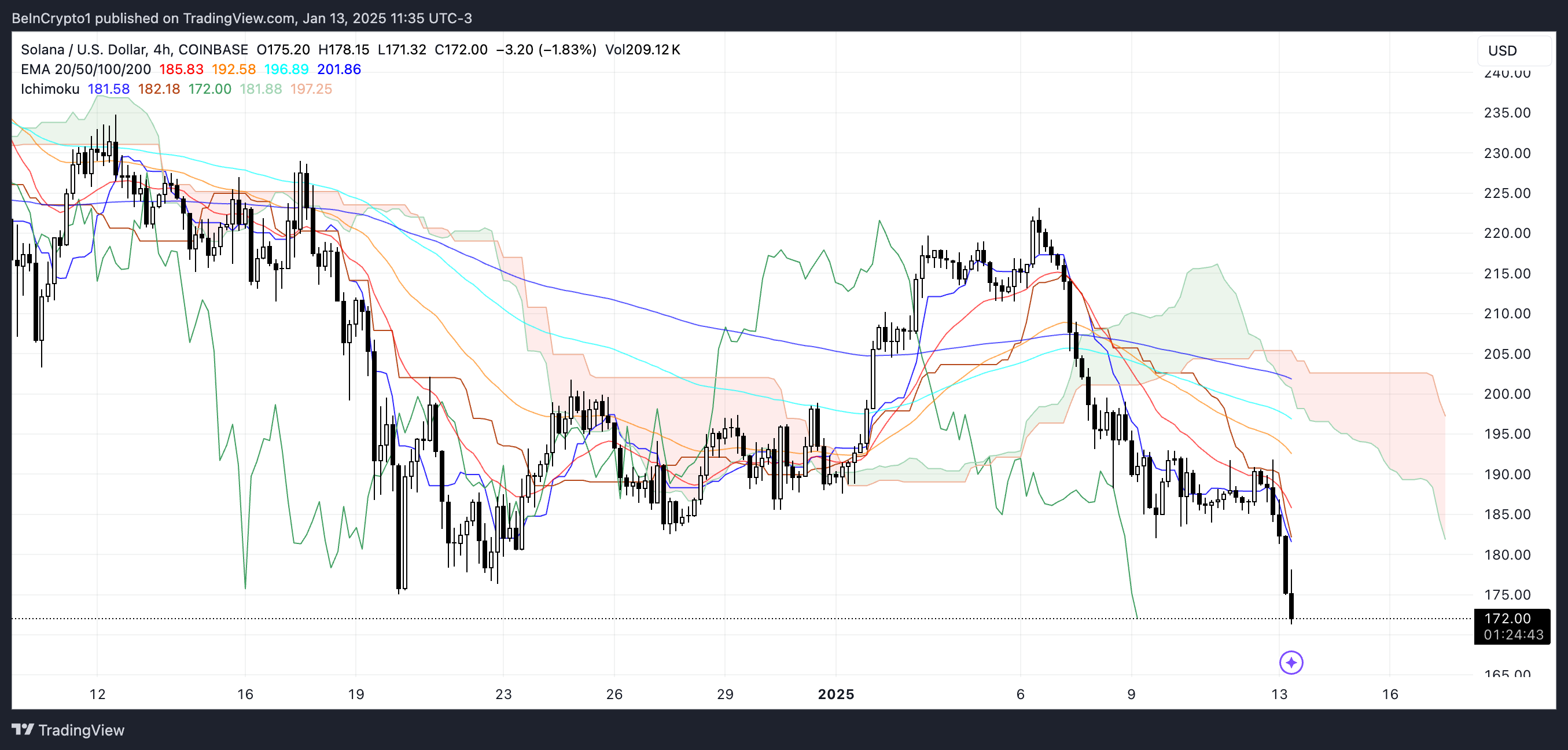

Solana Ichimoku Cloud Confirms a Bearish Setup

The Ichimoku Cloud chart for Solana finds a bearish outlook. Its impress is trading neatly below the cloud (Kumo), signaling proper downward momentum. The cloud itself is crimson and expanding, indicating an increasing bearish fashion and resistance forward.

Additionally, each and each the conversion line (blue) and the baseline (crimson) are trending downward, with the conversion line below the baseline, reinforcing the bearish setup. This alignment highlights ongoing promoting rigidity without a snappy indicators of reversal.

Moreover, the lagging span (inexperienced) is below the associated fee and the cloud, extra confirming the bearish bias. Conversely, for any restoration to occur, SOL impress would maintain to smash above the cloud.

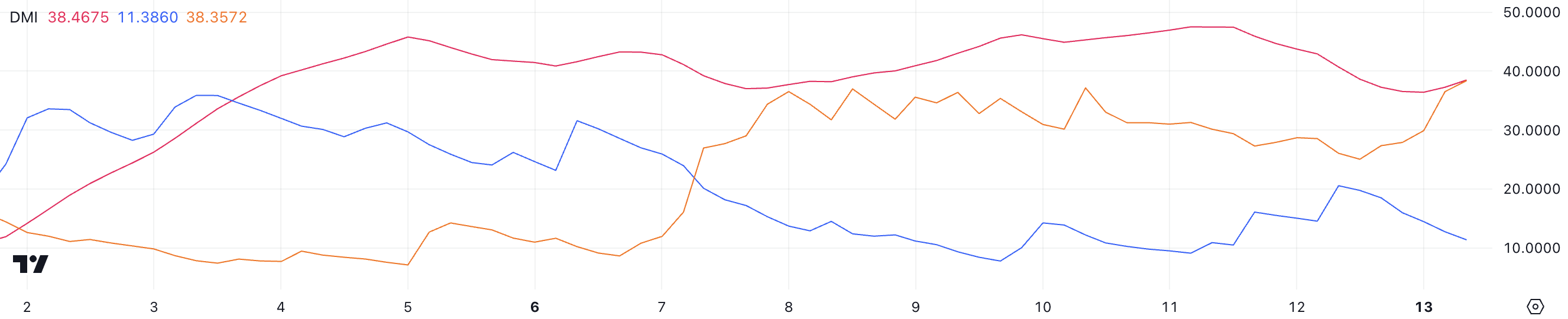

SOL Unique Downtrend Is Silent Valid

SOL DMI chart shows its ADX at 38.4, indicating a proper fashion. The ADX (Common Directional Index) measures the energy of a fashion without specifying its direction.

Values above 25 in general screen a proper fashion, and when the ADX exceeds 40, it displays very proper fashion energy, in spite of whether the fashion is bullish or bearish.

The directional indicators extra highlight the bearish rigidity on SOL. The sure directional index (+DI) has fallen sharply from 20.5 to 11.3, signaling a significant weakening of bullish momentum. Within the meantime, the detrimental directional index (-DI) has surged from 26 to 38.3, emphasizing increasing bearish dominance.

Together, these indicators confirm that SOL is firmly in a downtrend, with the correct ADX suggesting the downtrend is no longer in point of fact to reverse within the immediate timeframe. Except +DI shows indicators of restoration or -DI declines, SOL impress would possibly well perchance remain below rigidity within the approach timeframe.

SOL Tag Prediction: Can Solana Plod Below $140 In January?

If the mute downtrend persists, Solana impress would possibly well perchance take a look at its subsequent strengthen level at $159. Need to still this level fail to preserve, the associated fee would possibly well perchance tumble extra to $147, with a endured proper downtrend doubtlessly driving it down to $133, representing a 22.6% correction from mute ranges.

On the opposite hand, if SOL impress manages to improve its momentum, it would possibly probably perchance perchance danger the resistance at $183. A damage above this level would possibly well perchance pave the diagram in which for a rebound against $203, marking a significant restoration.