Solana (SOL) mark is up 10% on Tuesday, February 4, as it makes an are attempting to lend a hand above $200. Its market cap has recovered aid above $100 billion. No topic this rebound, buying and selling quantity has dropped by roughly 40%, now sitting at $8.9 billion over the identical duration.

Within the period in-between, SOL whale activity is showing indicators of restoration after a most fresh decline, and key pattern indicators stay undecided on the asset’s subsequent cross. Whether or no longer Solana can preserve its momentum or face renewed scheme back rigidity will rely on how it interacts with serious resistance and toughen ranges within the arriving days.

Solana Whales Are Making improvements to From A Latest Descend From Its All-Time High

The option of Solana whales – addresses retaining a minimal of 10,000 SOL – has rebounded to 5,120, up from 5,096 neutral correct four days within the past.

While it remains below the all-time excessive of 5,167 recorded on January 25, the latest enlarge suggests persevered accumulation by mountainous holders. This comes after a instant surge from 5,054 on January 17, highlighting great ardour from huge gamers on the market.

Monitoring SOL whales is the largest because their buying and selling activity can drastically affect mark traits. Great holders continually signal self assurance within the asset, and their accumulation can drawl bullish sentiment.

While the number is barely below its height, the indisputable fact that it is convalescing means that predominant investors are tranquil engaged, which can well toughen SOL mark steadiness and even future upward momentum.

Solana is Experiencing a Frail Downtrend Trend

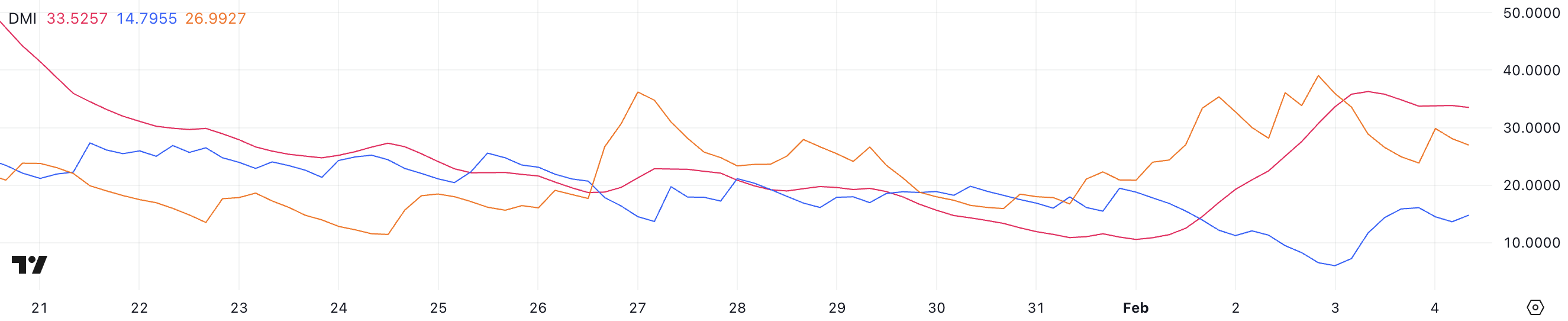

Solana’s DMI chart shows its ADX at 33.5, which is a upward thrust from 10.5 neutral correct four days within the past. While it peaked at 36.2 a day within the past, its fresh stage tranquil indicates a strengthening pattern.

The ADX (Sensible Directional Index) measures pattern energy, with values above 25 suggesting a good pattern and above 50 indicating an especially great one. The latest enlarge indicators rising momentum, but the route of the pattern remains unsafe.

Currently, Solana +DI is at 14.7, up from 6 a day within the past, while -DI has dropped to 26.Ninety nine from 39 two days within the past. The +DI represents bullish energy, while the -DI reflects bearish rigidity.

Even supposing bearish momentum is weakening, bullish momentum is tranquil quite low, that methodology the pattern remains undefined. If +DI continues rising and crosses above -DI, it could well well signal a shift toward an upward pattern, but for now, the market remains indecisive.

SOL Worth Prediction: Will Solana Quit Above $200?

The mark of Solana is currently buying and selling between $222.8 and $191, with its EMA lines showing non eternal though-provoking averages below the long-time-frame ones.

Alternatively, the downtrend isn’t that great anymore, leaving the pattern route unsafe. SOL mark is in a key differ where a breakout in both route could well elaborate the subsequent predominant cross.

If SOL mark regains its uptrend and breaks the $222.8 resistance, it could well well climb toward $244.Ninety nine, with a good rally doubtlessly pushing it aid to $271.

On the more than a number of hand, if a downtrend kinds and toughen at $191.69 is misplaced, the subsequent target could well be $181.91, with extra scheme back presumably taking it as low as $168.77.