Solana (SOL), the realm’s fifth-biggest cryptocurrency by market cap, didn’t defend sturdy and is now poised for a label drop. The most contemporary market sentiment appears bearish, with essential assets experiencing significant declines. SOL has also broken below its the largest help stage of $180.

Solana (SOL) Mark Motion and Upcoming Level

Per expert technical prognosis, SOL has been gaining help from this the largest stage since November 2024 and has tested it multiple instances.

On the opposite hand, this time, as the asset fails to defend, it loses this key stage and closes a each day candle below $180, in part confirming a bearish transfer forward. Per most contemporary label action and historic patterns, there is a sturdy probability that SOL might maybe observe a 15% label drop, reaching the $155 stage within the arriving days.

$115 Million Value SOL Outflow

Following this significant breakdown, traders and long-time length holders had been collecting SOL tokens, as reported by the on-chain analytics firm Coinglass. Details from blueprint inflow and outflow repeat that exchanges trust witnessed a essential outflow of $115 million fee of the asset, indicating doable accumulation.

On this bearish market model, such outflows can fetch looking to hunt down tension and potentially lead to a label rebound.

On the opposite hand, intraday traders seem like following long-time length holders, as they give the affect of being to be betting on the long side.

$45 Million Value Lengthy Wager

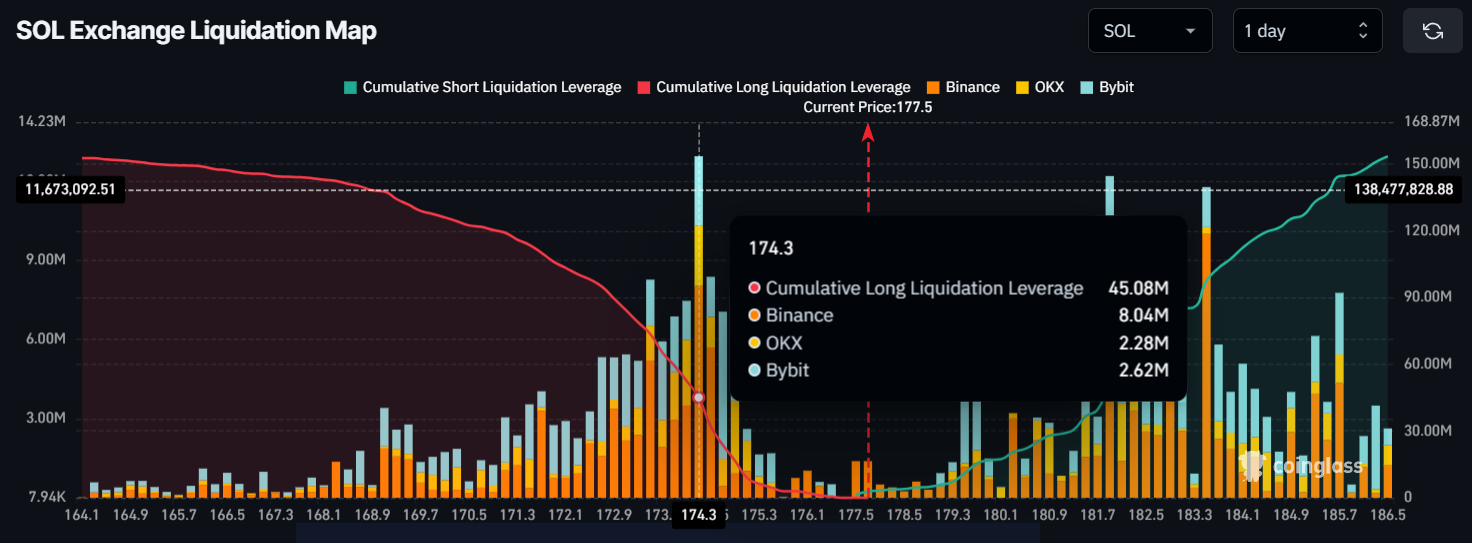

Details reveals that traders retaining long positions are strongly dominating the asset and are over-leveraged at $174.3, with $45 million fee of long positions. With such necessary commence positions, this stage acts as a the largest help.

Conversely, $180 is any other key stage the get traders retaining short positions are over-leveraged, with $15.50 million fee of short positions. This means that short sellers are exhausted, which can maybe maybe attend bulls reclaim the misplaced help stage.

Most up-to-date Mark Momentum

SOL is for the time being trading near $177 and has skilled a 6% label drop within the previous 24 hours. In all places in the same length, its trading quantity surged by 110%, indicating heightened participation from traders and traders amid the label decline.