After posting an spectacular 18% rally over the past 30 days, Solana’s (SOL) stamp now faces the probability of a deeper pullback that can per chance per chance wipe out a substantial part of these features. On Wednesday, October 15, SOL attempted to retest the $160 stage but didn’t interrupt by.

The cryptocurrency is now on the verge of falling under the significant $150 toughen stage. If SOL dips under this place, this prognosis indicates that the drawdown might result in the asset ending October with a get unfavourable return.

Solana Faces Crumple as Bearish Signals Emerge

Currently, Solana’s stamp sits at $153.10, reflecting a modest 1.20% decline over the past 24 hours. Historically, connected actions in SOL’s stamp absorb on the entire resulted in sharper declines.

In August, when SOL reached the $153 label, it rapidly lost 15% of its worth, dropping to $129.35. September saw an identical pattern with a 12% decline, whereas October followed suit with a 10% fall below connected instances.

If this pattern continues, Solana will be going by one other double-digit decline. The Bollinger Bands (BB), which tracks volatility, toughen this outlook. While SOL’s stamp stays above the middle band, it is a ways not in an upward fashion. Thus, if the token drops under the middle band, the anticipated correction might materialize.

Read extra: 13 Easiest Solana (SOL) Wallets to Think in October 2024

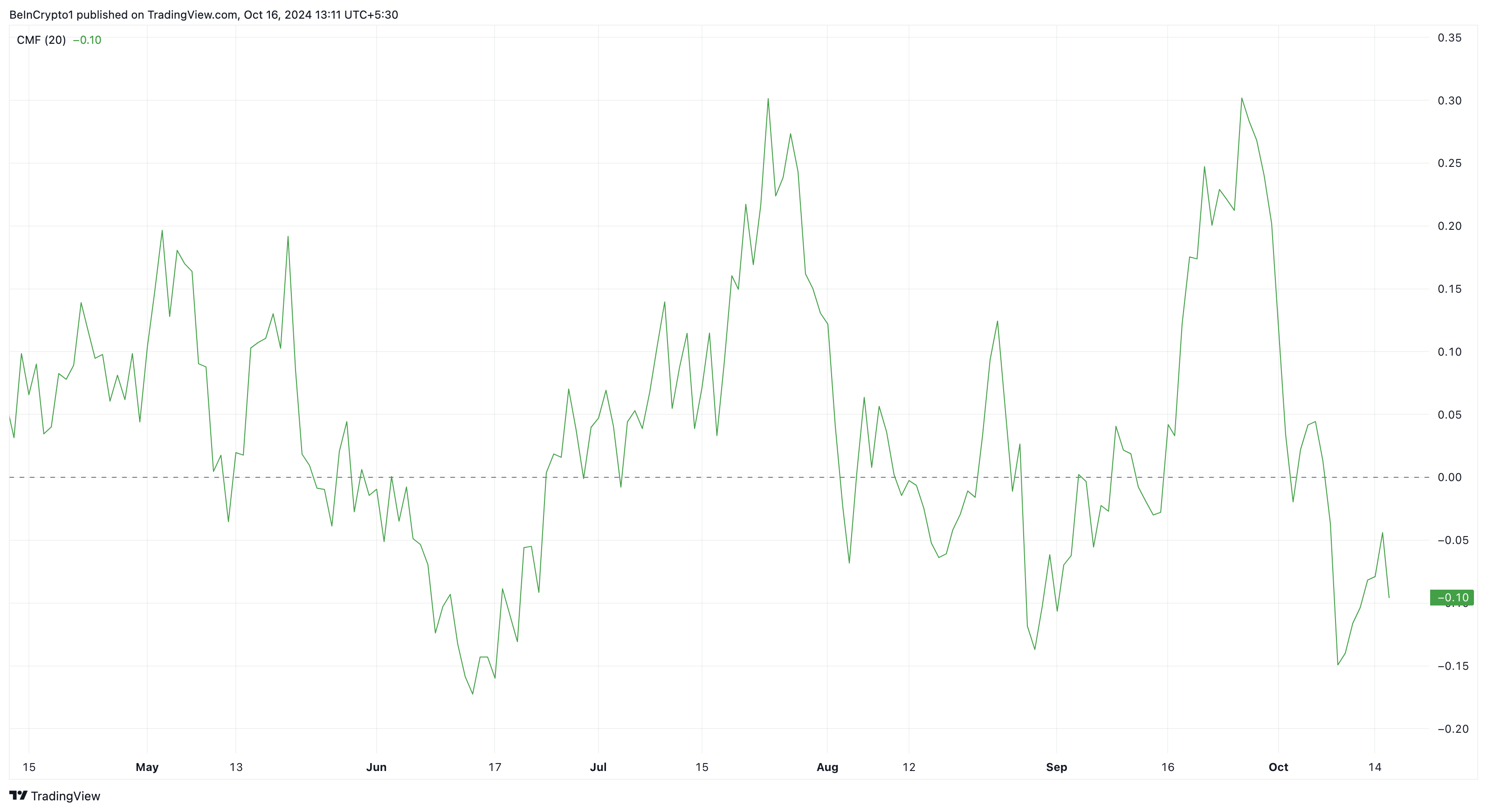

One more indicator reinforcing this bearish outlook is the Chaikin Cash Coast along with the skedaddle (CMF), which measures the quantity-weighted moderate of accumulation and distribution. The next CMF reading signals stronger accumulation, whereas a lower reading indicates elevated distribution.

On the day to day chart, the CMF has dropped under the zero signal line, signaling that Solana goes by heightened selling strain. If basically the most contemporary fashion continues, this extra helps the forecast of a probably double-digit decline in SOL’s stamp.

SOL Trace Prediction: 10% Retracement Next

As eminent earlier, Solana’s stamp is likely to fall under the significant $150 psychological toughen stage. Given basically the most contemporary market instances, bulls might fight to defend this zone, doubtlessly resulting in a single other stamp fall.

If this scenario performs out, SOL might discover a 10% decline to $136.07, echoing the stamp circulation considered between October 1 and 3. In an great extra bearish scenario, if selling strain intensifies, Solana might abilities a extra decline, with its stamp dropping to $125.02.

Read extra: 7 Easiest Platforms To Purchase Solana (SOL) in 2024

Conversely, if SOL manages to wait on above the $150 toughen, a rebound will be on the horizon. In this case, Solana might rally toward $173, a stage it hasn’t reached since July.