Solana (SOL) has been consolidating in most customary days, posting a 2.7% decline over the last week. Indicators equivalent to the BBTrend and DMI replicate susceptible momentum, with the BBTrend a exiguous obvious at 0.14 and the ADX at a low 12, signaling an unclear trend.

SOL’s EMA lines point out a bearish setup, though the inability of a solid downtrend suggests ability stabilization. Key stages at $183 toughen and $194 resistance will doubtless dictate whether or no longer SOL continues consolidating or makes a decisive transfer in the device timeframe.

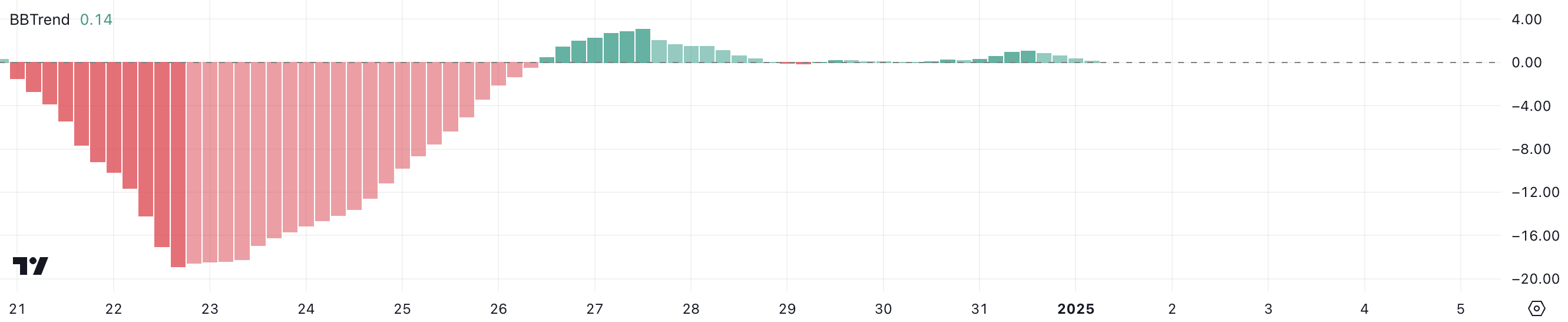

SOL BBTrend Is No longer Stable But

Solana BBTrend is currently at 0.14, reflecting a modestly obvious outlook because it attempts to attain elevated stages. Over the past few days, the BBTrend has been exact, fluctuating between 0 and 1.08, suggesting runt momentum in both direction.

While the indicator’s obvious mark marks a recovery from its carefully negative stages seen between December 21 and December 26, the inability of significant upward trot implies that SOL is struggling to make the momentum compulsory for a stronger rally.

The BBTrend, derived from Bollinger Bands, measures the strength and direction of a trend. Obvious values point out upward momentum, while negative values counsel downward momentum. Though Solana BBTrend is no longer in negative territory, its low obvious studying spherical 0.14 shows a market environment with subdued strength.

This suggests that while selling tension has eased, there isn’t sufficient procuring for job to power a significant breakout, conserving SOL mark in a cautious consolidation section. Extra trot in the BBTrend would be compulsory to substantiate any decisive mark motion.

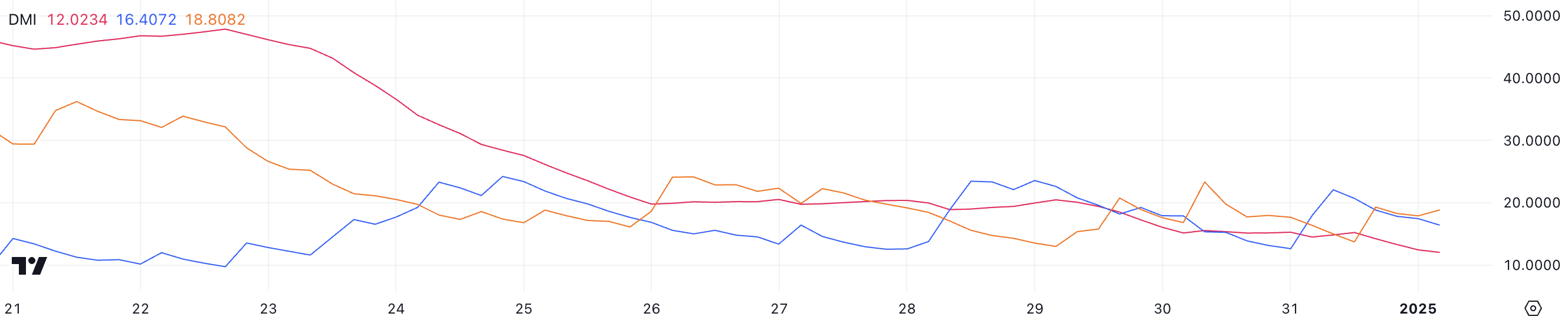

Solana Is Stuck in Consolidation

Solana DMI chart shows its ADX currently at 12, final under 20 since December 30, indicating susceptible trend strength. This low ADX studying suggests that essentially the most customary downtrend lacks significant momentum, reflecting a consolidative market environment.

With both directional indicators (D+ and D-) barely shut, the chart shows a lack of particular dominance, despite the truth that D- at 18.8 a exiguous exceeds D+ at 16, asserting a bearish bias.

The Average Directional Index (ADX) measures trend strength, no matter direction, on a scale from 0 to 100. Values above 25 point out a solid trend, while readings under 20, cherish SOL most customary 12, signal a susceptible or absent trend.

In the short timeframe, this mixture of a low ADX and a exiguous dominant D- suggests that Solana is in a consolidation section, with the downtrend shedding strength but no longer yet reversed.

SOL Tag Prediction: More Facet Movements Forward

The EMA lines for Solana mark point out an total bearish setup, with prolonged-timeframe lines positioned above temporary ones, reflecting lingering downward momentum. Alternatively, as highlighted by the DMI chart and BBTrend, there might be currently no solid trend riding SOL mark motion, which aligns with its consolidative behavior.

If the downtrend strengthens, SOL mark might perchance take a look at the toughen at $183, and a failure to support this stage might perchance push the mark extra all the draw down to $175, signaling elevated bearish tension.

Conversely, if SOL mark regains its momentum and an uptrend emerges, it is going to undertaking the resistance at $194.

A breakout above this stage might perchance result in a take a look at of the next resistance at $201, being able to rise extra to $215 if that barrier will be broken.