Solana (SOL) is down 5% at some level of the last seven days and has traded below $180 for six consecutive days. Despite this, institutional pastime in SOL is rising, with huge gamers amassing and staking important amounts earlier than a doable altcoin season.

Alternatively, technical indicators are exhibiting signs of weak spot, collectively with a detrimental BBTrend, a bearish Ichimoku Cloud setup, and a looming EMA loss of life unsuitable. These blended indicators counsel that while lengthy-time length self belief is rising, non permanent momentum remains below rigidity.

Solana Draws Institutional Ardour, Nonetheless Ichimoku Cloud Indicators Uncertainty

Institutional accumulation of Solana is intensifying in Can even 2025, signaling real self belief earlier than a doable altcoin season.

Despite altcoin buying and selling volumes ultimate below old high stages, most foremost gamers had been stacking SOL—staking huge amounts and adding to lengthy-time length holdings.

Over 65% of SOL’s offer is now staked, and Q1 2025 app earnings reached $1.2 billion, the strongest in a yr. These trends, blended with certain on-chain flows and ecosystem enlargement, location Solana as a frontrunner if altcoin momentum returns.

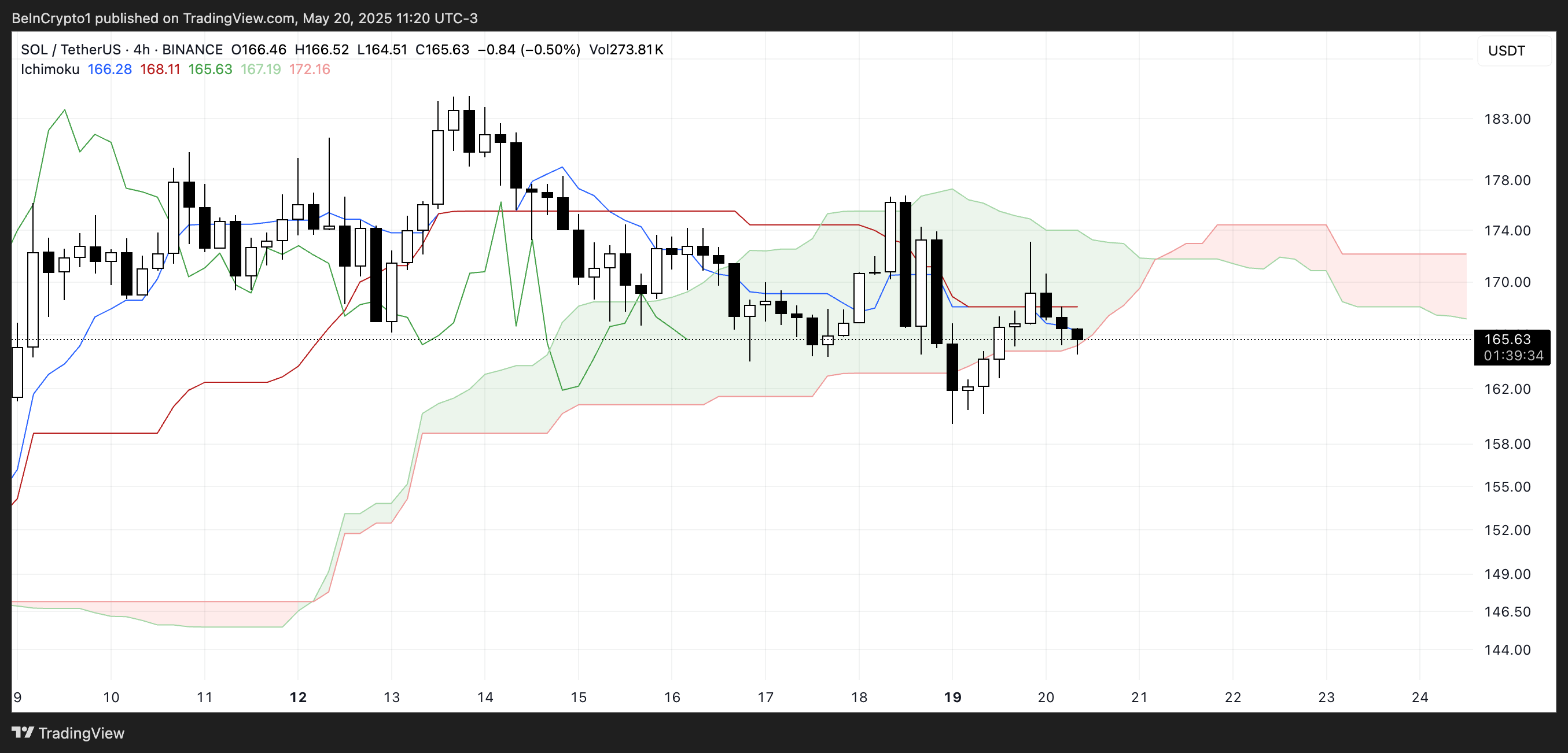

The Ichimoku Cloud chart for Solana currently reflects market indecision with a itsy-bitsy bearish tilt. Place action is hovering at some level of the inexperienced cloud, suggesting consolidation and an absence of certain direction.

The blue Tenkan-sen (conversion line) sits below the crimson Kijun-sen (baseline), indicating non permanent weak spot. The Chikou Span (inexperienced lagging line) is tangled in newest label action, reinforcing the neutral-to-bearish bias.

Forward, the cloud shifts to crimson and appears to be like to be flat, pointing to doable resistance and low momentum except a real breakout occurs.

SOL BBTrend Stays Negative, Bearish Momentum Holds Below -4

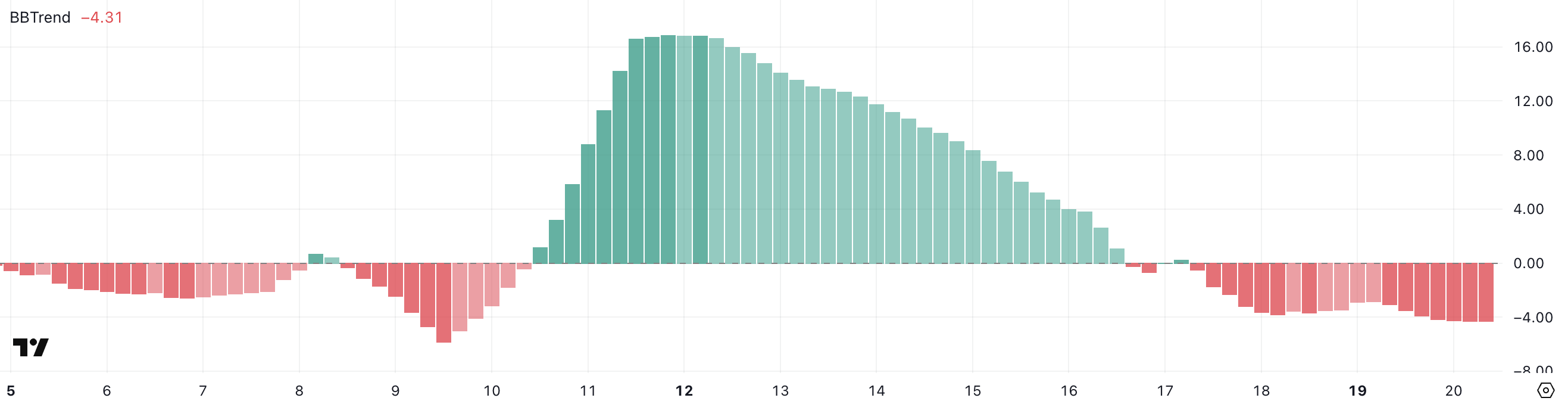

Solana’s BBTrend is currently at -4.31, marking its third consecutive day in detrimental territory.

Over the past several hours, the indicator has remained real around -4, suggesting consistent bearish rigidity within the instant time length.

The BBTrend (Bollinger Band Model) measures the energy and direction of label hurry relative to the width of the Bollinger Bands.

Values above 0 usually philosophize bullish momentum, while values below 0 signal bearish momentum. A BBTrend at -4.31 reflects real downward rigidity and restricted volatility enlargement to the upside.

If this pattern continues, it will furthermore demonstrate extra consolidation and even a deeper pullback except a spicy reversal breaks the pattern.

Death Substandard Setup Can even Push SOL Wait on To $141 If $160 Enhance Fails

Solana’s EMA lines are converging and can soon make a loss of life unsuitable, a bearish technical signal where the non permanent EMA crosses below the lengthy-time length EMA. If that happens, SOL label might well perhaps furthermore take a look at the toughen level at $160.

A breakdown below this level might well perhaps furthermore push the label the total style down to $153.ninety 9, and if bearish momentum quickens, Solana might well perhaps furthermore decline extra towards $141.

On the different hand, if Solana regains bullish momentum, the first resistance to leer is at $176.77.

A winning breakout above this level might well perhaps furthermore originate the door for a extra rally towards the $184.88 zone.