Solana (SOL), the enviornment’s fifth-greatest cryptocurrency by market cap, is poised for downside momentum as its daily chart flashes a warning impress. On December 3, 2024, the sentiment across the cryptocurrency landscape appears bearish, with sources struggling to assemble momentum.

Solana (SOL) Technical Analysis and Upcoming Ranges

Amid the impress correction phase, Solana (SOL) has did now not preserve its main toughen stage and has fallen beneath the $227 tag. Basically based on knowledgeable technical diagnosis, after hitting its all-time high, SOL entered a consolidation phase, forming a bearish head-and-shoulders impress action sample.

In nowadays’s bearish, or moderately impress-corrective, stance, SOL breached the neckline of the bearish sample and tried to conclude a daily candle beneath it. Basically based on most contemporary impress action and historical momentum, if SOL closes a daily candle beneath the $226 stage, there could be a robust possibility it could in point of fact likely well decline by 10% to reach the $200 tag in the arrival days.

On the obvious facet, SOL is trading above the 200 Exponential Fascinating Common (EMA) on the daily timeframe, indicating an uptrend. In the period in-between, the Relative Strength Index (RSI) suggests a seemingly upside rally in the arrival days, as its impress is near the oversold zone.

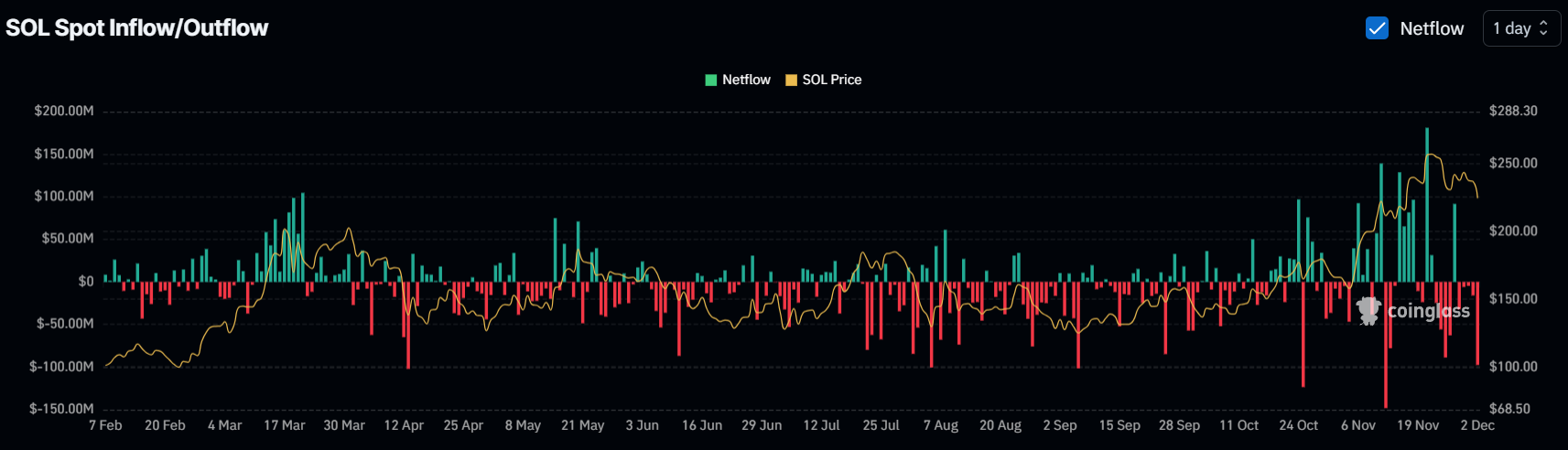

The outflow of $159M SOL

Irrespective of the bearish outlook, whales and establishments relish shown strong self belief and keenness in the altcoin, in step with the on-chain analytics company Coinglass. SOL’s disclose inflow/outflow files finds that at some level of the last four days, exchanges relish witnessed a basic outflow of $159 million worth of SOL.

In the cryptocurrency context, outflow refers to whales withdrawing tokens from exchanges to their wallets, which is regarded as a bullish impress and suggests a seemingly upside rally in the arrival days.

Alive to relating to the outflow, apparently SOL traders could likely well merely be capitalizing on doubtlessly the most contemporary market sentiment and worth decline by buying extra sources.

Unusual Label Momentum

At press time, SOL is trading near $222, having experienced a 6.55% impress decline in the previous 24 hours. All the device via the same duration, its trading volume surged by 101%, indicating heightened participation from traders and traders when in contrast with the day outdated to this.