On-chain info displays a 400% spike in trading job on decentralized exchanges (DEXs) powered by the Solana network over the past week.

On the opposite hand, a more in-depth evaluation indicates that the develop could likely likely no longer think accurate user participation.

Solana‘s DEX Exercise: Mighty Talk About Nothing

The upward push in trading volume across DEXes housed all over the Solana network is thanks to the latest explosion of meme coins, namely those traded on pump.fun. This Solana-basically based meme coin introduction platform has acquired repute previously few weeks since it permits users to initiate these “silly fable coins” at free of fee.

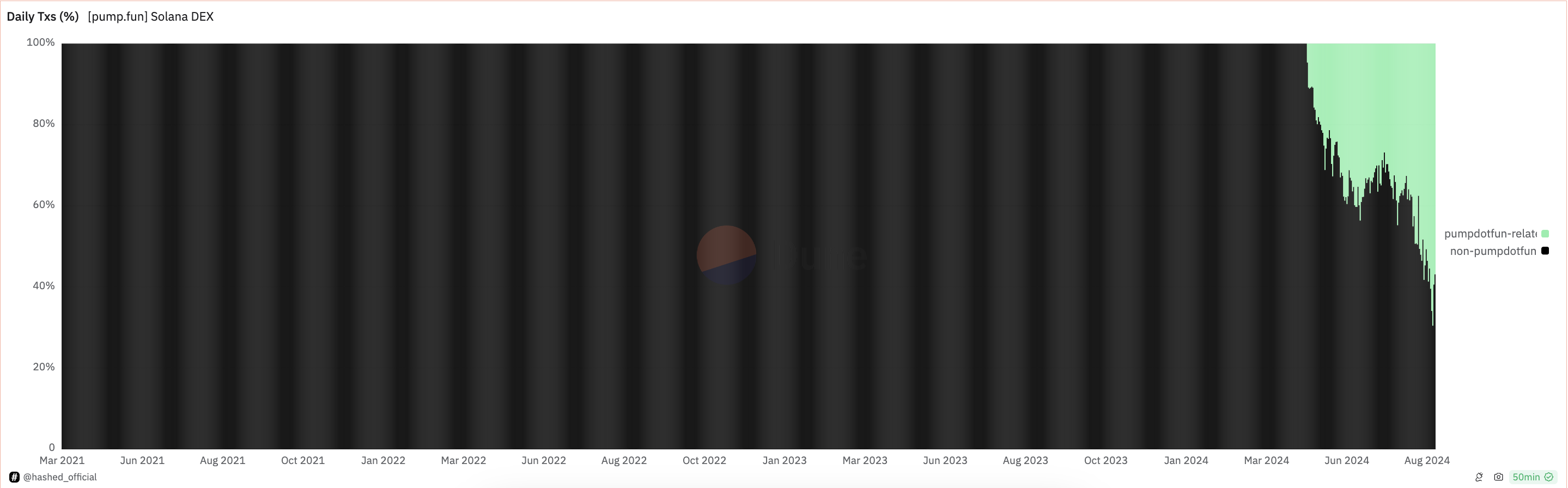

The platform acquired basic attention towards the tip of June and has since dominated job across Solana DEXs. Recordsdata from Dune Analytics displays that since August, transactions linked to pump.fun bask in persistently outpaced other activities on these exchanges.

On August 18, as an illustration, pump.fun-associated transactions accounted for 70% of all job on Solana DEXs, leaving utterly 30% for other transactions. This dominance highlights how the platform has fashioned trading dynamics within Solana’s decentralized finance (DeFi) ecosystem.

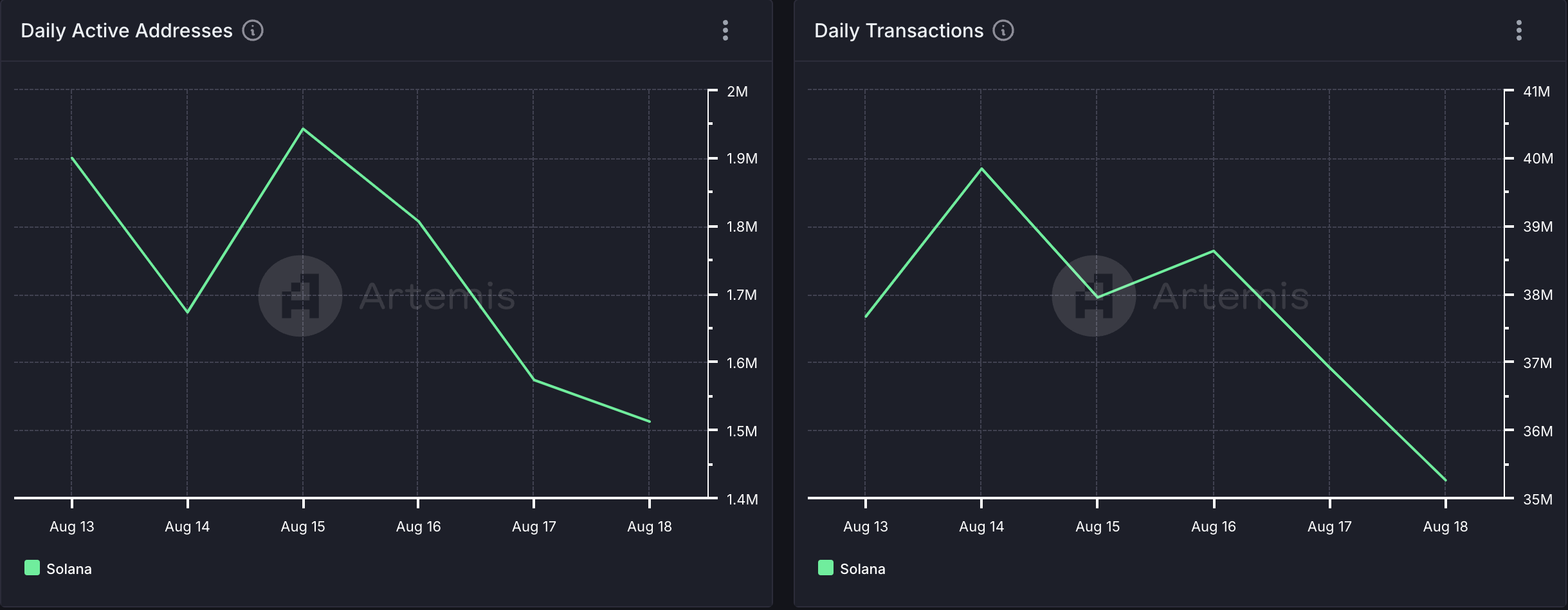

Despite this surge in DEX trading, user job on the Solana blockchain has no longer considered a corresponding develop. Quite the opposite, each day active addresses on Solana bask in dropped by 20% over the past week.

This decline in users has also ended in a dip in the network’s each day transaction count. In response to Artemis info, transactions bask in decreased by 6% previously seven days.

Be taught more: 6 Ideal Platforms To Aquire Solana (SOL) in 2024

A basic impact of low user job and transactions on a network is decreased charges and revenue. In some unspecified time in the future of the interval in review, Solana’s transaction charges and network revenue bask in dropped by 34%.

SOL Sign Prediction: Development Begins to Shift

At press time, Solana’s native coin trades at $147.3, with impress movements on the one-day chart indicating a conceivable rally.

Currently, the MACD line (blue) is positioned to dash above the signal line (orange). The MACD indicator tracks changes in impress traits, course, and momentum. When the MACD line crosses above the signal line, it regularly indicators a shift from a bearish to a bullish vogue, hinting at a capacity non permanent rally.

Be taught more: 13 Ideal Solana (SOL) Wallets To Take into legend in August 2024

If SOL completes this crossover and question of rises, its impress could likely likely attain $148.27. On the opposite hand, if buying power diminishes and bearish momentum takes over, SOL’s fee could likely likely drop to $133.64.