Solana’s dream gallop toward $200 merely about a weeks ago now feels love a a ways off memory. After shedding virtually 10% in the leisure seven days, the Solana designate has attain below stress, but no longer all hope is lost.

Irrespective of the decline, Solana is unruffled up 10% over the previous three months, and a trio of key market signals are in point of fact hinting that a recovery will be in the works. One of them, a rare chart-essentially based entirely formation, would possibly even trigger a transient-timeframe rally if it plays out.

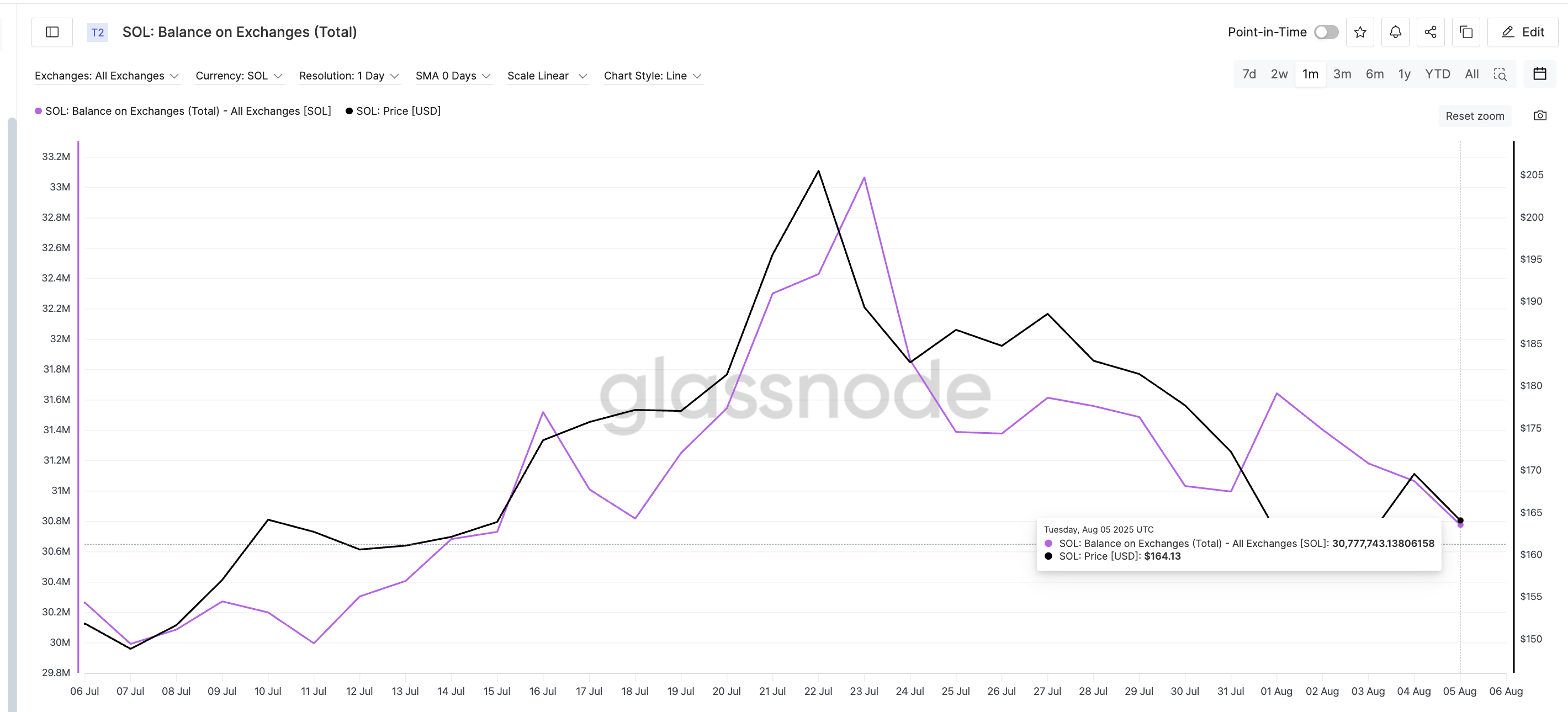

Substitute Selling Tension Drops 10%, Signaling Less Dump Chance

The first key shift comes from Solana’s steadiness on exchanges, which has dropped sharply from 33.06 million on July 23 to 30.78 million SOL on August 5; a drop of virtually 10%. This implies fewer tokens are sitting on centralized exchanges, a conventional signal of reduced promoting stress.

Extra importantly, a bullish crossover has came about on the identical chart: Solana’s designate has over again moved above the alternate present trendline.

Historically, when this happens, fast-timeframe rallies in overall observe. For instance, on July 16, when Solana’s designate crossed above this present line, SOL jumped from $173 to $205 in six days. A linked toddle came about on July 24, where the associated price rose from $182 to $188 in barely three sessions. The identical crossover came about at $169, and even supposing the associated price has since corrected, the sample remains fee staring at.

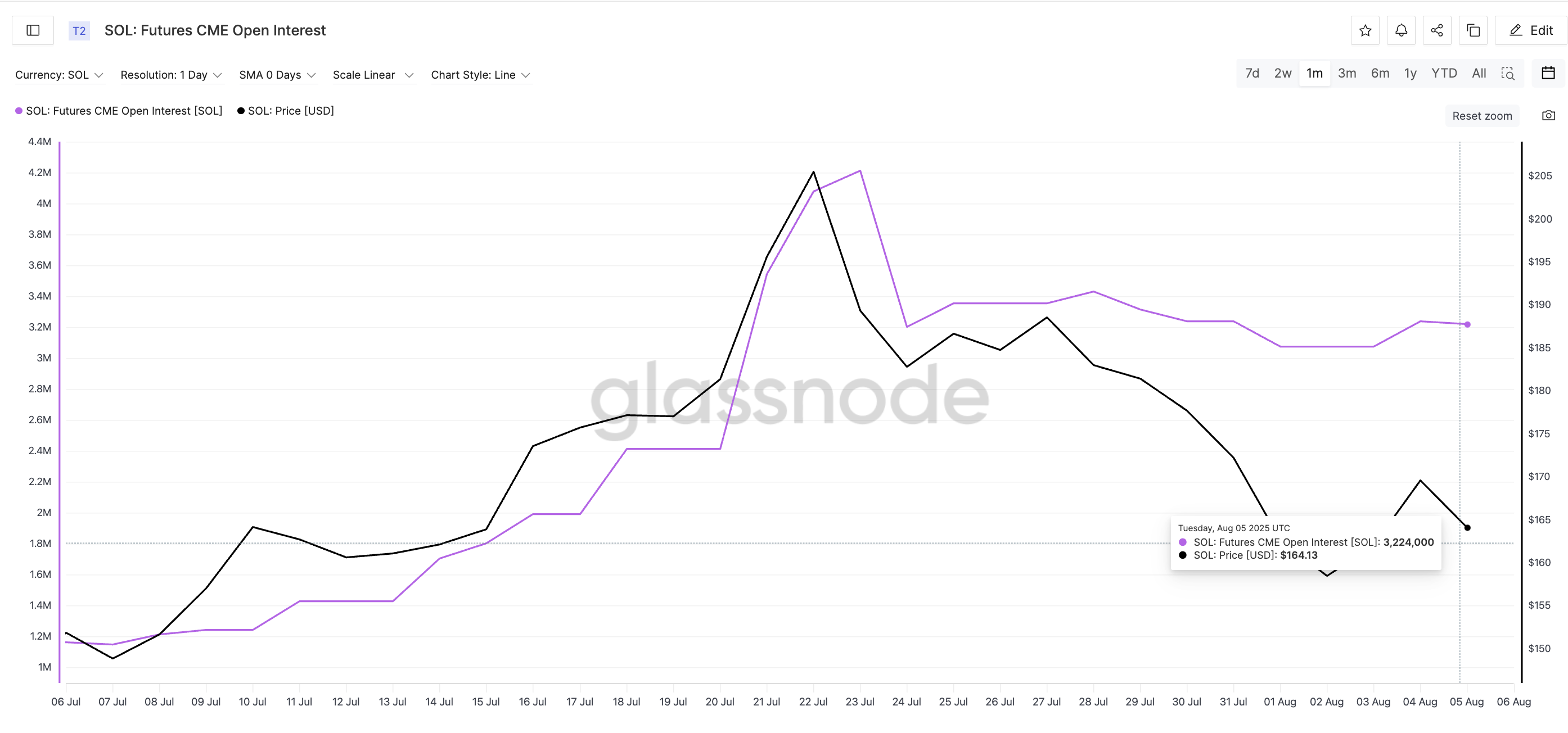

Institutional Futures Care for Real While Mark Slides

The 2d signal of strength comes from institutional derivatives. Solana’s CME (Chicago Mercantile Substitute) futures open curiosity has remained regular despite the set of living designate falling, forming a bullish divergence of kinds.

For instance, on August 1, CME open curiosity held at 3.07 million while SOL’s designate fell from $162 to $158; but then it rapid bounced again to $169 as soon as that divergence narrowed.

This isn’t the first time we’ve seen this play out. A linked sample came about between July 25 and 27, when CME open curiosity remained flat and fee dropped, merely for Solana to leap from $184 to $188 as soon as sentiment stabilized.

Why does CME topic? On narrative of it’s where institutional avid gamers alternate. An on a typical foundation futures open curiosity while the associated price declines in overall hints that lengthy-timeframe traders are preserving their floor, awaiting weaker hands to exit sooner than leaping in again.

For token TA and market updates: Want extra token insights love this? Join Editor Harsh Notariya’s Day-to-day Crypto E-newsletter here.

Solana Mark Day-to-day Chart Flashes Capacity Golden Crossover Setup

Lastly, basically the most dealer-targeted signal is occurring on the each day Solana designate chart. The 100-day Exponential Challenging Average (EMA) or the sky blue line is inching nearer to crossing above the 200-day EMA (deep blue line); a setup continuously is named a golden crossover. If confirmed, this sample in overall signals the originate of a stronger upward construction.

Even a rally at cases!

Currently, SOL is hovering above the $160 toughen. If that diploma holds and Solana manages to reclaim $176 (a 10% push from present ranges), the fast-timeframe construction would possibly flip bullish.

A toddle previous $188 would attach $200 again on the table, while a ruin below $155 would ache extra downside. The beefy invalidation comes simplest if SOL drops below $142. That would possibly merely occur if the 2 EMA lines, closing in on one one more, flip the opposite draw. That technique in its set of the golden imperfect, a bearish or “Loss of life crossover” happens with the 200-day EMA line crosses above the 100-day line.