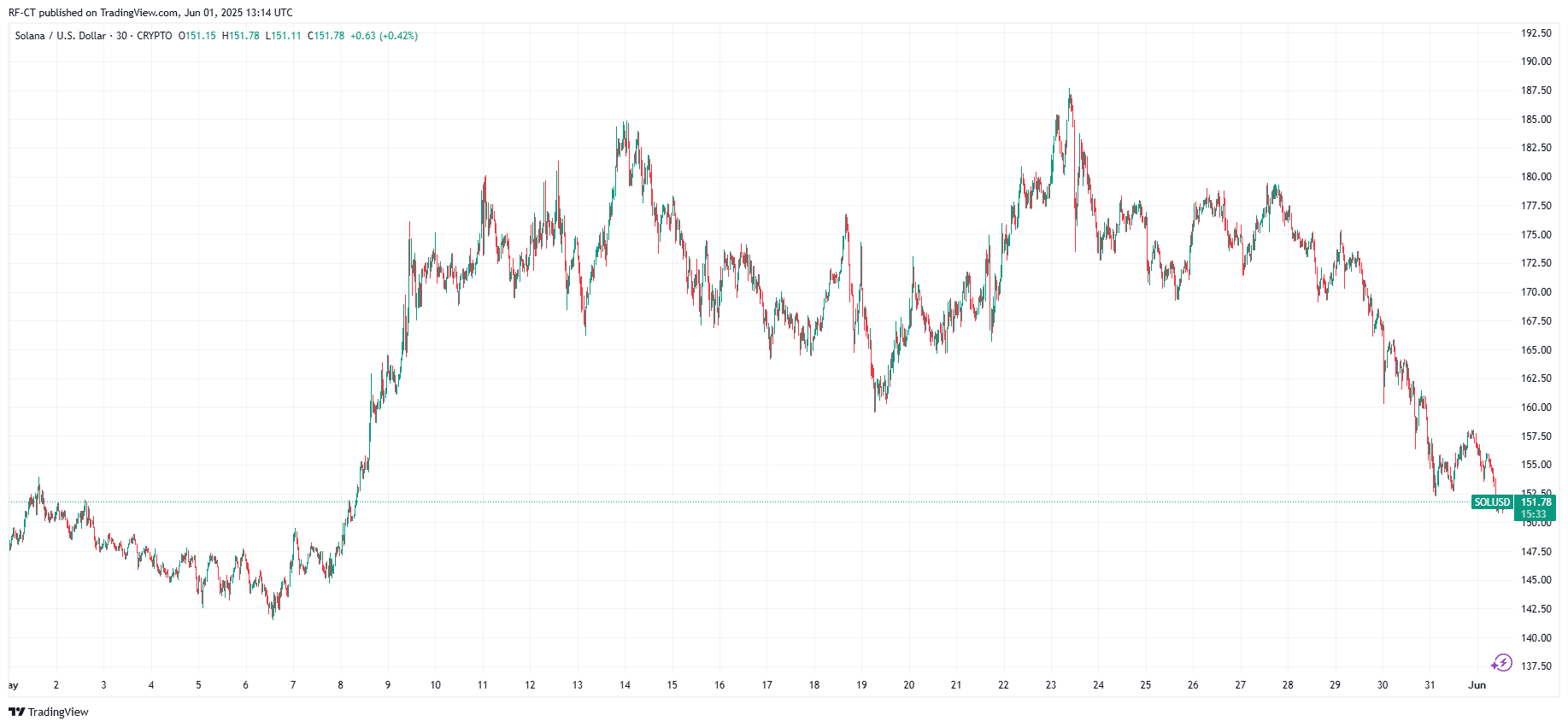

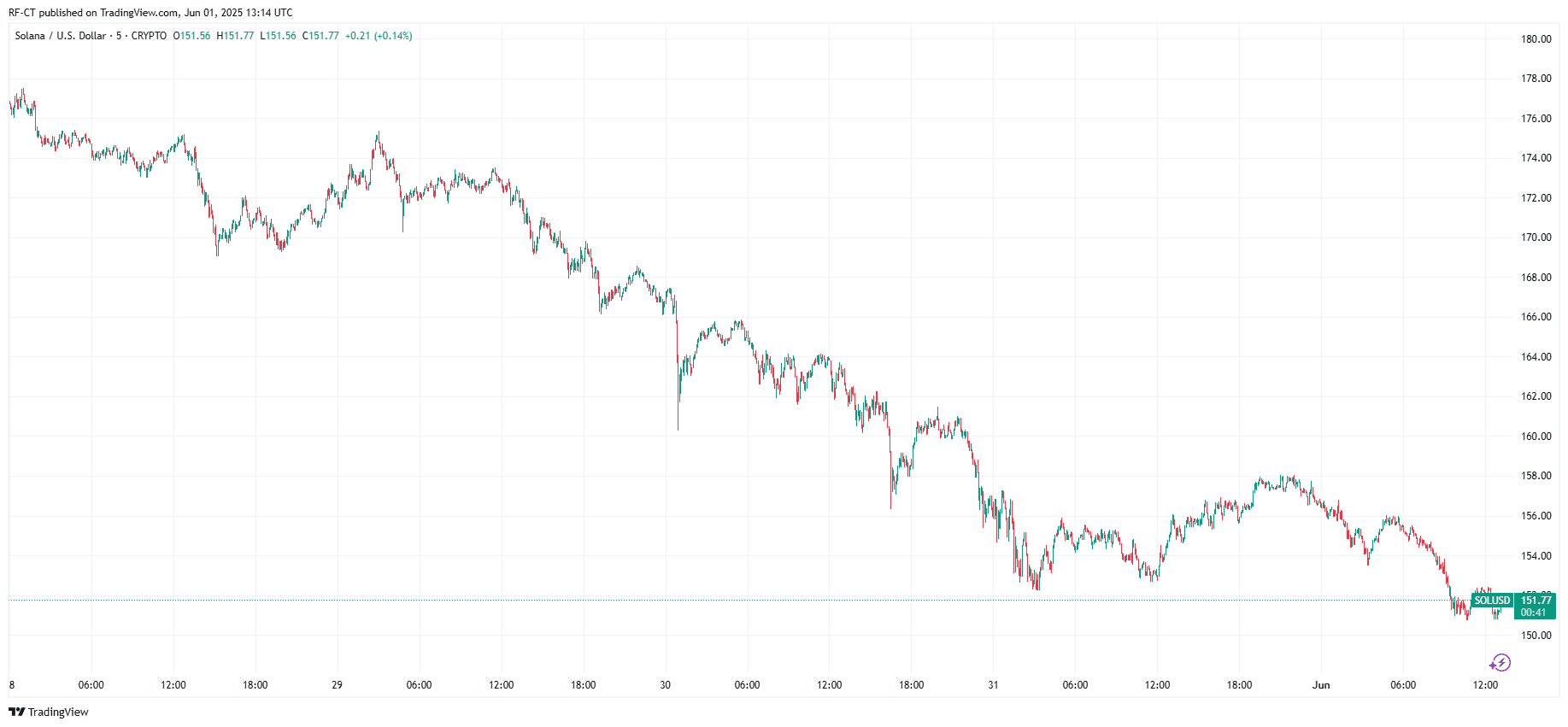

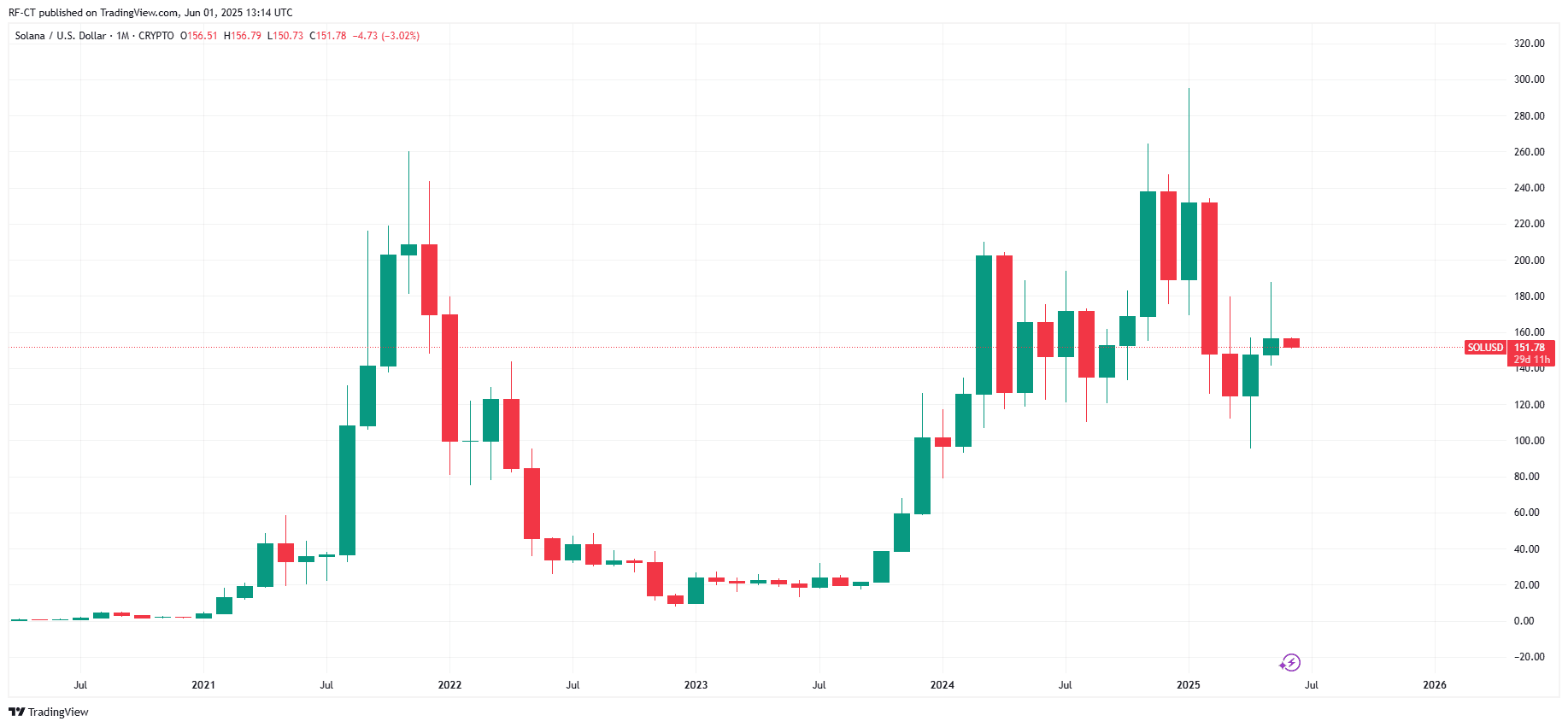

As of June 1, 2025, Solana is trading spherical $152, down roughly 10% over the final week. After failing to lend a hand above key strengthen ranges, considerations are rising that the common altcoin might perhaps perhaps well plunge even extra. With macroeconomic tensions rising and on-chain signals flashing red, the sizable question is: Will Solana smash to $70?

Bearish Signals: Could SOL Fall to $70?

Several warning signs are stacking up in opposition to the $Solana charge:

- Technical Breakdown: SOL has dropped below critical strengthen at $165 and exited a bullish channel that had sustained its uptrend since April. This destroy signals a critical shift in market structure.

- Macroeconomic Headwinds: Ongoing world tariff disputes and investor uncertainty are weighing on the broader crypto market, amplifying promote stress on nice-cap tokens like Solana.

- Token Unlocks and DEX Slowdown: Upcoming token unlocks and declining trading volumes on Solana-basically based DeFi platforms are contributing to the bearish outlook.

If momentum fails to reverse, some analysts imagine SOL might perhaps perhaps well dawdle below $100 and even retest the $70 zone in a worst-case field.

Bullish Catalysts: Is a Rebound Nonetheless That you might perhaps perhaps perchance imagine?

Despite the bearish mood, some metrics dwell bullish for the $SOL charge:

- Institutional Accumulation: Mountainous investors and funds continue to derive Solana, citing its high-velocity network and prolonged-time length scalability.

- Alternate Outflows: Over 4 million SOL tokens had been no longer too prolonged ago withdrawn from exchanges, a classic signal that investors are keeping, no longer promoting.

- Network Strength: Solana’s blockchain stays one among basically the most lively available within the market, with robust validator performance and sizable transaction quantity.

While non permanent stress exists, many imagine the fundamentals peaceful favour prolonged-time length mutter for SOL.

Professional Predictions: What’s Subsequent for SOL Label?

Solana charge predictions for 2025 fluctuate widely:

- Conservative analysts search recordsdata from a leap to the $160–$200 vary if strengthen ranges lend a hand.

- Others forecast a bullish breakout toward $400 later within the 365 days.

- Some prolonged-time length bulls even imply a future $1,000 valuation if the Solana ecosystem continues its expansion.

Nonetheless, except the SOL charge decisively reclaims key technical ranges, bearish momentum might perhaps perhaps well dominate.

Conclusion: $70 or Rebound?

Solana is at a a must bear turning level. The technical breakdowns and historical market sentiment might perhaps perhaps well situation off a deeper decline, perchance as low as $70. Nevertheless, institutional hobby and robust network metrics imply that a reversal isn’t out of attain.

For now, cautious optimism prevails. Traders must visual display unit the $145 and $130 zones closely, as a destroy below might perhaps perhaps well confirm the bearish case, while a recovery above $165 might perhaps perhaps well shift momentum lend a hand in favour of the bulls.

$Solana, $SOL