Solana’s tag is hovering round the $200 impress just correct because the U.S. Federal Reserve faces one of its hardest selections of the twelve months. The July PCE inflation document confirmed that prices are aloof rising sooner than the Fed’s draw, but merchants are making a wager heavily on a September rate lower. This combination of sticky inflation, labor market concerns, and market optimism is constructing the final be conscious storm for crypto volatility. For Solana, a coin that prospers on liquidity shifts, the Fed’s next transfer would possibly resolve whether it breaks higher toward $240 or slips aid into consolidation.

Solana Price Prediction: Inflation Light Sticky. Why It Issues?

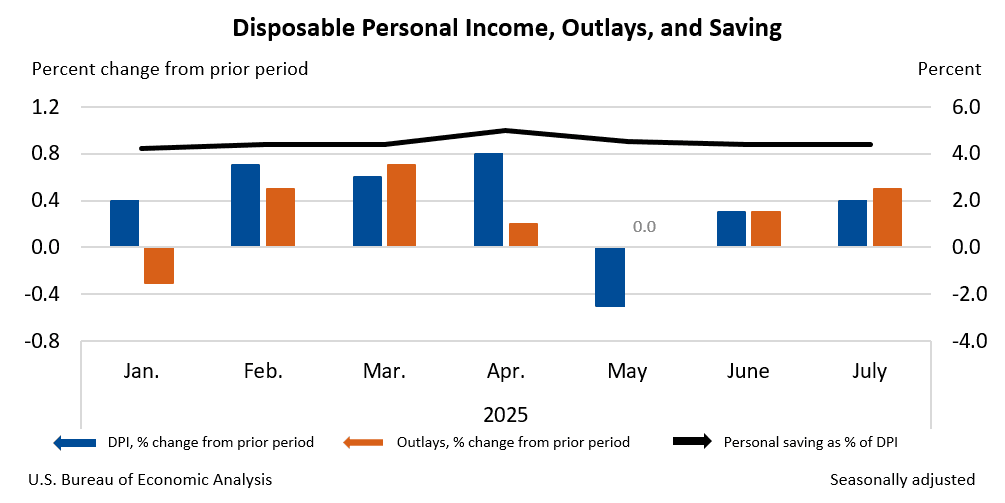

The July PCE document confirmed inflation is aloof working hotter than the Fed’s long-term draw. Headline PCE stayed in style at 2.6%, however the core PCE moved up for the third straight month, now sitting at 2.9%. That is no longer going to ogle alarming on its hang, however the persistence is exactly what central bankers danger: inflation that refuses to chill no matter tight protection.

For crypto merchants, this creates a paradox. On one aspect, inflation sticking above draw in total argues for higher charges. On the opposite, Powell and the Fed hang hinted that labor market weak point would possibly moreover merely outweigh inflation concerns. This tug-of-battle makes the September FOMC meeting in particular important for Solana’s tag trajectory.

Solana Price Prediction: Solana Consolidates Shut to Resistance

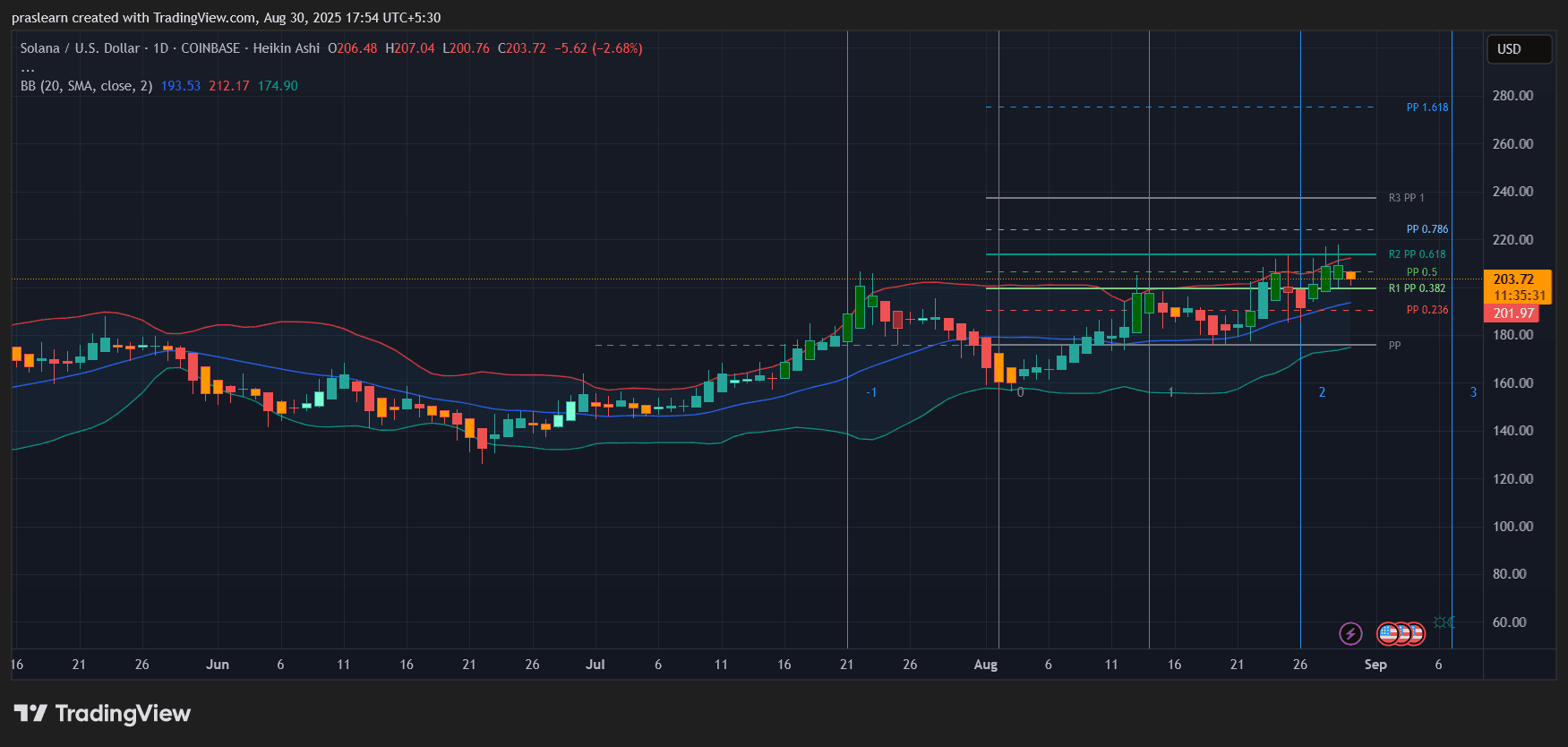

Having a behold at Solana tag day-to-day chart, SOL is trading round $203, hovering just correct underneath the $212 resistance level marked by the upper Bollinger Band and pivot resistance cluster. The Fibonacci retracement presentations key ranges at $198 (beef up) and $220 (valuable breakout zone). Momentum has been hunch since mid-July, with SOL getting better from the $160 zone, however contemporary candles expose hesitation just correct below resistance.

The 20-day SMA round $193 affords solid beef up, suggesting investors are stepping in on dips. If SOL tag holds this level, it objects the stage for any other push higher. An amazing breakout above $212–$220 would possibly divulge off a transfer toward $240, with $260 because the next extension draw.

Market Bets: Traders Are Earlier than the Fed

No matter sticky inflation, the CME FedWatch instrument presentations merchants pricing in an 87% likelihood of a lower in September. That’s a solid vote of self assurance within the Fed’s willingness to pivot. The market is successfully saying: “Yes, inflation is higher, however the Fed will prioritize direct and jobs.”

For Solana, right here is bullish within the shut to term. Charge cuts mean more inexpensive capital, weaker greenback strength, and more speculative flows into high-direct sectors enjoy crypto. However the anxiousness is clear: if the Fed disappoints by signaling simplest one lower or a slower poke, anxiousness assets would possibly unwind sharply.

Fed’s Balancing Act: Inflation vs. Jobs

Powell’s feedback last week already opened the door to a lower, citing a weakening job market. The Fed now faces a credibility test. Nick too rapidly and inflation would possibly moreover merely flare aid up. Extend too long and unemployment would possibly rise sooner than anticipated. This balancing act injects volatility into every anxiousness asset — and crypto is repeatedly first in line to react.

For Solana merchants, the jobs document next week turns accurate into a construct-or-ruin catalyst. Mature files strengthens the bull case for a September lower, adding fuel to SOL’s rally. Accurate files muddies the waters, potentially conserving Solana tag caught in its $200–$212 vary.

Solana Price Prediction:Why Solana Particularly Reacts Strongly?

$Solana isn’t just correct any other altcoin — it’s one of essentially the most liquidity-sensitive Layer 1s. Establishments, funds, and retail alike treat it as a high-beta proxy for anxiousness-on flee for food. When liquidity is abundant, Solana tag tends to outperform Ethereum in percentage beneficial properties attributable to its smaller market cap and volatility profile. Conversely, when liquidity tightens, SOL tag in total sells off more challenging.

That’s why the PCE document and Fed outlook matter more for $Solana than most. It’s the form of coin that amplifies macro sentiment, and in a rate lower atmosphere, it would possibly probably develop into most certainly the most tip beneficiaries.

Chart Meets Macro: What’s Next for SOL Price?

The chart presentations SOL tag consolidating just correct underneath $212 resistance. This traces up completely with the macro uncertainty — the market is anticipating confirmation. A dovish Fed and inclined jobs document would possibly neatly be the double divulge off that breaks SOL above $220, opening the door to $240 and $260.

On the opposite hand, if the Fed tones down lower expectations, SOL would possibly test $190 again, with scheme back anxiousness toward $175. Macro force will resolve whether right here is a wholesome consolidation or a failed breakout.

The July PCE numbers verify one ingredient: the Fed’s job isn’t carried out, and merchants are making a wager on a pivot that will advance with caveats. For $Solana, this atmosphere creates both opportunity and anxiousness. If liquidity returns in September, $SOL is poised to rally aggressively previous $220. However if the Fed pushes aid against market expectations, Solana would possibly scurry aid to its beef up ranges.