Key Insights:

- A bullish pennant sample suggests a that you simply’d also imagine breakout to $200 if Solana mark clears resistance at $184.

- Solana mark holds above needed strengthen, reinforcing the bullish structure.

- Solana On-Chain and Derivatives Records Paint Mixed Image.

Solana (SOL) mark is approaching a actually main resistance point after rising by 18% this month. Analysts explain that if the conclude crypto breaks out above $184 and important strengthen holds, it will also merely upward thrust to $200 rapidly.

Bullish Pennant Sample Components to $200 Solana Fee Breakout

Solana mark is showing signs of a bullish pennant on the day-to-day chart, which approach the upward pattern from $123.89 would perchance possess going. In keeping with crypto analyst Lark Davis, this trend showed that the altcoin is pausing before settling on its subsequent mosey. The tip line of the pennant is anchored on the $180–$184 resistance zone, also linked to the 61.80% retracement level.

Notably, Lavis identified that if Solana mark sustains its volume strengthen at this level, it would perchance upward thrust in opposition to $200. In keeping with the chart, the following seemingly target is $211, indicated by the 78.60% Fibonacci retracement. Apart from, technical analyst Ucan noticed a cup-and-take care of setup, making it more seemingly for a breakout if the bulls regained $184 in power.

SOL Fee Holds Above Most considerable Toughen

Extra so, Ucan famed that the mark is aloof above $165, representing the 50% Fibonacci retracement, and acts as a actually main strengthen point. Moreover, the strengthen can also be solid since the 200-day EMA is found at $163. No topic consolidating for some time, Solana has refrained from bearish outcomes.

Nonetheless, Ucan identified that if breaking through $184 is no longer a hit, SOL mark would perchance head aid in opposition to $150–$160, a old consolidation vary. Toughen levels below $123.89 would invalidate the bullish outlook, and it will also merely drop to around $100–$110. Whereas SOL is buying and selling over $165, there are no longer any severe signs of a breakdown within the chart sample.

Technical Indicators Ticket SOL Fee Consolidation

Meanwhile, the Shifting Real looking Convergence (MACD) has no longer but confirmed a bullish crossover, nonetheless both its lines are getting nearer. From Lark Davis’ chart, if both the mark and the histogram are rising after a crossover above the signal line, this will effect bullish continuation. As of the time of writing, the conclude result of the rally used to be aloof unsure.

Nonetheless, Solana mark showed signs of rising with the RSI at 60, suggesting it is miles no longer but in overbought territory. Consequently, this implies there might be more doable for suppose. Buying and selling volumes be pleased stayed rather unchanged whereas costs pattern increased, showing a lack of important selling exercise.

Solana On-Chain and Derivatives Records Paint Mixed Image

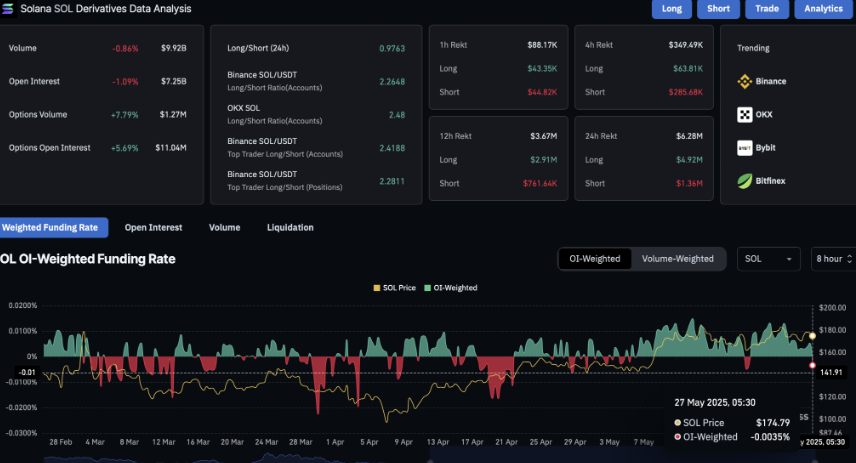

No topic the bullish mark sample, merchants within the derivatives market are being cautious. In keeping with Coinglass, the different of start contracts for SOL futures has diminished by 1.09% to reach $7.25 billion. At the identical time, the OI-weighted funding charge used to be -0.0035%, indicating bearish bets.

Over 24 hours, $4.92 million of prolonged positions were eradicated, whereas lawful $1.36 million were misplaced briefly positions. As a result, many bullish merchants got trapped all over instant dips in SOL mark. Nonetheless, other on-chain metrics point to resilience. Trusty numbers of active addresses and transactions show hide that users are aloof interacting with the network, no topic the unclear market.

Meanwhile, Peter Brandt’s present diagnosis on Solana mark suggested a cup-and-take care of breakout, aiming for $518. Whereas SOL mark used to be come $177, Brandt’s statements and present news regarding the $100k commerce effect a bullish outlook.

Nonetheless, some analysts deem it would possess shut a 180% upward thrust for SOL to reach $500, and its market cap desires to triple. Momentum is good, nonetheless this kind of rally would demand sustained buying stress and recent catalysts.

At the time of writing, Solana mark used to be buying and selling at $178, up 2% on the day. The tip altcoin mark rapidly touched $179 before taking flight, signaling resistance amid intraday volatility.