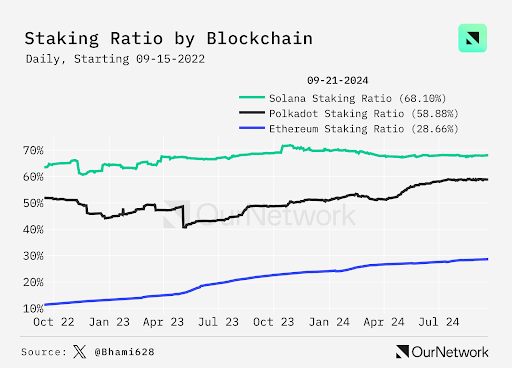

In a indispensable shift in blockchain staking trends, Solana has overtaken Ethereum in staking ratio, with 68% of its entire present staked as of September 2024. By comparison, easiest 28% of Ethereum’s present is staked. This demonstrates a foremost difference in user participation across the two main blockchain networks.

Within the occasion you stake, you lock up tokens to encourage stable a blockchain community in replace for rewards. This staking ratio is a foremost metric to evaluate how extra special of a blockchain’s present is being frail for validation and security.

The records on staking ratios entails both native staking, where tokens are locked at as soon as all the device thru the community, and liquid staking, which lets in customers to stake tokens whereas maintaining liquidity thru derivative tokens.

Solana Has $50B Extra Locked in Staking Pools Than a twelve months Within the past

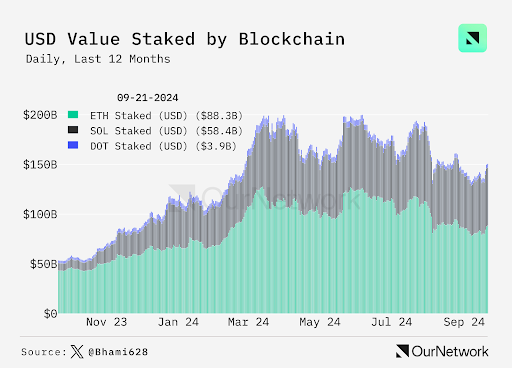

Even supposing Solana has a nearer staking ratio, Ethereum remains the excellent proof-of-stake (PoS) blockchain by entire cost staked. As of September, Ethereum had over $88 billion in tokens staked, when put next to Solana’s $58 billion.

Meanwhile, Solana’s present staked cost reflects a dramatic development from $7.5 billion in September 2023, which implies fresh capital of over $50 in a single year. This interesting enlarge highlights Solana’s rising community engagement and adoption. However Ethereum’s higher entire cost staked reveals its energy because the main PoS blockchain by asset cost.

Notably, the Polkadot (DOT) community has viewed extra special extra staked tokens over the past year. Polkadot is fair within the aid of Solana in phrases of staked ratio, with 58.88% of its present locked. Whereas Solana and Ethereum agree with several billion bucks in locked cost, Polkadot is a long way within the aid of with fair $3.9 billion.

Disclaimer: The records presented listed right here is for informational and tutorial applications easiest. The article doesn’t constitute monetary advice or advice of any kind. Coin Model is now not accountable for any losses incurred on yarn of the utilization of narrate material, products, or companies talked about. Readers are instantaneous to command warning earlier than taking any movement linked to the corporate.