With bitcoin BTC$111,933.36 stuck factual above $110,000 and ether (ETH) consolidating after hitting new files, Solana SOL$209.89 has emerged as a standout performer within the crypto market only within the near past.

The token traded round $211 on Monday, up 33% from early August lows, making it one in all the most productive performers within the CoinDesk 20 Index within the past month. In opposition to bitcoin, SOL has won 34% at some level of the final month, and it has bolstered 14% versus ETH since mid-August.

The rally shows a broader rotation into altcoins, analysts acknowledged.

“The season of profit redistribution among holders of cryptocurrencies continues,” Sergei Gorev, head of threat at YouHodler, acknowledged in a market present shared with CoinDesk. He acknowledged liquidity has been sharp out of BTC into 2d-tier tokens, with “a noticeable hang larger within the certain dynamics in capital flows to SOL.”

Such flows would possibly maybe well be long-timeframe as company investors peek great, liquid initiatives to shield up, Gorev added, naming SOL alongside with XRP XRP$2.8446 because the “subsequent attention-grabbing market ideas.”

Jeff Dorman, chief investment officer at Arca, tipped SOL to copy ether’s turnaround earlier this year. He pointed to Ethereum’s resurgence after stablecoin adoption, receive ETF inflows and the relentless characterize from digital asset treasuries, or DATs, helped ETH rally nearly 200% since April.

“SOL looks poised to repeat the actual identical playbook that ETH factual accomplished within the upcoming months,” Dorman wrote in a new document.

The main U.S.-listed Solana ETF launched in July, on the other hand it was once futures-primarily based. Several asset managers, at the side of VanEck and Fidelity, keep in mind filed for residing merchandise with choices due later this year, Dorman acknowledged.

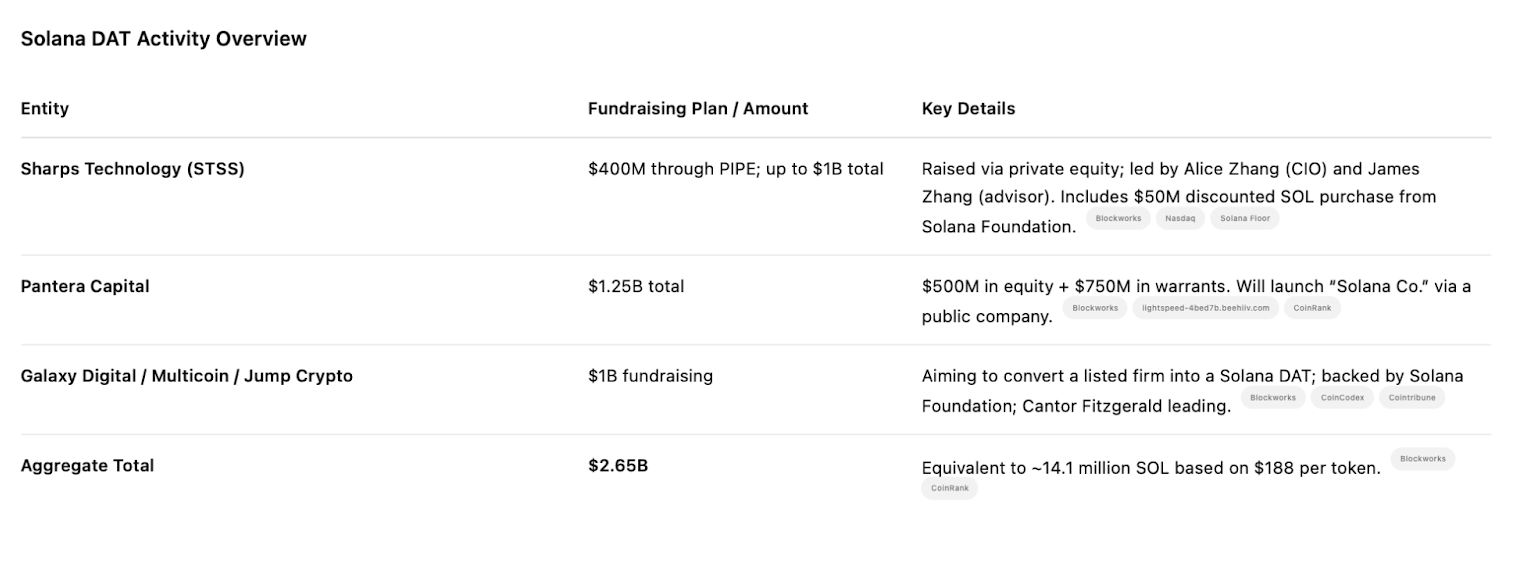

Within the period in-between, no much less than three Solana-focused DATs are elevating funds that would possibly maybe well channel as much as $2.65 billion into SOL over the next month, he added.

At most productive one-fifth of ETH’s market capitalization, SOL’s designate would possibly maybe well be great more reactive to the flows within the occasion that they materialize.

“SOL would possibly maybe well be the most logical long stunning now,” Dorman acknowledged. “If the designate of ETH rose almost 200% on roughly $20 billion of present demand, what attain you’re thinking that happens to SOL on $2.5 billion or more of present demand?”

Contemporary files would possibly maybe well also add to the momentum. Nasdaq-listed digital asset conglomerate Galaxy Digital tokenized its shares on Solana, whereas the approval of the Alpenglow upgrade guarantees to fortify transaction dash and finality.

Read more: TRUMP, XRP, and SOL Alternatives Signal a Seemingly 300 and sixty five days-Conclude Altcoin Season: PowerTrade