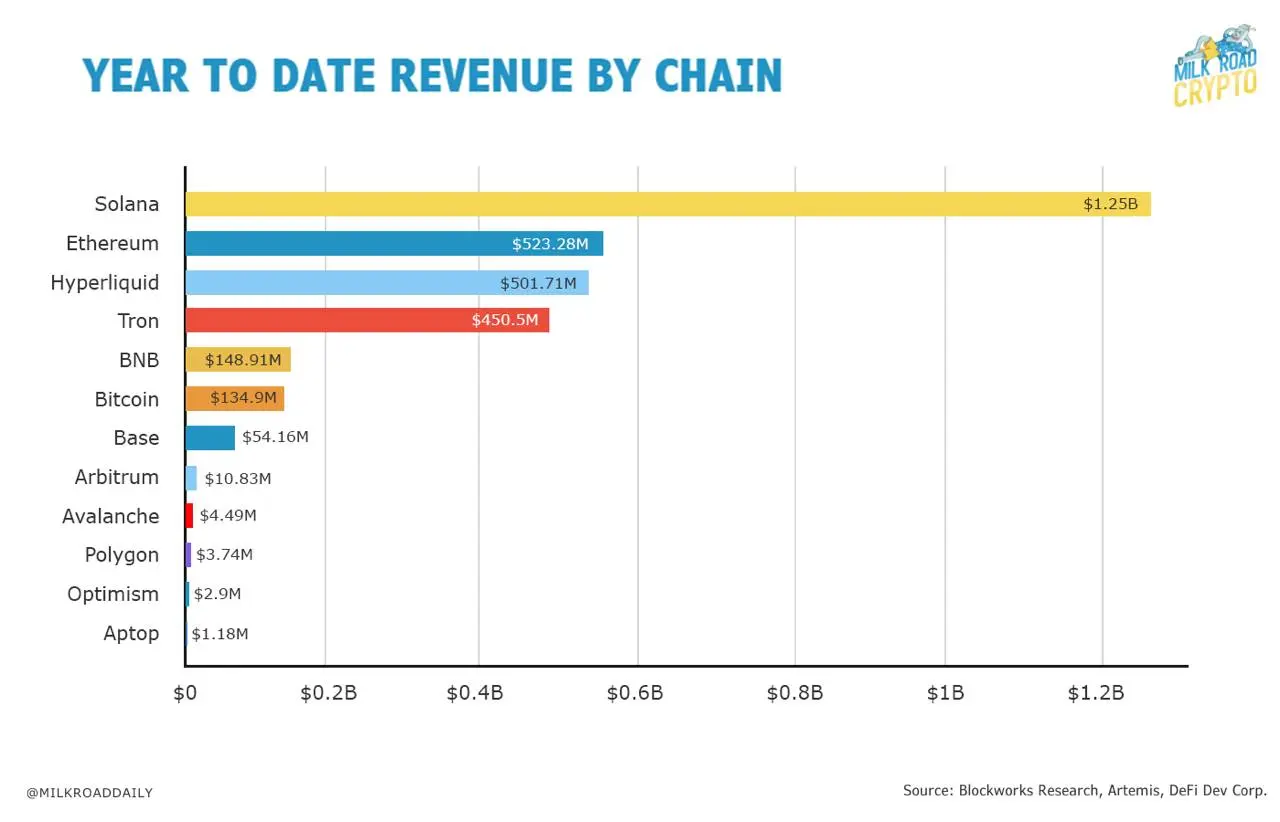

Solana has generated $1.25 billion in earnings year-to-date, sufficient to create it the grisly chief for earnings amongst blockchain networks. Crypto media platform Milk Avenue shared the info, noting that Solana has 2.5x of Ethereum earnings.

In step with the info, Ethereum, whereas being the closest to Solana in earnings, has supreme $523.28 million this year. Other networks that extend finish are decentralized perps blockchain Hyperliquid, and the TRON network, with $501.71 million and $450.5 million, respectively.

Milk Avenue post stated:

$SOL is in a league of its hold. Solana has generated $1.25B in earnings YTD… That’s trusty quiz for blockspace and fair appropriate now, no chain comes finish.

Delivery air of Solana at the tip and the assorted three networks, supreme two varied chains have generated over a hundred million dollars in earnings. These are BNB Dazzling Chain with $148.91 million and Bitcoin with $134.9 million. Coinbase layer-2 network Sinful additionally has $54 million to create it the L2 network with the most earnings. Its competitors, akin to Arbitrum, Polygon, and Optimism, supreme have earnings ranging between $10.83 million and $2.9 million.

Solana’s management in 2025 earnings continues a construction that started in November 2024. Within the major quarter of 2025, the network recorded more earnings than all varied L1 and L2 Chains combined, which has persisted all year long.

Solana’s earnings is largely going to apps

Unsurprisingly, Solana additionally leads in month-to-month earnings, with the network generating bigger than $210 million in the final 30 days. On the opposite hand, what’s more attention-grabbing is that many of the earnings goes to the decentralized apps in step with the network.

Within the past month, memecoin launchpad Pump.fun and trading bot Axiom Pro myth have generated $52.83 million and $50.Seventy 9 million in earnings on Solana. Decentralized exchanges Jupiter and Meteora, to boot to crypto wallet Phantom, are amongst Solana’s high ten earnings generators.

Interestingly, Solana itself ranks eighth in earnings all around the last 30 days, with the chain supreme generating $4.56 million. While right here is quiet essential, it is small in contrast to what varied Layer-1 and Layer-2 networks, akin to Hyperliquid, Ethereum, and even Sinful, generate in chain charges.

On the opposite hand, Solana proponents akin to Helius Labs CEO Mert Mumtaz articulate that what makes Solana special is how decentralized apps thrive in the ecosystem. Mumtaz believes many dApps builders are coming to Solana due to the ecosystem helps immediate earnings-generating apps.

Indicators of this are evident with the trading bot, Axiom Exchange, now not too long ago turning into the quickest app to succeed in $200 million in earnings in August in only 202 days. The platform reached $200 million in earnings on August 4 and generated over $50 million previously 30 days. It reached the milestone even faster than Pump.fun, which took 303 days.

SOL reaches $216 as the crypto market sees a resurgence in mark

Within the intervening time, SOL is currently on the uptrend, with the altcoin emerging as one in every of the tip performers as of late after seeing bigger than 7% rise in mark to succeed in $216. The token has been one in every of the accurate performers previously 30 days, picking up from where varied altcoins akin to Ethereum and XRP appear to have lagged after their earlier gains.

In step with CoinMarketCap, SOL is up 19% previously 30 days, even because it continues to underperform varied major cap tokens akin to Bitcoin, Ether, XRP, and BNB in year-to-date performance.

On the opposite hand, sentiments around Solana are currently bullish, especially in gentle of contemporary milestones. Beyond its substantial earnings, the network additionally now not too long ago hit $100 billion in market cap all over again, drawing comparisons with major tech firms akin to Google, Meta, and Nvidia for taking a unparalleled shorter length (4.5 years) to hit the milestone.

There are experiences that Solana may perchance soon have its hold digital assets treasury heavyweight, with Forward Industries announcing plans to use $1.65 billion in non-public placement money and stablecoin commitments to get SOL.

While varied publicly traded firms, akin to Sol Recommendations and DeFi Style Corp, have already created SOL treasuries, this marks the major time a Nasdaq-listed company will deploy institutional capital at once in opposition to procuring SOL.