Solana exercise situation a chain of data in August, while maintaining its height app revenues. For the previous month, Solana locked in $148M from app revenues, largely linked to DEX trading.

Solana saw a month of sturdy exercise in August, as its main apps locked in over $148М, of which trading platforms obtained spherical $85M. The chain adopted the total crypto success, breaking a chain of data for the previous month. While Ethereum became trending, Solana moreover expanded in numerous metrics and novel markets. Within the previous month, Solana exercise remained above 3.3M day after day active customers on most days, with spherical 20M day after day active customers for all diversified chains.

Over the route of the previous month, Solana increased its model locked from $8.5 to $9.5B, extending the vogue into September. Cost locked persisted to grow to $11.51B, with over $12.26B in stablecoin liquidity.

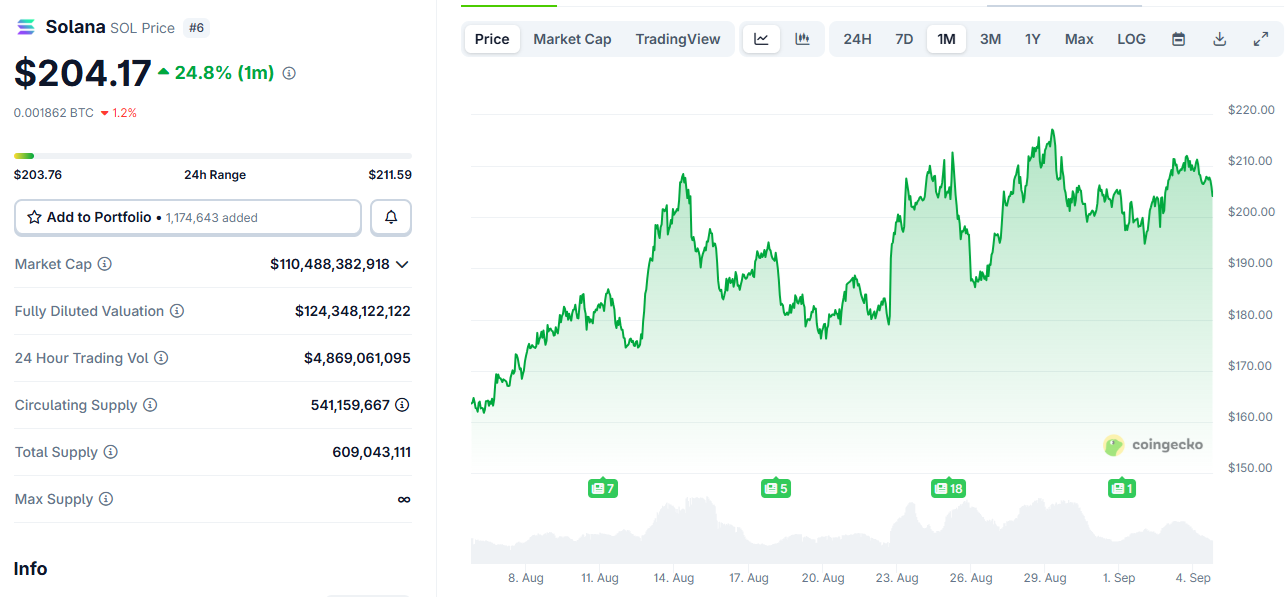

For the previous month, SOL moreover regained its earlier positions, shifting from $163 to a height above $215. For the previous month, SOL begin ardour expanded by over 30%, final above $6B. SOL moreover saw the bulk of derivative settlements by itself chain, in situation of on centralized exchanges.

Solana grew on BTC inflows, LST, and RWA tokenization

Solana moreover produced between $1M and $2M in day after day prices usually. App revenues produced over $7.4M in 24 hours, surpassing the indispensable Solana rate construction. The Solana chain continues to surpass diversified networks for over eight months in a row, pushed by a mix of tendencies and use conditions.

For the previous month, Solana completed height perpetual futures volumes of over $43.8B, attributable to Waft Protocol. Perpetual futures trading obtained a take from SOL token swaps, as the worth rallied above $200. Solana objectives to fabricate a share of the perpetual futures markets, no longer too long within the past outcompeting Ethereum.

August on Solana, by the numbers:

➔ $148 million in app earnings, up 92% from 2024 and surpassing all diversified networks

➔ All-time excessive perps quantity of $43.8 billion

➔ 2.9 billion transactions, up 46% y/y and extra than 4x all diversified networks blended

➔ $144 billion in DEX… pic.twitter.com/uPIZXObxW6

— Solana (@solana) September 4, 2025

The diversified boost vector became RWA tokenization, as extra tokenized shares moved to Solana. The sphere is consistently breaking novel data, with over $500M in model.

One other vogue in August became liquid staking tokens, which expanded their influence on DeFi protocols. Marinade Finance supplied the finest boost within the previous month, severely drawing attention with its token burn.

Solana moreover invited inflows of BTC, offering a bridged tokenized version, which became then largely utilized in DeFi.

Solana token launches prolong by over 30%

In August, token launches on Solana accelerated as soon as extra. After July’s salvage of spherical 1M tokens, in August, the Solana network produced 1.34M novel tokens.

📊DATA: In August, over 1.34 million novel tokens launched on @Solana, largely memecoins. pic.twitter.com/C5n7rhQS66

— SolanaFloor (@SolanaFloor) September 4, 2025

The newly launched tokens tracked the meme token wars within the previous month, where diversified platforms outperformed for a couple of days. Most tokens on Solana were light meme-connected, and most did no longer graduate to DEX. No topic this, trench trading saw a restoration in August.

On the opposite hand, Pump.relaxing remained basically the fundamental venue for token launches, regaining its situation as a top rate producer.