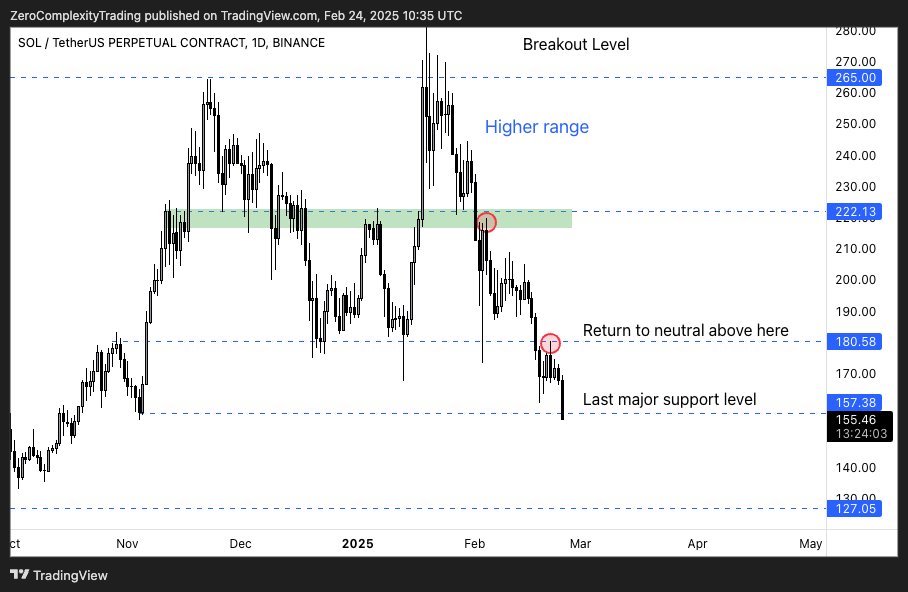

In a technical chart shared this day, crypto analyst Koroush Khaneghah, Founding father of Zero Complexity Trading, underscores Solana’s ongoing downtrend, highlighting pivotal strengthen and resistance levels on the SOL/USDT Perpetual (Binance) day-to-day timeframe. Basically based fully mostly on the chart, Solana has misplaced several key zones and is currently hovering shut to the $157 location—what Khaneghah labels as the “remaining major strengthen level.”

The Bearish Argument For Solana

“The downtrend continues as SOL gets rejected by some other S/R flip and crashes staunch down to the $150 level. Sentiment at an all-time low. Whine continuation except confirmed otherwise,” Khaneghah writes by procedure of X.

A outstanding characteristic of the prognosis is a strengthen/resistance (S/R) flip around $180.58. Earlier in February, Solana attempted to reclaim this level but became once met with accurate selling stress. The failure to stable a day-to-day shut above $180.58—now acting as resistance—signaled renewed downside momentum.

Following the drop, Solana has settled staunch above $157, marked on the chart as the “Last major strengthen level.” Prices internet mercurial dipped below this zone, suggesting fragility in the market’s latest stance. A failure to fetch $157 on day-to-day closes increases the doable of extra decline towards the subsequent fundamental horizontal line around $127.05—visible on the lower stop of the chart.

Koroush’s annotations also camouflage that crossing attend above $180.58 would shift the market bias from bearish to “honest.” Except that happens, the analyst cautions that sellers appear to be in adjust, with adverse sentiment around meme cash reinforcing the continuing downtrend.

The Bullish Argument For SOL

Within the period in-between, crypto analyst RunnerXBT (@RunnerXBT) has shared a orderflow prognosis of the Solana (SOL) futures chart (2-hour timeframe on Binance) this day. The chart underscores essential tag aspects, liquidations, and adjustments in positioning prior to the upcoming March 1 unlock—when 11.2 million SOL (valued at roughly $1.77 billion) are scheduled for open.

Within the annotated chart, the tag peaked in mid-January, reaching $295, before starting up a accurate descent that has most recently viewed SOL hovering in the mid-$150 vary. The chart presentations that from early to gradual January, there became once a major drop in open ardour (OI) alongside a skedaddle in the tag, with Cumulative Volume Delta (CVD) suggesting it became once pushed primarily by long positions closing. RunnerXBT’s notes attribute this to SOL weakness transferring largely in tandem (1:1) with Bitcoin.

By gradual January, after a extra pronounced downward switch, the tag and OI both settled at lower levels. OI mercurial rebounded in early February, though the chart signifies that initial long positioning became once quickly adopted by fast masking as traders pivoted to benefit-taking or closed losing fast positions. No matter this job, SOL’s tag became once unable to mount a sustained uptrend, reinforcing a broader sense of hesitancy amongst traders.

Spherical mid-February (February 16–18) and again on February 24, the chart highlights phases of “aggressive shorting and location selling,” which contributed to power downward stress on the tag. Though there internet been cases of fast masking (significantly around February 21, where CVD ticked up a cramped bit), the final momentum has remained subdued, with few signs of latest long accumulation.

On the staunch facet of the chart, RunnerXBT has placed a vertical red line marking March 1 as the date of what he calls the “ideal SOL unlock known to mankind.” Many market contributors appear to be “entrance-running” the match by selling in anticipation of a flood of latest tokens hitting the market. This has the doable to power heightened volatility.

Yet, in his put up, RunnerXBT warns towards shorting SOL at latest levels, explaining that he firstly started monitoring this difficulty when the token traded staunch below $200 and is now seeking a scalp long after the unlock has happened. He aspects out that makes an try to salvage every 5–10% day-to-day drop are bad and that traders who manufacture so risk frequent stop-outs or liquidations.

“I dont ponder its a clever “contemporary” fast here of SOL. I started posting referring to the problem at jus below $200 per SOL. I am seeking a scalp long AFTER the unlock, folk “frontrunning” it are getting stopped out or liquidated. You aren’t a hero catching -5% to -10% day-to-day falling knives. […] TLDR: Attempting for longs (now not 5 days before unlock). NOT shorts. if folk can’t read, i will’t support you,” he writes by procedure of X.

At press time, SOL traded at $158.