Solana struggles below $140 as bearish momentum grows. Can Solana bulls support the $130 enhance, or will the SOL establish run toward $65?

With the total crypto market cap falling to $2.87 trillion, altcoins are struggling to search out predominant enhance. Amid the declining market stipulations, Solana is procuring and selling below $140.

Currently, the SOL token trades at $139, with an intraday pullback of 3.05%. Will the bearish style in Solana attain the $125 enhance stage? Let’s discover.

Dismay Spikes Amongst Solana Investors

Because the decline continues, Solana investors fill entered a teach of effort. In accordance with a recent tweet by crypto analyst Ali Martinez, the on-line unrealized revenue and loss (NUPL) indicator by Santiment shows that Solana is in the “Dismay” zone and drawing close “Capitulation.”

#Solana $SOL investors seem like in a teach of “effort.” pic.twitter.com/SpGTL3knNX

— Ali (@ali_charts) February 26, 2025

Furthermore, Solana’s switch volume has plummeted from $1.ninety nine billion in November 2024 to precise $14.57 million at the fresh time. This shows an enormous decline over the past three months, increasing the synthetic of a bearish continuation.

Solana Imprint Prognosis: A Bearish Outlook

Within the every single day chart, the SOL establish style shows an enormous smash after failing to surpass the $260 present zone. The pullback has dropped Solana’s market establish by almost 47% from its $280 peak.

Furthermore, the bearish crossover in the 50-day and 100-day EMA traces will enhance the synthetic of a demise execrable between the 50-day and 200-day EMAs. With the continuing bearish style, the every single day RSI line has plunged into the oversold territory, reflecting elevated selling momentum.

Derivatives Market: Optimism Despite the Tumble

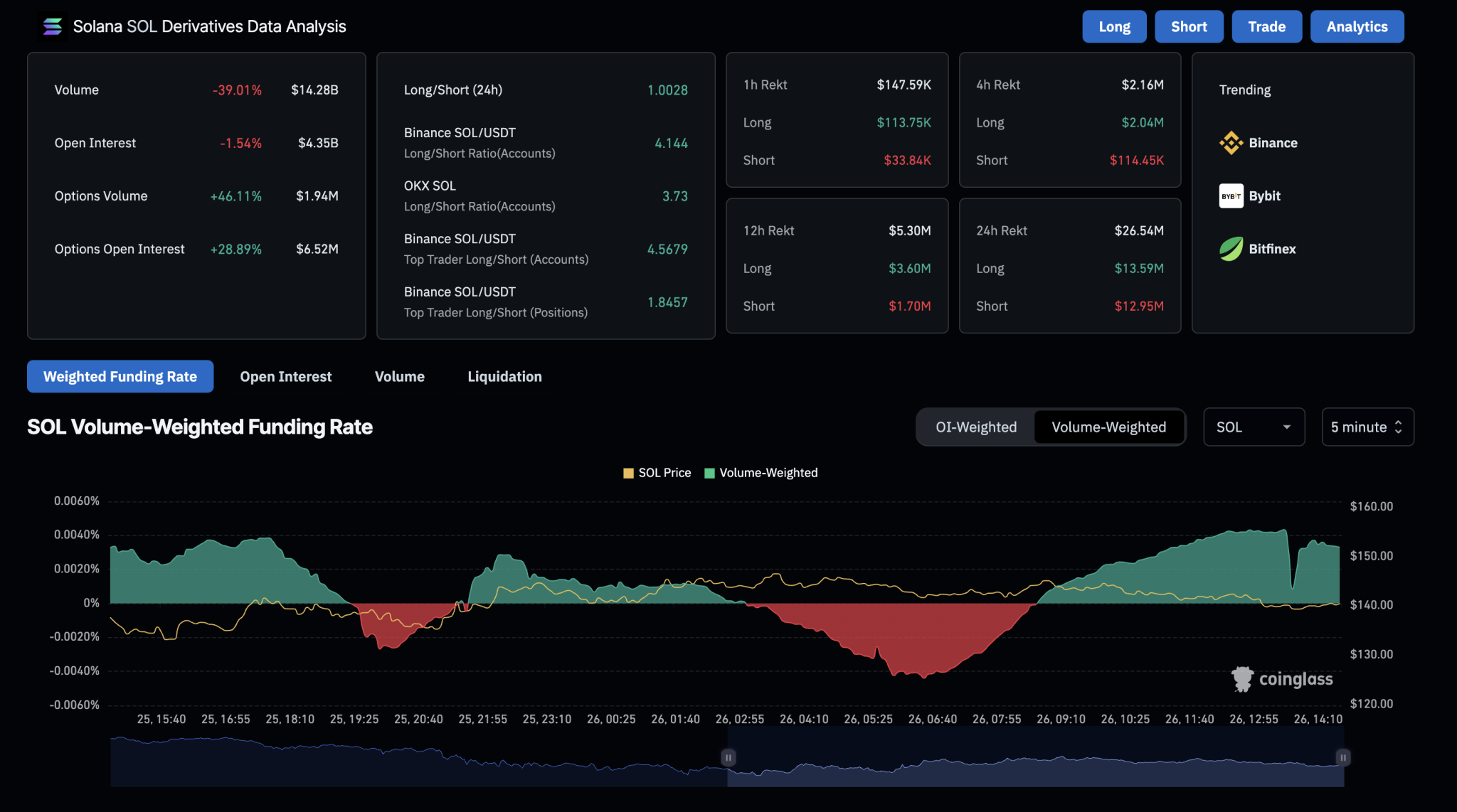

Despite the downfall in Solana prices, the immediate-timeframe fight arrive $140 has fueled minor optimism in the derivatives market. The lengthy-to-immediate ratio in Solana derivatives has equalized, reflecting an equal quantity of bullish and bearish gamers available in the market.

Furthermore, the Solana volume-weighted funding price has grew to vary into positive, reaching 0.0033%, indicating merchants’ willingness to pay a top class for lengthy positions. Over the past 24 hours, liquidations fill additionally almost equalized, with lengthy positions accounting for $13.59 million, whereas immediate liquidations fill risen to $12.95 million.

Overall, the Solana derivatives market has witnessed a minor tumble in open interest by 1.54%, bringing all of it the style down to $4.35 billion.

Needed Red meat up Level at $130

Analyst Ali Martinez highlights a factual-angled ascending broadening formation on Solana’s 3-day chart. Currently, the value inner this formation is drawing close predominant enhance arrive $130.

If bulls fail to defend the $130 stage, the downtrend could well well proceed toward $65, in response to Martinez.

#Solana $SOL looks forming a factual-angled ascending broadening pattern. A spoil below $130 could well well open the door for a tumble to $65! pic.twitter.com/iNPjrgbBNH

— Ali (@ali_charts) February 25, 2025