- Solana has risen extra than 2,000% since its 2022 lows following the FTX collapse.

- SOL outperformed each Bitcoin and Ethereum in buying and selling volumes for over a 365 days for the reason that decline.

- Solana has maintained a distinct gain capital influx since September 2023, indicating that nearly all token holders are in earnings.

Solana (SOL) is up 6% on Monday following a Glassnode document indicating that SOL has seen extra capital develop than Bitcoin and Ethereum. Despite the neat features suggesting a rather heated market, SOL might well per chance per chance additionally unruffled stretch its development before setting up a high for the cycle.

SOL outperforms Bitcoin and Ethereum with $776 million in capital inflows day-to-day

Solana has seen unbelievable progress in 2024 marked by new all-time highs and elevated converse on its blockchain.

Solana’s rebound has been essential, especially with its development after plunging to a low of $9 following the collapse of FTX in 2022. Since then, SOL has risen over 2000%, with its designate outperforming Bitcoin and Ethereum, based mostly totally on Glassnode’s document.

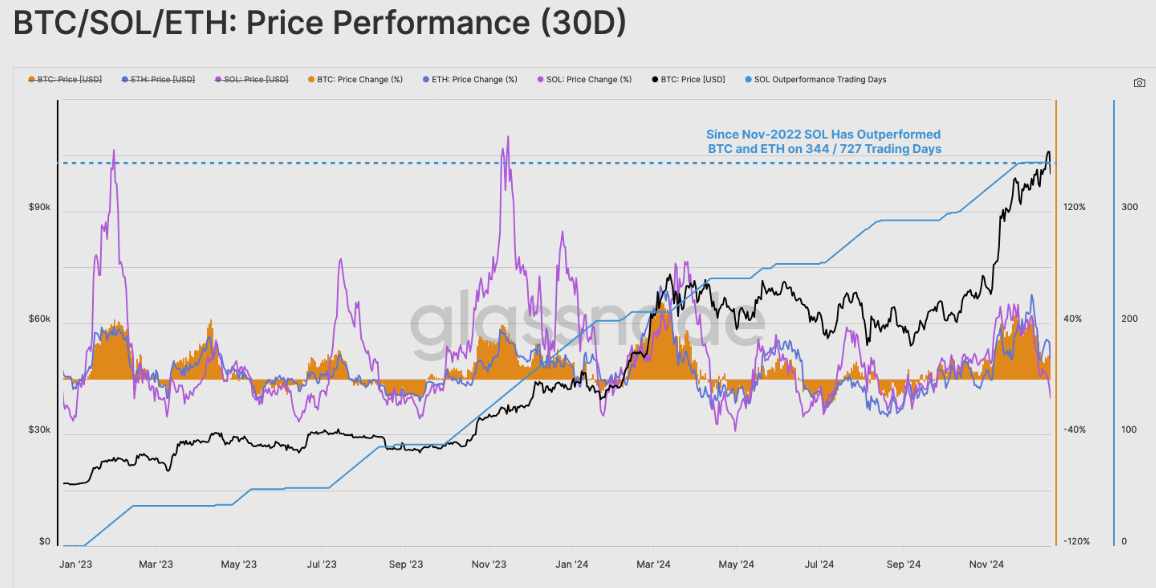

The document exhibits that Solana has surpassed the two wide cryptocurrencies in 344 out of 727 buying and selling days for the reason that 2022 event.

BTC/SOL/ETH Trace Performance. Offer: Glassnode

Likewise, Solana witnessed extra capital influx valid thru the identical duration, the utilization of the relative Realized Cap switch as a measuring tool.

This suggests that SOL has taken in new capital and liquidity, indicating elevated request of for the asset amongst investors.

Glassnode acknowledged that this new band of investors bringing in capital is the major driver of Solana’s development.

A key reason for this development in new investors is the surge in meme coin converse the Solana blockchain skilled valid thru the 365 days. With SOL serving because the sinful forex for settling these meme coin transactions on the Solana community, excessive request of pushed it to a brand new all-time excessive of $263 on November 23.

The document also famed that Solana has maintained a distinct gain capital influx since September 2023, with $776 million worth of new capital flowing into its community day-to-day.

Adding to that, Glassnode highlights the holder cohort with the ideal earnings-taking volume since January 2023.

Tokens held from 1 day-1 week, 1 week-1 Month and 6-365 days all realized earnings of $13.7 billion, $14 billion and $15.7 billion, respectively.

This connotes equality of market fraction amongst these classes of holders, which accounts for 51.6% of all earnings realized.

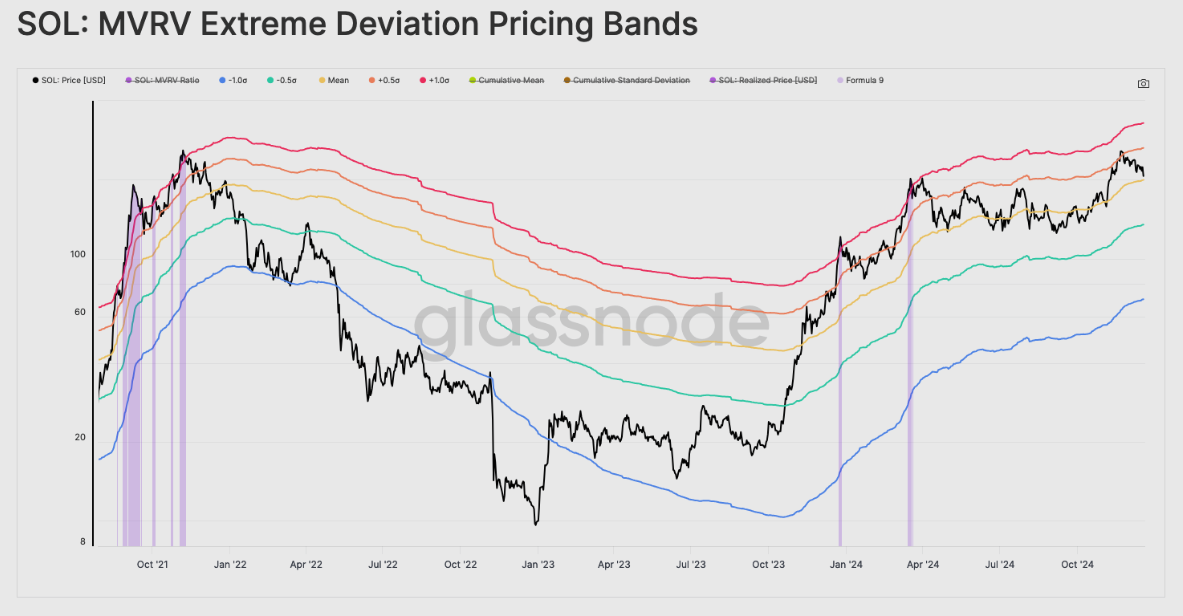

Furthermore, the MVRV ratio — a metric that compares market capitalization to realized capitalization — remains at some point soon of the +0.5 celebrated deviation vary.

SOL: MVRV Outrageous Deviation Pricing Bands. Offer: Glassnode

“This suggests the market is rather heated, but also suggests the aptitude for extra room to creep before the earnings held by the frequent investor reaches its impolite band of +1σ, enticing a flurry of earnings taking and distribution,” wrote Glassnode.