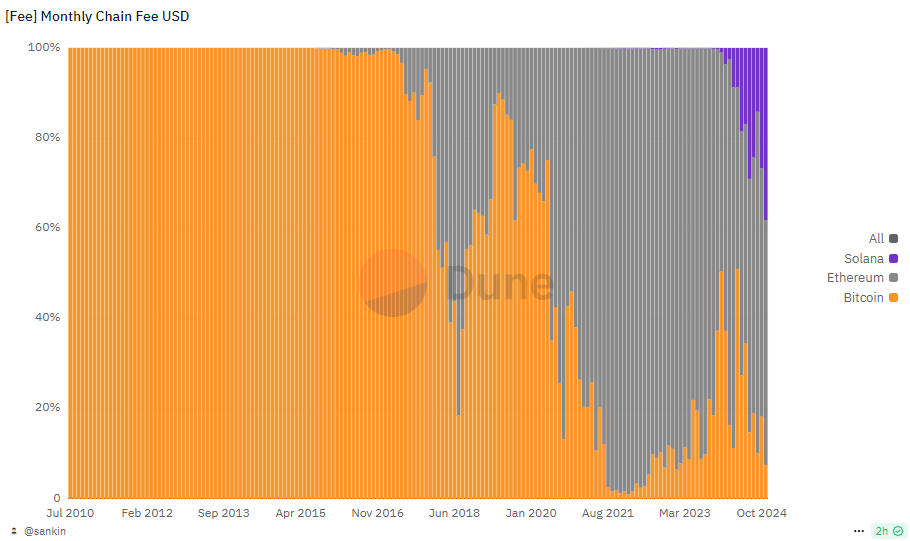

Solana expanded its have an effect on as a payment-generating chain, surpassing Bitcoin on a monthly foundation. The chain accumulated lags on the relief of Ethereum, nevertheless reveals the marked dwell of meme token launches and procuring and selling.

Solana was once amongst basically the most actively rising networks, taking on a a lot bigger a part of generated bills. In October, Solana’s a part of payment-generating networks increased to a yarn, while diversified networks slowed down. Solana marked a shift in October, as the market’s attention turned to meme tokens and cheap on-chain DeFi. Raydium, Jupiter DEX, and Pump.stress-free remained Solana’s high three apps, making up the majority of the chain’s online page online page visitors.

Solana’s performance surpassed that of Bitcoin, on account of keeping and lower on-chain recount. For plenty of of 2024, Bitcoin accumulated produced more bills than Solana, which retained the fourth space. The pattern shifted in the past month, per Token Terminal recordsdata.

As well to the Solana L1 chain itself, Raydium and Jito are amongst the largest payment producers, in most cases in the head 5 or high 10 of apps and platforms. In step with DeFi Llama recordsdata, Solana is ranked seventh by strategy of 24-hour bills, while Raydium ranks at region 4 with $2.56M in day-to-day bills. Apps and procuring and selling hubs were amongst the largest payment-generating protocols, as essential in basically the most in vogue Binance monthly market insights for October.

Solana additionally carries a rising DeFi sector, on account of the influx of liquidity and customers. Fee locked stays shut to the high vary for this cycle at $6.65B. From November 7 onward, Solana will additionally carry cbBTC, the wrapped BTC version launched by Coinbase. The contemporary asset will add to the liquidity locked on Solana thru DeFi apps, tapping the worth of BTC as it rises to contemporary highs.

Ethereum additionally marked powerful lower bills when compared to its yarn ranges, on account of the Dencun upgrade and a shift to L2 transactions. The chain produced 134.02M bills in October, with minimal funds from L2, as neatly as negligible blob bills.

Meme tokens and Raydium trades, alternatively, are settled as L1 transactions, checking out Solana’s capability. This limitation creates a Solana economy of bribes and precedence bills, which offer a enhance to validators thru MEV payouts.

Solana as a L1 operates at a loss, as quite a lot of the bills generated drag against apps, validators, and MEV companies. Costs are accumulated a proxy metric for Solana’s economy and tokenization trends. In October, Solana paid out $323.73M in incentives and bills, main to a loss of $286.99M.

Can Solana ruin its all-time high?

The correct-performing cycle for SOL was once in 2021, in some unspecified time in the future of the major Web3 and NFT hiss. At that time, SOL was once identified to be influenced by FTX, main to peak costs above $249.

After basically the most unique Bitcoin (BTC) peak above $76,200, SOL additionally spoke back, by rising above $192. At one point, SOL traded above $194, with a top class against the US dollar. Unlike diversified sources, SOL did not have a top class in its pairing with the Korean received, and in its keep traded at $188.81 on Upbit.

Start passion on SOL rose sharply from November 5 onward, reaching an all-time high. Leveraged positions rose to $3.15B for SOL futures, pointing to basically the most energetic season in the asset’s history.

On the ranges appropriate below $200, SOL additionally noticed a selection of long positions to 60% of all originate passion. This ratio may perchance maybe additionally invite selling to assault the long positions. SOL is probably going to be at probability of sell-offs from whales or payment recipients.

On the upside, SOL raised expectations of a breakout and a switch to a brand contemporary ticket vary as high as $500. As regarded as one of the most major platforms for crypto recount, Solana may perchance maybe additionally additionally match diversified utility coins, engaging closer to the vary of BNB. Within the short time duration, SOL is predicted to strive a rally to above $250, and up to $1,000 in a more extended bull market.