The fresh starting up of the xStocks platform enabled Solana to snappy derive dominance in stock market tokenization.

Solana has abruptly change into a frontrunner in stock-essentially essentially based true-world assets. In accordance with the records analytics platform SolanaFloor, the starting up of Backed Finance’s xStocks platform helped Solana capture dominance in tokenized stock shopping and selling.

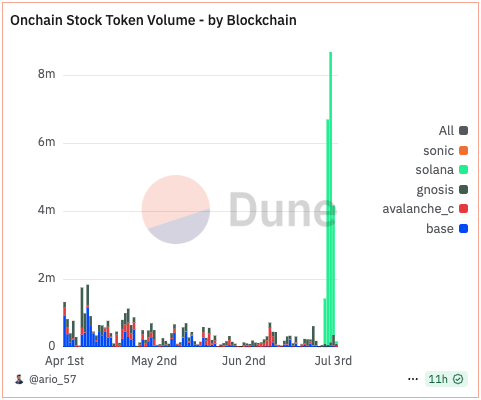

Significantly, files from Dune Analytics exhibits that since xStocks’ starting up on June 30, Solana has accounted for bigger than 95% of all tokenized stock shopping and selling quantity. Within the interim, xStocks offers 60 tokenized assets on its platform, 55 shares and 5 ETFs.

On the principle day of shopping and selling, xStocks’ quantity surpassed $1.3 million, with Approach’s shares taking pictures 30% of that figure. Then all as soon as more, shares and indices devour Tesla and the S&P 500 snappy overtook it in shopping and selling activity.

The $SPYx tokenized stock recorded $4.67 million in daily quantity on July 2, representing bigger than 50% of all shopping and selling that day. Tranquil, by July 3, shopping and selling volumes had dropped by bigger than half of, indicating that initial shopping and selling enthusiasm had cooled.

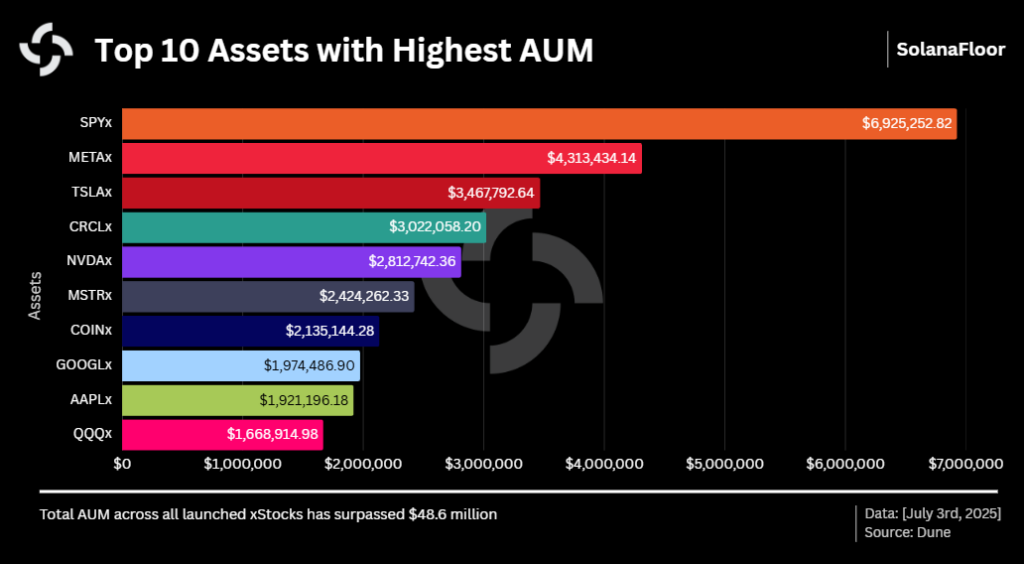

xStocks AUM reaches $forty eight.6 million

No topic the decline in shopping and selling volumes, critical users on the platform persisted to abet their stock tokens. On July 3, xStocks’ assets under management reached $forty eight.6 million. The leading asset became the $SPYx token, with $6.9 million in AUM. $METAx followed with $4.3 million, and $TSLAx came in third at $3.4 million.

The platform also saw critical particular person adoption, with over 20,000 uncommon wallets holding tokenized shares. Amongst them, the $SPYx token became the most well-favored, held by bigger than 10,000 wallets. $TSLAx and $NVDAx followed, with 8,100 and 5,500 holders, respectively.

Tranquil, no topic this early engagement, liquidity remains low, SolanaFloor cautioned. The platform noted that liquidity is repeatedly the critical component in figuring out whether tokenized stock shopping and selling on Solana proves viable.