Despite the undeniable fact that the “altcoin season” has not officially begun, Solana (SOL) is witnessing increasing hobby from institutional traders, with vital accumulation strikes neatly-known in Would possibly well well also merely 2025.

Most unusual reports and analyses level to that Solana is attracting capital from establishments and experiencing enlighten in new developer activity, alongside sure indicators from on-chain files.

Altcoin Season Yet to Arrive, But SOL Attracts Institutional Attention

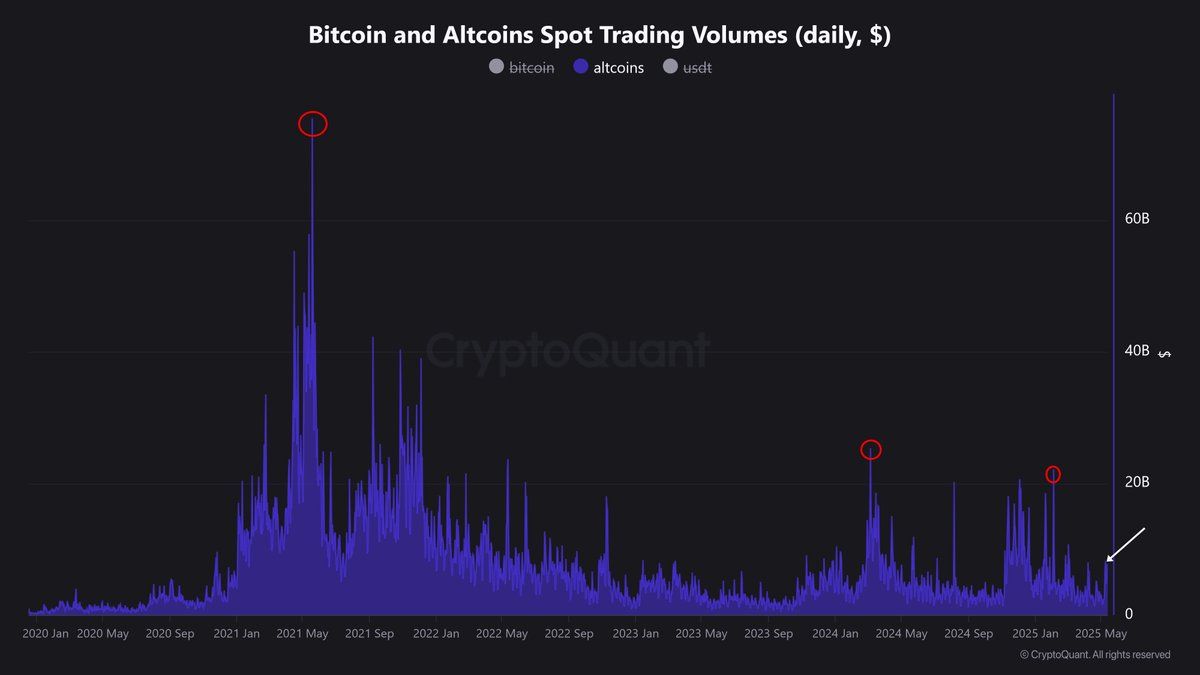

Data shows that the space procuring and selling quantity of altcoins stays decrease than the ranges viewed in January 2025 and 2024. Naturally, it is quiet removed from the tip ranges of 2021. This suggests that the altcoin market as a full has but to reach the vibrancy desired to kickstart a solid enlighten cycle.

“We now bask in a long technique to roam sooner than we discover out about the same ranges of hobby in alts that we saw in outdated rallies,” shared Nic Puckrin, co-founding father of Coin Bureau.

Nonetheless, no topic this backdrop, Solana (SOL) is emerging as a intellectual space, taking pictures the attention of institutional traders.

Namely, several establishments bask in increased their SOL holdings sooner than the altcoin season. In line with OnchainLens, a whale lately increased its holdings by 17,226 SOL while investing $1 million in FARTCOIN and $300,000 in LAUNCHCOIN.

One other whale withdrew 296,000 SOL from FalconX and staked it, signaling a vogue of accumulation and long-time period commitment to the Solana ecosystem.

Moreover, DeFi Style Corp lately increased its Solana holdings by over 170,000 SOL, pushing the total price above $100 million. In an analogous map, SOL Techniques added over 122,524 SOL to its funding portfolio in Would possibly well well also merely.

These strikes judge solid self assurance from institutional traders in Solana’s future enlighten doable.

Solana Ecosystem Prospers

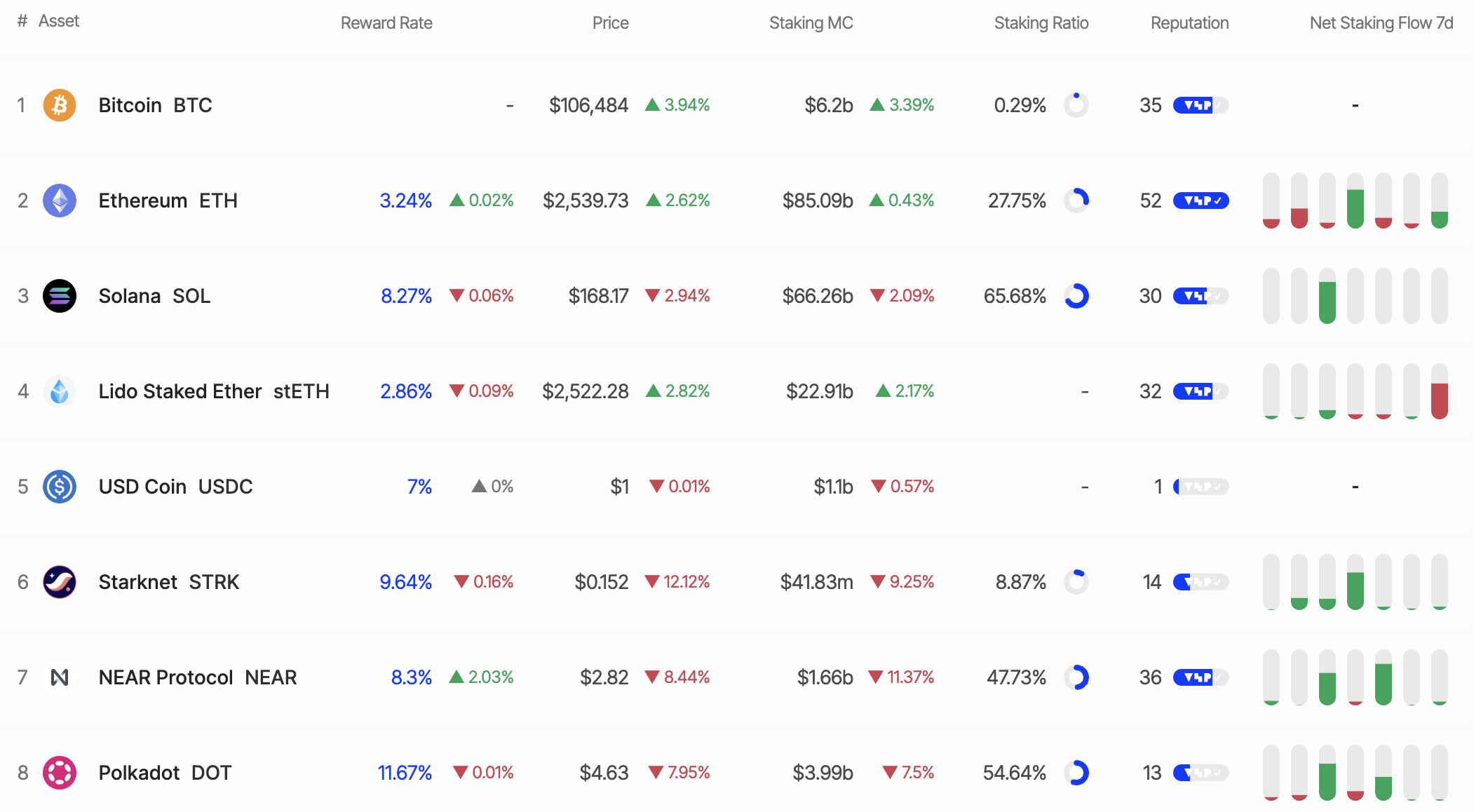

Beyond the hobby from institutional traders, Solana is moreover seeing sure indicators from its ecosystem. The fact that 65% of SOL’s total supply is currently staked is a definite fee, reflecting the community’s self assurance in Solana’s steadiness and long-time period doable.

As previously reported by BeInCrypto, Solana finished a total app revenue of $1.2 billion in Q1 2025. This consequence marks a 20% enlighten in contrast with the outdated quarter ($970.5 million). It is the top-performing quarter for Solana within the previous twelve months, demonstrating a solid ecosystem restoration after a year of vital volatility.

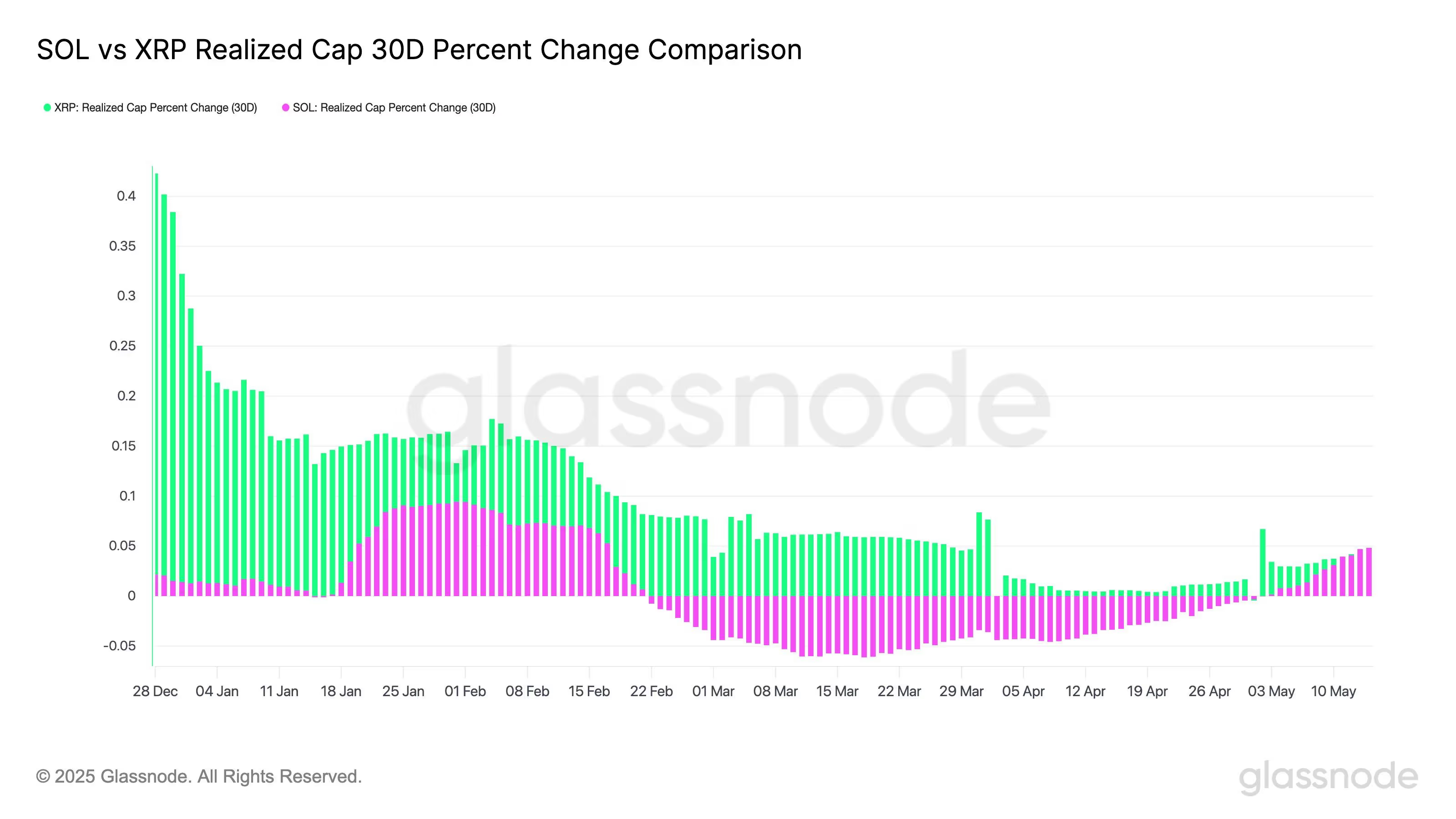

Moreover, Glassnode files shows that the categorical capital influx into SOL over the previous 30 days has returned to sure territory, increasing at a fee on par with XRP. These indicators level to that on-chain request for Solana shows indicators of restoration, even though the broader altcoin market has but to take off fully.

Solana Mirrors Ethereum’s 2021 Efficiency

One other great analysis from the X anecdote jon_charb suggests that SOL’s ATH mark at the start up of 2025 bears striking similarities to Ethereum in 2021. Namely, SOL skilled a vital mark surge earlier this year, principal cherish Ethereum’s breakout sooner than the 2021 altcoin season.

If history repeats itself, Solana might possibly possibly be in an accumulation allotment forward of a brand new enlighten cycle, especially as institutional traders proceed to pour capital into its ecosystem. This parallel reinforces self assurance in SOL’s doable and highlights the possibility that this blockchain might possibly possibly lead the upcoming altcoin season.

Nonetheless, it’s price noting that the altcoin market is quiet within the early stages of restoration. Space procuring and selling volumes, which might possibly possibly be decrease than outdated highs, level to that market sentiment stays cautious.

On the other hand, the accumulation strikes by institutional traders and the vogue of Solana’s ecosystem recommend that SOL might possibly possibly be gearing up for a vital leap when market prerequisites was extra favorable.