Bitcoin’s stamp edged simply under $90,000 to relaxation at $89,962, with a market capitalization of $1.79 trillion and around $54.29 billion in 24-hour shopping and selling volume. The intraday shopping and selling vary spanned from $87,304 to $90,295, pointing to a disturbing standoff between investors and sellers. The market is teetering on the perimeter of direction, and frankly, bitcoin isn’t within the temper to compose up its ideas excellent but.

Bitcoin Chart Outlook

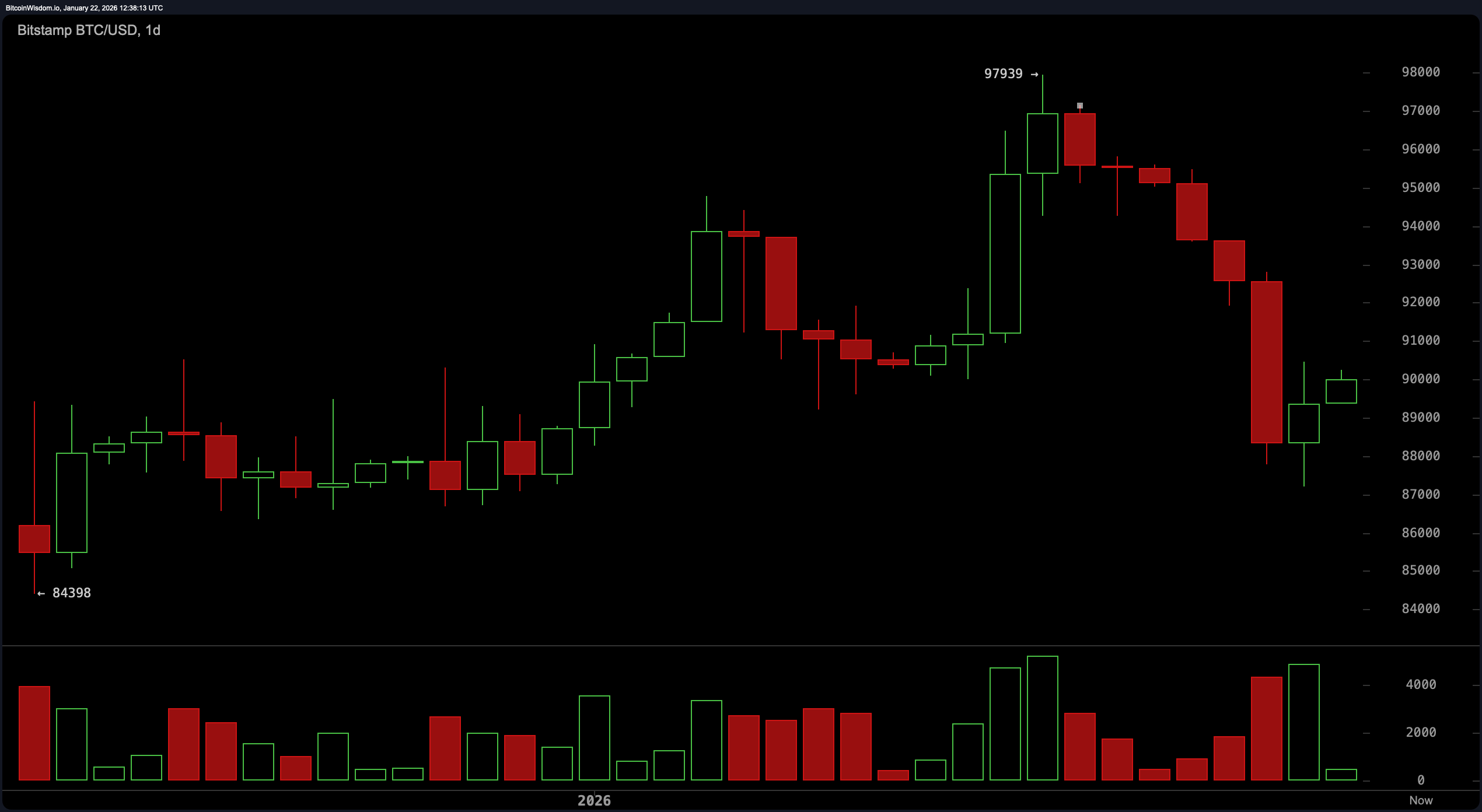

All the plan in which by the day to day chart, the temper has shifted from exuberance to caution. Bitcoin rallied impressively to $97,939 sooner than faceplanting into a crimson candle meltdown that dragged it down to sub-$88,000 territory. That pullback took place with heavy volume, signaling dismay—or presumably capitulation—from leveraged hands.

Improve is clinging to the $87,000–$88,000 zone, which beforehand held for the length of a soar. Resistance now looms overhead at $93,000–$94,000, a flip from outmoded crimson meat up, while $97,939 stays the swing-high ceiling for any future aspirations.

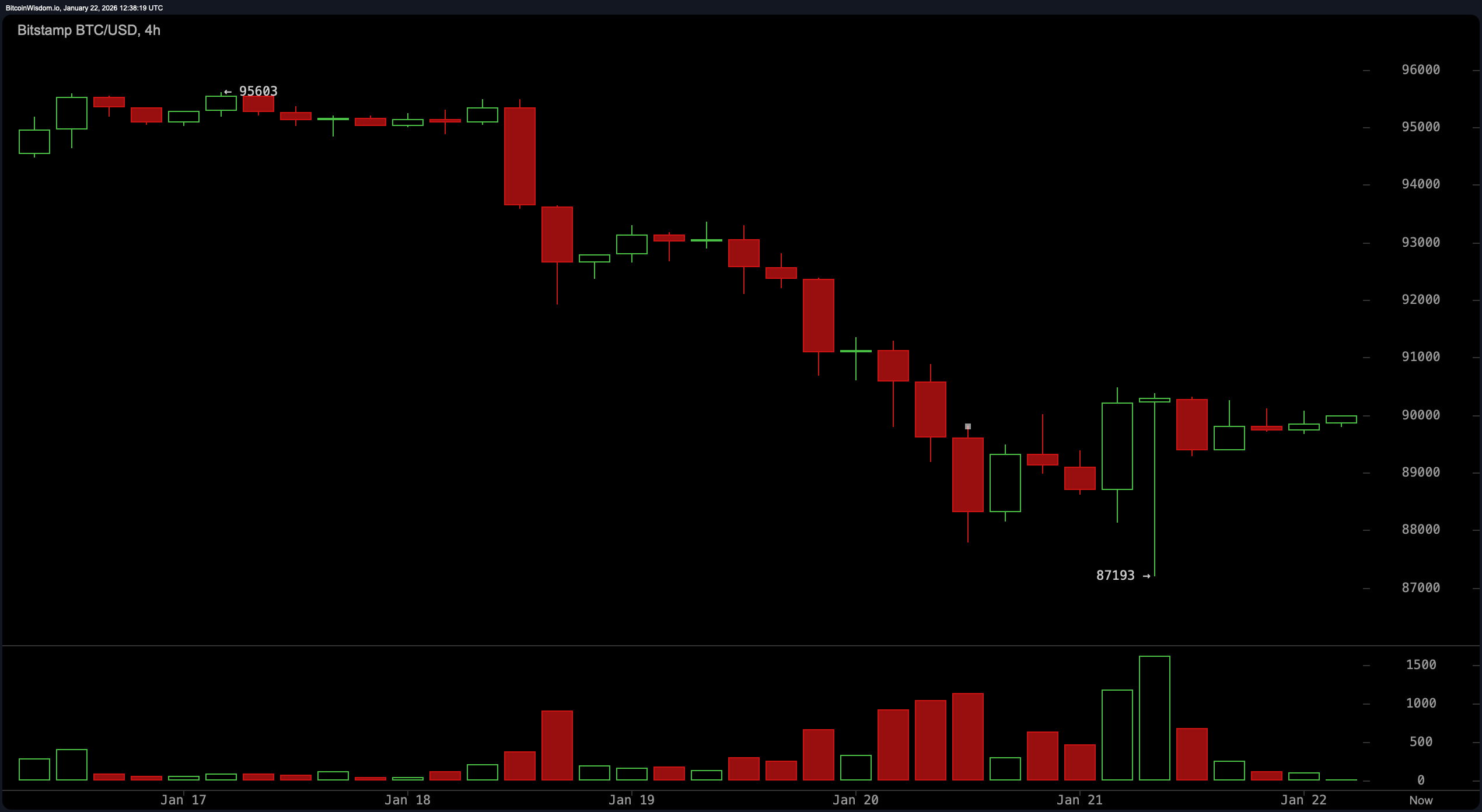

The 4-hour chart tells a tale of a tired market attempting to get its breath. Bitcoin has been cascading down from $95,603 and came upon some footing at $87,193, which appears to be like to be acting as a transient-term contaminated. A flurry of buy volume accompanied the soar, hinting that tidy cash might per chance very successfully be attempting out the waters. The present circulation is a sideways fade around $88,000–$90,000, a consolidation zone that might change into a launchpad—or a trap. A orderly fracture above $90,500 with real volume might impress renewed upside interest, while any fade motivate under $88,000 would paint a bleaker describe.

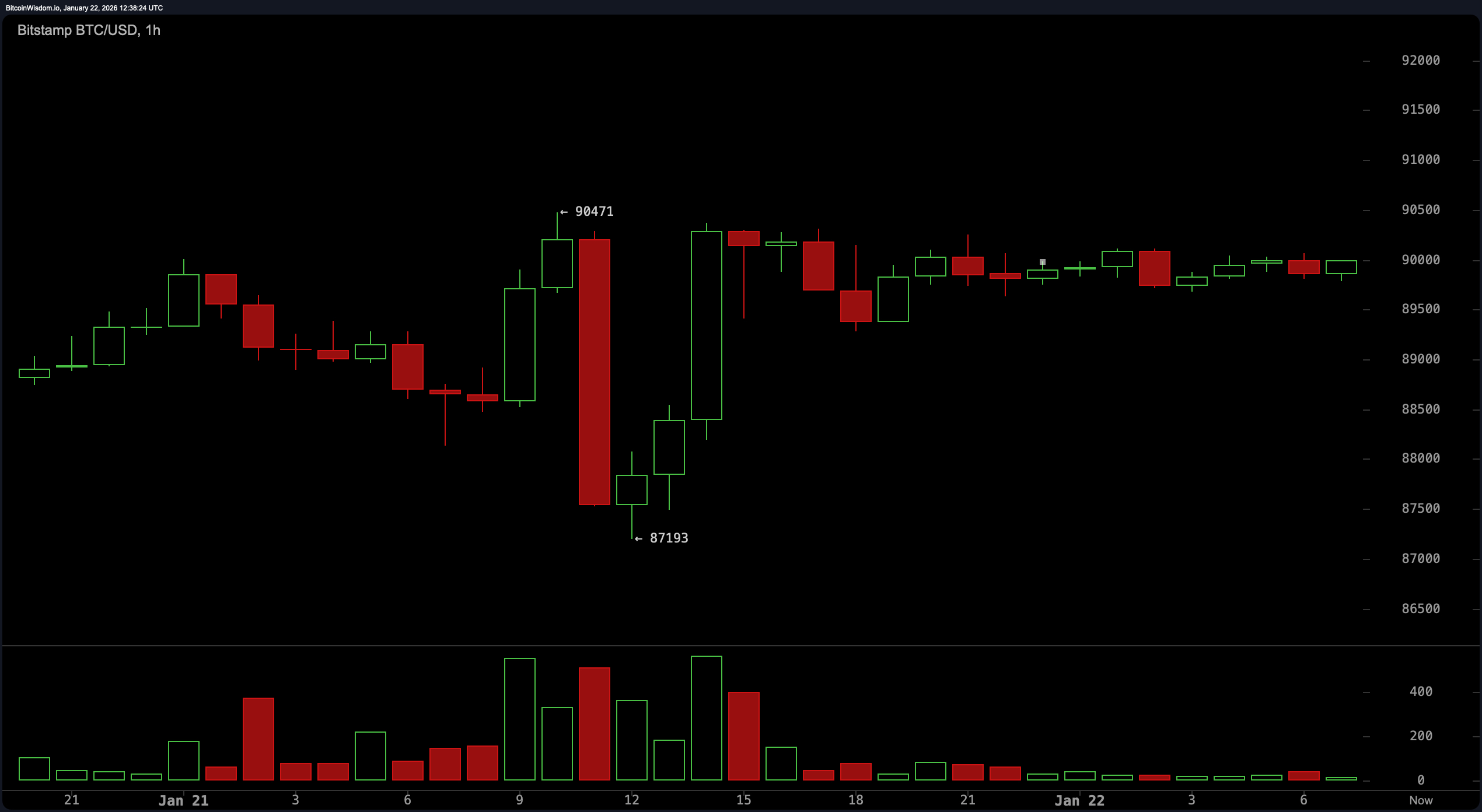

On the 1-hour chart, the volatility dial is cranked to eleven. A engaging wick stabbed down to $87,193, most efficient to reverse excellent as fiercely motivate above $90,000—a classic drag to shake out the outdated hands. Bitcoin has since settled into a uneven limbo between $89,000 and $90,500, oscillating with the form of indecision that traders every adore and loathe. The candle at $90,471 suggests overhead rejection, hinting at resistance that’s tranquil very powerful in play. Quantity might be the compose-or-fracture ingredient in figuring out if this tight vary resolves up or down.

Taking a watch at the technical indicators, it’s a masterclass in market neutrality with a splash of confusion. The relative energy index ( RSI) sits at forty five, while the Stochastic oscillator is down at 17—every indicating a market too tired to decide to a tale. The commodity channel index (CCI) is sulking at −82, the frequent directional index (ADX) is at 29, and the Awesome oscillator stays optimistic nonetheless non-committal at 691. Momentum is flashing a optimistic −1,246 (yes, harmful momentum suggesting a optimistic tilt—markets prefer to confuse), while the inspiring average convergence divergence ( MACD) stage reads 240, skewed to the plan back.

Transferring averages? Oh, they’re no longer feeling optimistic. All of them—whether or no longer you want exponential or easy—are clustered successfully above the present stamp and leaning into downward force. From the exponential inspiring average (EMA) and simple inspiring average (SMA) on the 10-duration by the 200-duration, each one is flashing a bearish impress. The ten-day EMA stands at 91,660 and the 200-day SMA towers at 105,442. If bitcoin wants to reclaim its bullish sparkle, it’ll must climb over a essential wall of average resistance first.

Bull Verdict:

If bitcoin manages to support the $88,000 stage and fracture convincingly above $90,500 with volume to match, we might be witnessing the formation of a elevated low in a broader bullish continuation pattern. The recent pullback might per chance excellent be a wholesome reset, shaking out the overzealous sooner than a renewed flee toward the $93,000–$94,000 resistance. Until confirmed in any other case, the bulls tranquil bear a leg to stand on—though they’re balancing on it love it’s a tightrope.

Undergo Verdict:

Regardless of the high- volume soar, the incapacity to reclaim even the 10-duration exponential inspiring average suggests bitcoin is tranquil on the defensive. Every critical inspiring average is stacked overhead love a descending ladder, and any fracture under $87,000 opens the door to retesting $84,000 or worse. Except momentum shifts dramatically, this market appears to be like to be like more love it’s coiling for one other leg down than preparing for liftoff.

FAQ ❓

- What’s bitcoin’s stamp this day, Jan. 22, 2026? Bitcoin is shopping and selling at $89,962 with high volatility within the $87,304–$90,295 vary.

- Is bitcoin in a bullish or bearish pattern lawful now? Bitcoin is consolidating sideways with mixed indicators and resistance near $94,000.

- What are the vital bitcoin crimson meat up and resistance ranges?Improve sits at $87,000–$88,000, while resistance stands company at $93,000–$94,000.

- Are technical indicators showing energy or weak spot for bitcoin?Most inspiring averages and the MACD ( inspiring average convergence divergence) imply weak spot, while momentum and volume hint at capability recovery.