Bitcoin’s mark plunged at the originate of the week. On the opposite hand, it considerably recovered losses by a weekend rebound, stabilizing advance $106,000 mark. The weekly decline, which had approached -10%, within the spoil closed at -4.Ninety nine%.

The rebound modified into once driven by files of an drawing end spoil to the US executive shutdown and a social media publish from President Trump.

‘Immense Short’ Rumors Triggered Preliminary Plunge

The initial fall modified into once sparked by deteriorating sentiment within the US stock market. On Tuesday, files broke that significant endure Michael Burry had established a $1.2 billion immediate field in AI shares like Nvidia (NVDA) and Palantir (PLTR). This files inspired skeptical investors to promote, leading to declines across all three predominant US stock indexes.

Despite the conventional residing lying with AI equities, the crypto sector observed a steeper decline: BTC fell roughly 5% that day, while altcoins recorded even bigger losses.

On-chain analysts attributed the exciting fall to an exodus of institutional investors. Fundamental players had been lowering crypto positions attributable to the October 10 “Shaded Friday” crash. Subsequently, the Tuesday stock market turbulence caused the already fragile present-question balance to interrupt down.

The market imbalance worsened immediate, pushing Bitcoin beneath the psychological $100,000 make stronger on Wednesday, to a low of $Ninety nine,000.

365-Day MA Holds as Severe Pork up

Analysts watched nervously, intellectual an additional fall would spoil the 365-day Transferring Reasonable (MA) line—a principal inflection point customarily marking the originate of a endure market.

Fortunately, doubtlessly the most stylish fall didn’t breach this line. Bitcoin stumbled on make stronger and rebounded, efficiently holding the 365-day MA as it had sooner or later of two previous crises: the August 2024 Yen elevate-exchange unwinding and the April 2025 tariff disaster.

Ethereum (ETH), the 2nd-finest crypto, plummeted to $3,100 on Wednesday. On the opposite hand, it recovered alongside Bitcoin, rising above the $3,600 level by Sunday, even though its weekly loss stood at -6.55%.

Shutdown Resolution Becomes the Fundamental Catalyst

Real by the extended trot, analysts actively hoped for the spoil of the month-long US executive shutdown. This modified into once attributable to the shutdown modified into once broadly believed to be lowering market liquidity by halting executive spending.

The shutdown has resulted in roughly 750,000 federal employees being furloughed and a with regards to 10% surge in flight delays attributable to pay suspensions for air web insist online web insist online visitors controllers. Sooner or later, this has disrupted wanted make stronger programs.

Raoul Ultimate friend, founder of RealVision, argued that the spoil in US fiscal policy modified into once worsening market liquidity, with the crypto sector bearing the brunt. He predicted the shutdown’s decision would be a robust capability catalyst for a bullish reversal.

This belief modified into once validated on Sunday when Senate Majority Leader John Thune hinted at the prospective for ending the shutdown. The records straight spurred a Bitcoin rally. Thune’s feedback caused the having a wager market on Polymarket to shift greatly; the likely spoil date for the shutdown moved from November twentieth to November 11th.

Trump’s Dividend Focus on Fuels Aquire Impulse

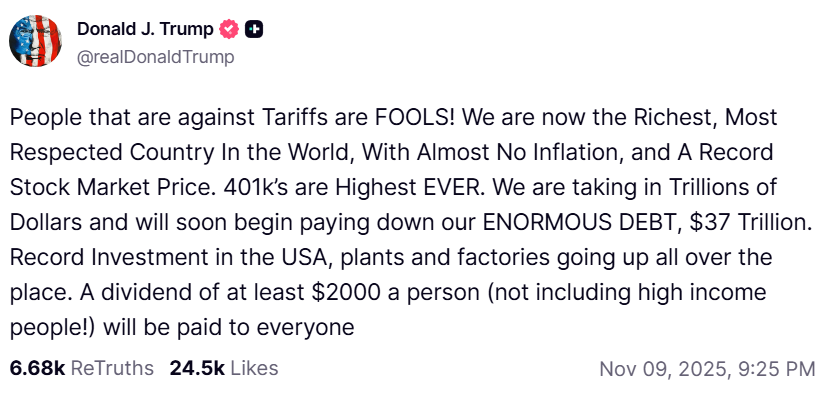

Simultaneously, a social media publish from President Trump equipped one other catalyst. He wrote: “Other folks which will likely be against Tariffs are FOOLS!…A dividend of in any case $2000 a particular person (no longer in conjunction with excessive earnings other folks!)”

The probability of declare cash funds to electorate would possibly well moreover very effectively be channeled into stock or crypto purchases. This possibility straight pushed Bitcoin from the $103,000 vary to over $105,000.

The Week Ahead: Politics and the Fed

The most serious ingredient this week will likely be whether or no longer the US executive shutdown ends immediate. Preliminary procedural vote in Congress is anticipated on Tuesday. As the shutdown has suspended most US macro files series for over a month, the influence of these figures will likely be microscopic for now.

Consideration stays mounted on the aptitude for another Fed rate nick within the December FOMC meeting. Several influential Fed officials are scheduled to focus on this week, in conjunction with:

- On Monday, Mary Daly (San Francisco Fed President) and Alberto Musalem (St. Louis Fed President),

- On Wednesday, John Williams (New York Fed President), Anna Paulson (Philadelphia Fed President), Raphael Bostic, Chris Waller, Stephen Miran, and Susan Collins.

The insist material of these speeches is anticipated to have an effect on Bitcoin volatility considerably.

The publish Shutdown Hopes, Trump Dividend Focus on Take Bitcoin to $106K appeared first on BeInCrypto.