Stellar (XLM) is up 11% over the previous seven days, bringing its market cap to almost $9 billion as bullish momentum continues to fabricate. After a period of consolidation, fresh indicators counsel that XLM also can honest be making ready for any other hasten increased.

Whereas technicals devour RSI and DMI reflect rising buyer energy, the price has yet to enter the overbought territory, signaling doubtless room for extra upside.

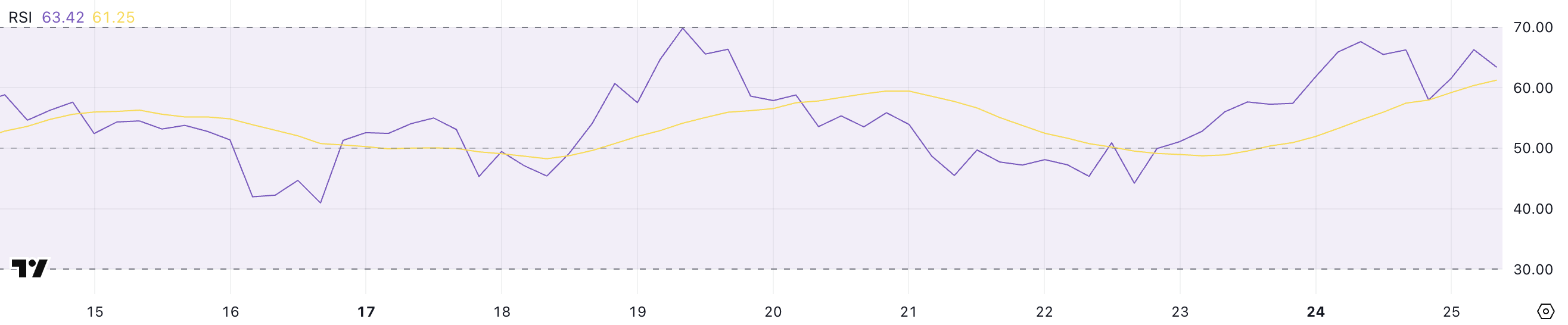

XLM RSI Paints A Bullish Picture

Stellar’s Relative Energy Index (RSI) is at the moment at 63.42, showing a solid upward thrust from 44.21 correct three days ago. The indicator has been keeping above 55 since the day gone by, suggesting a considerable shift in momentum towards bullish territory.

This fresh amplify points to rising procuring for interest, doubtlessly positioning Stellar for a breakout if momentum continues constructing.

On the opposite hand, no subject the upward hasten, it’s price noting that Stellar’s RSI has now not crossed the 70 impress since March 2. This potential that whereas investors are energetic, the asset hasn’t entered overbought or excessive-momentum conditions in nearly a month.

RSI, or Relative Energy Index, is a momentum oscillator that measures the scuttle and magnitude of up-to-the-minute tag adjustments to evaluate overbought or oversold conditions.

The RSI scale ranges from 0 to 100, with values above 70 indicating that an asset also can honest be overbought and due for a correction, and readings below 30 signaling oversold conditions and doubtless for a rebound. On the total, values between 50 and 70 counsel life like bullish momentum, whereas 30 to 50 technique bearish.

With XLM’s RSI now at 63.42, the vogue looks determined, but the failure to breach 70 since early March may presumably maybe maybe indicate a cautious market soundless attempting ahead to stronger conviction earlier than pushing increased.

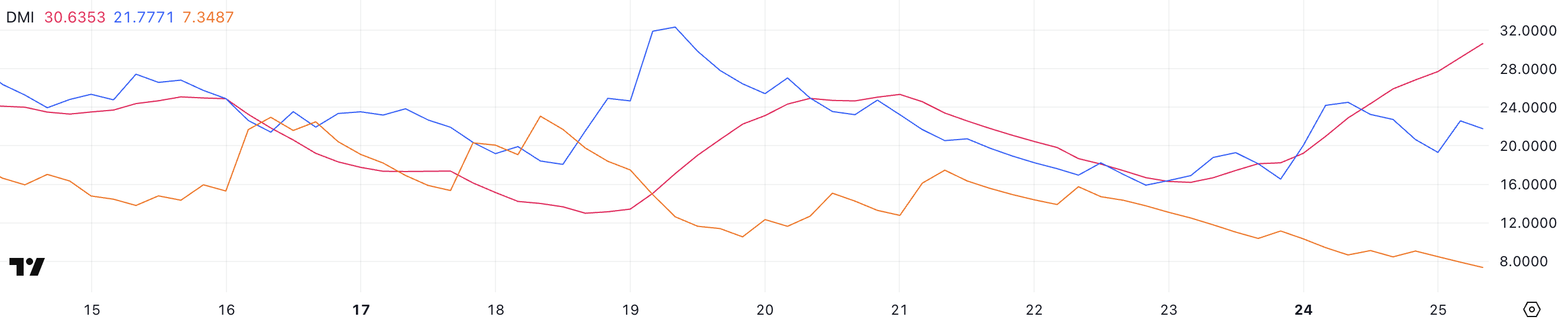

Stellar DMI Reveals Shoppers Are In Corpulent Alter

Stellar’s DMI (Directional Circulation Index) chart reveals that its ADX is at the moment at 30.63, up sharply from 16.2 correct two days ago.

This indispensable upward thrust in the ADX means that a vogue is strengthening, confirming that the present tag hasten—whether or now not up or down—is gaining momentum. At the same time, the +DI line, which tracks bullish stress, is at 21.77, a little bit down from 24.5 the day gone by, whereas the -DI line, which displays bearish stress, has also declined from 8.65 to 7.34.

Despite the exiguous dip in procuring for energy, the wide gap between the +DI and -DI lines soundless favors the bulls, indicating that the continuing vogue is upward, even though presumably cooling off in intensity.

The ADX, or Practical Directional Index, is a enlighten of the DMI blueprint and is passe to quantify vogue energy no subject direction. Readings below 20 in general show a worn or non-existent vogue, whereas values above 25 counsel a strengthening vogue and these above 30 verify a solid one.

The +DI and -DI lines, on the opposite hand, abet settle the direction of that vogue—whichever is increased signifies whether or now not investors (+DI) or sellers (-DI) are as much as the impress.

With ADX rising above 30 and +DI comfortably above -DI, Stellar looks to be in a get uptrend. On the opposite hand, the unusual dip in +DI also can honest be an early stamp of fading momentum, making the next few days necessary for confirming whether or now not bulls can support administration.

Can XLM Break Above $0.40 In April?

Stellar’s EMA lines are showing signs of a doubtless surge, with temporary appealing averages nearing a crossover above longer-term lines.

If this crossover materializes, this is in a position to presumably maybe also honest invent a bullish “golden mistaken” sample, most regularly viewed as a solid signal for upward continuation.

This technical setup may presumably maybe maybe allow Stellar tag to push increased towards the $0.30 level, with extra upside targets around $0.349 and $0.375 if momentum quickens. This could doubtlessly pave the technique for a upward thrust above $0.40 in April.

The convergence of these EMAs suggests constructing bullish stress, which, if confirmed by tag circulate, also can honest soon consequence in a breakout.

On the opposite hand, if the anticipated golden mistaken fails to materialize and as a substitute a downtrend takes shape, Stellar also can honest get itself attempting out the give a rob to level around $0.27.

A destroy below that give a rob to may presumably maybe maybe house off extra declines towards $0.25, and if promoting intensifies, at the same time as little as $0.22.