Shiba Inu (SHIB) is struggling to safe away of a falling channel sample after a brief-lived rally. Amid bearish power from derivatives and revenue-taking by long-term holders, will SHIB drop to the principal enhance stage at $0.000010?

With a pullback amongst high meme money, Shiba Inu continues to face challenges escaping the falling channel sample. Will SHIB surpass the overhead trendline or tumble to the principal $0.000010 enhance stage?

Shiba Inu Designate Analysis

Shiba Inu has been exhibiting a falling channel sample since early May maybe, when it did not damage above $0.000017. After shedding below the 50-day EMA, the meme coin reached a monthly low reach $0.000012.

At the moment, SHIB is trading at $0.00001288, experiencing an intraday pullback of nearly about 2%. Despite a 5% worth surge on Monday, which hinted at a likely breakout from the falling channel, the intraday pullback signals a likely bearish reversal.

On the opposite hand, the MACD and signal traces are drawing reach a bullish crossover, indicating likely momentum.

Within the tournament of a breakout rally, the 23.6% Fibonacci stage at $0.00001590 is a key worth target. Non eternal resistance lies at the 100-day EMA at $0.00001418.

Conversely, principal enhance remains at the lower boundary of the falling channel and the psychological $0.000010 stage.

Long-term Investors E-book Profits

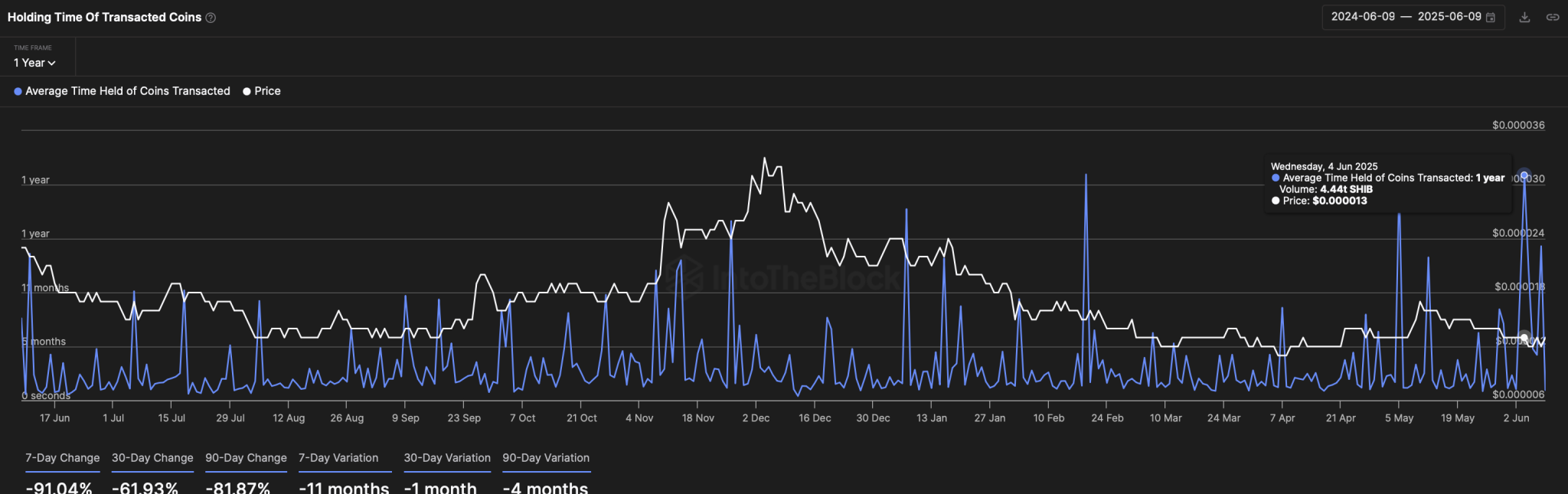

Amid the 6.3% worth rupture on June 5, Shiba Inu on-chain files finds principal revenue-taking by long-term investors on June 4. Basically primarily based totally on IntoTheBlock’s Preserving Time of Transacted Coins indicator, 4.44 trillion SHIB tokens, with a median retaining duration of one one year, were offered, reflecting sales seemingly at a revenue given the cost stages sooner than the rupture.

This reflects sizable revenue-taking by investors who held Shiba Inu tokens for nearly just a few one year, signaling declining self belief.

Derivatives Merchants Predict Pullback in SHIB

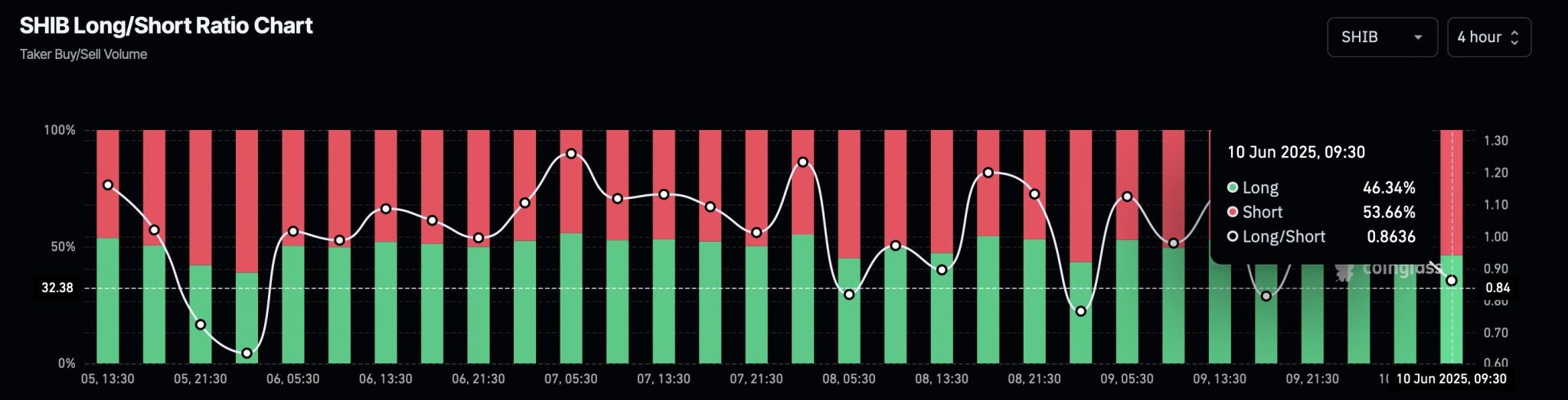

With the intraday pullback, the Coinglass files showcases a surge in bearish power in Shiba Inu derivatives. The long-to-quick ratio chart indicates that quick positions luxuriate in increased to fifty three.66% all over the final four hours, reducing the long-to-quick ratio to 0.8636.

This implies the next bearish affect, making an try ahead to a steeper correction in Shiba Inu.