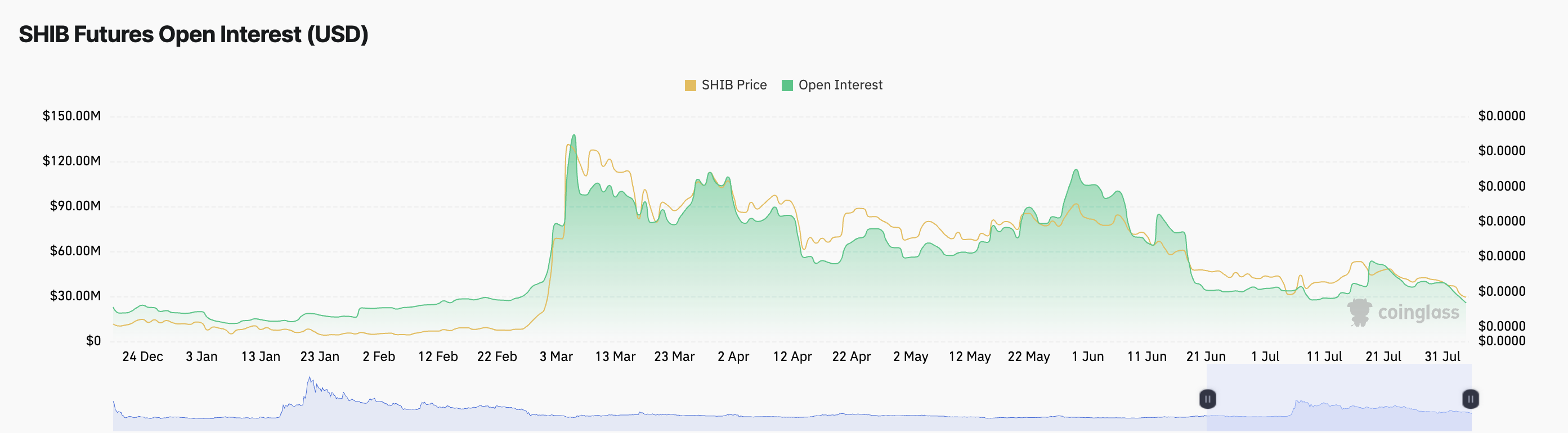

Shiba Inu’s (SHIB) derivatives market has seen a decline in exercise within the previous few weeks. That is mirrored in its falling futures launch passion, which now sits at its lowest stage since February 14.

This decline is attributable to the tumble within the meme coin’s designate. As of this writing, SHIB trades at $0.000014, a designate stage it last reached on March 1.

Shiba Inu Traders Defend Away From Making a wager on the Coin’s Future Tag Movements

Based utterly on Coinglass, SHIB’s futures launch passion is $26 million. It has declined persistently since July 19, shedding by 51% within the previous 16 days.

An asset’s futures launch passion refers to the whole number of significant futures contracts that have not been settled. When it declines, it signifies a decrease in market exercise and passion within the underlying asset. It is in most cases interpreted as a bearish signal which suggests that merchants have gotten less confident within the future designate of the asset.

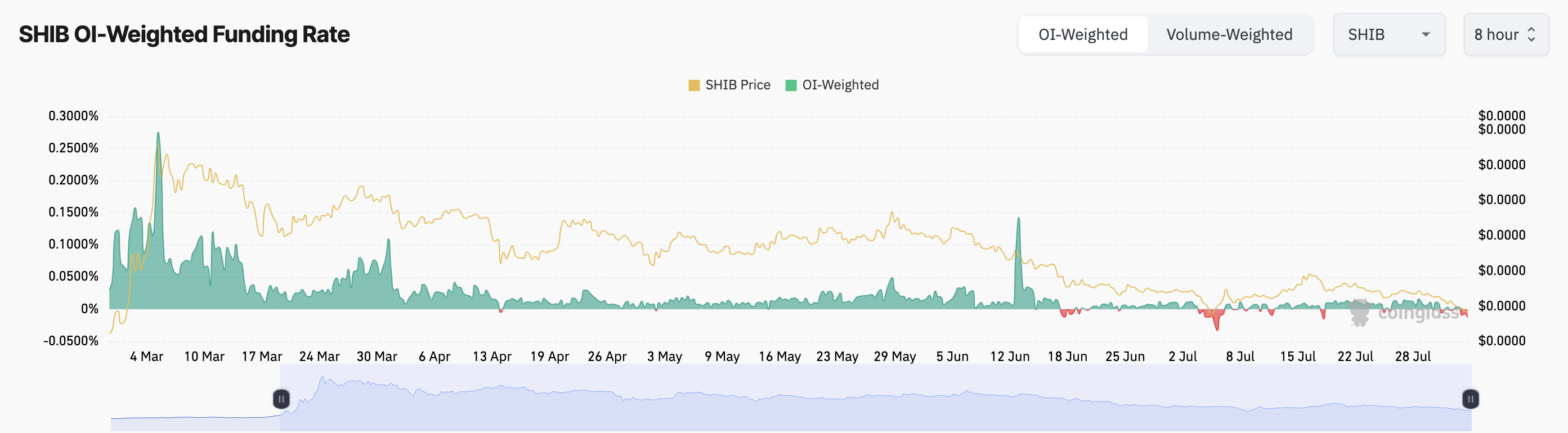

Nonetheless, SHIB’s predominantly sure funding fee across cryptocurrency exchanges suggests that this could well presumably not be only for the meme coin.

For context, because it climbed to a year-to-date height of $0.000035 on March 6, SHIB’s designate has maintained a downtrend. Nonetheless, its weighted funding fee has remained primarily sure since then, highlighting the constant inquire for lengthy positions among futures merchants.

Read extra: Shiba Inu — A Beginner’s Handbook

Funding charges are a mechanism utilized in perpetual futures contracts to make obvious an asset’s contract designate stays shut to its place aside of residing designate. When they’re sure, it approach extra merchants are procuring the asset and attempting ahead to a designate rally than these procuring and hoping for a decline, which is a bullish signal.

SHIB Tag Prediction: Is Rebound Underway?

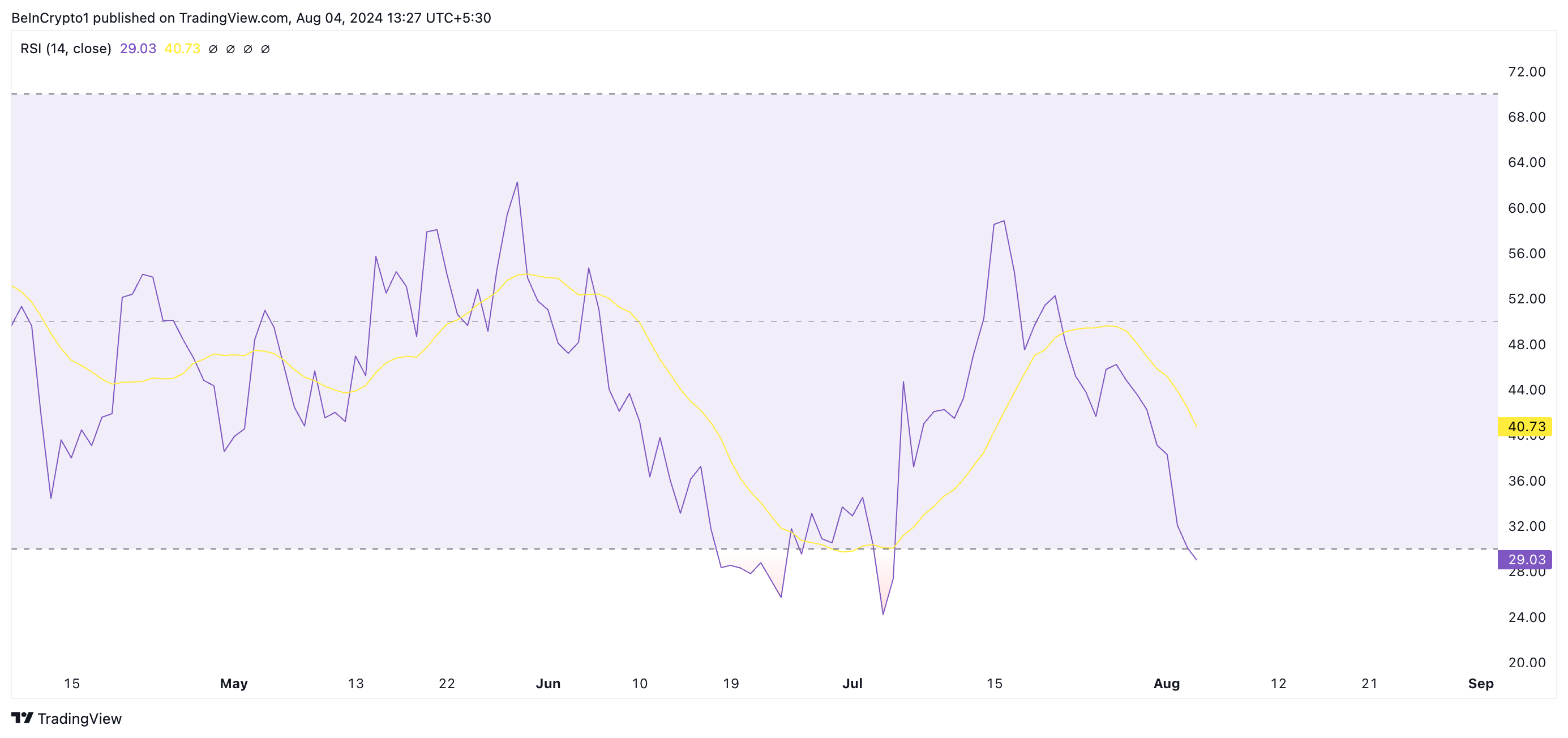

SHIB’s Relative Energy Index (RSI), assessed on a one-day chart, suggests a seemingly designate rebound. At press time, the indicator’s designate is 29.03.

An asset’s RSI indicator measures its oversold and overbought market circumstances. At 29.03, SHIB’s RSI suggests that the meme coin could presumably perhaps furthermore be oversold and due for an upward correction.

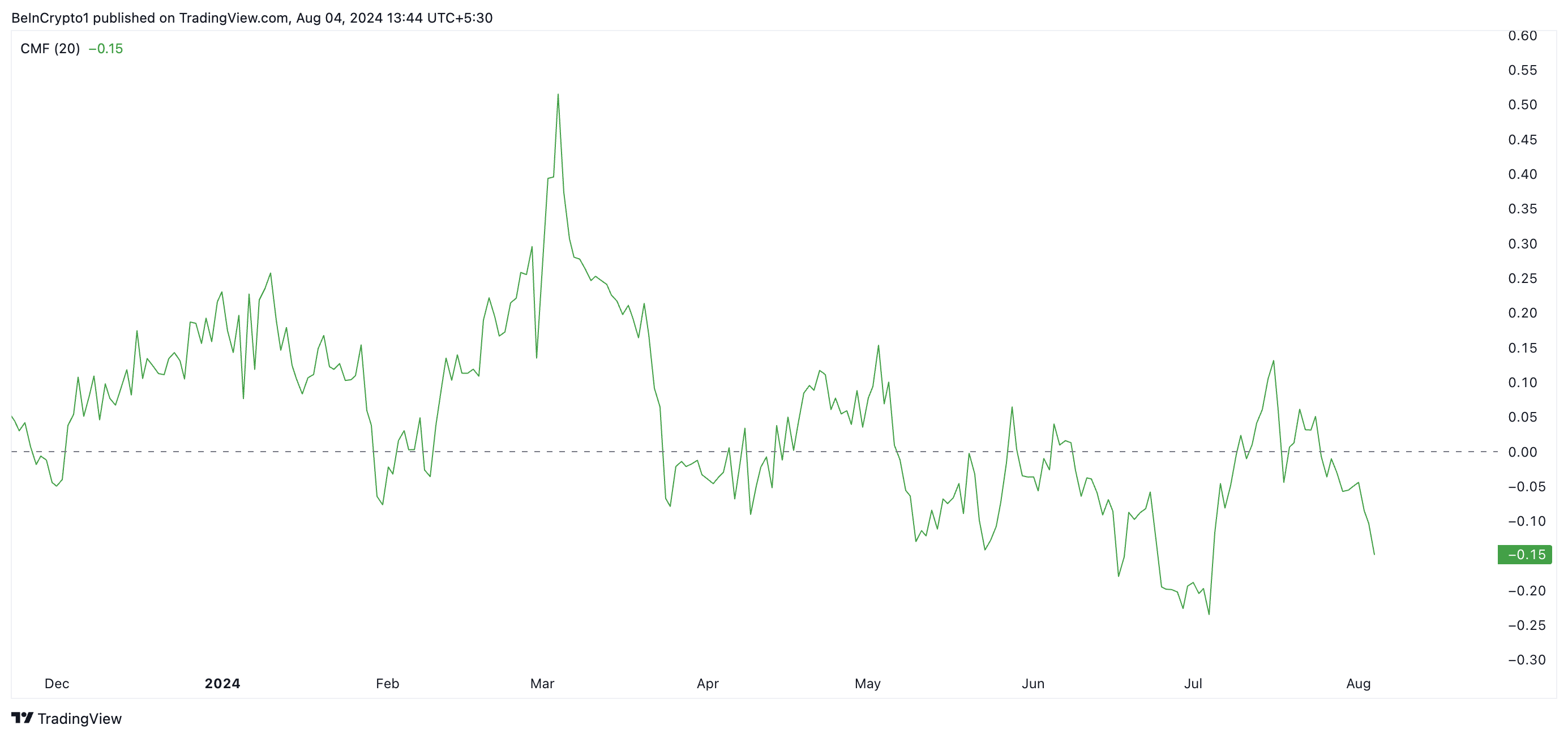

Nonetheless, readings from its other indicators signal that the rebound could presumably not happen within the shut to time-frame. To illustrate, SHIB’s designate decline has been accompanied by a falling Chaikin Money Waft (CMF). At press time, SHIB’s CMF is beneath zero at -0.15 and in a downtrend.

This indicator tracks the waft of cash into and out of an asset. A CMF designate beneath zero is a signal of market weakness.

A falling designate coupled with a declining and detrimental CMF suggests a convincing bearish pattern. The falling CMF implies extra money is flowing out of the asset than into it, reinforcing the bearish pattern and making it sure that selling stress critically outweighs procuring stress.

If this pattern continues, SHIB’s designate will tumble to $0.000012. It last traded at this designate stage on July 5.

Read extra: 12 Most productive Shiba Inu (SHIB) Wallets in 2024

Nonetheless, if the market pattern reverses and extra liquidity begins to waft into SHIB than out of it, it can presumably compare a rally, pushing its designate to $0.000020.