Shiba Inu’s model has already crashed by over 60% from its November highs, and each technical and vital factors show conceal further downside in the as regards to term.

- Shiba Inu model has crashed by over 60% from its perfect level in November.

- It has shaped a bearish flag pattern, pointing to a solid bearish breakdown in the upcoming weeks.

- Top metrics like burn fee and Shibarium TVL delight in all plunged this 12 months.

Shiba Inu model at risk as necessary metrics dip

Shiba Inu, the absolute very best meme coin on Ethereum (ETH) continues to ride feeble metrics that locations its efficiency at risk.

Recordsdata compiled by Shibburn reveals that the burn fee as dwindled in the past few days. It dropped by 72% on Tuesday, Aug. 12, to 181,928, which would per chance maybe well be equal to true $2.

Traditionally, SHIB model tends to carry out better when the burn fee is rising, as diminished inflation boosts investor sentiment.

Shibarium, its layer-2 network, has moreover struggled to entice builders and merchants. Its whole worth locked has fallen 10% in the past 30 days to $1.75 million, making it a minor player in an replace with a total TVL of nearly $300 billion.

Investor demand for Shiba Inu has weakened this 12 months. Its 24-hour trading volume is $222 million, far below Dogecoin’s $1.7 billion and Pepe’s $698 million. Futures commence curiosity has dropped to below $155 million.

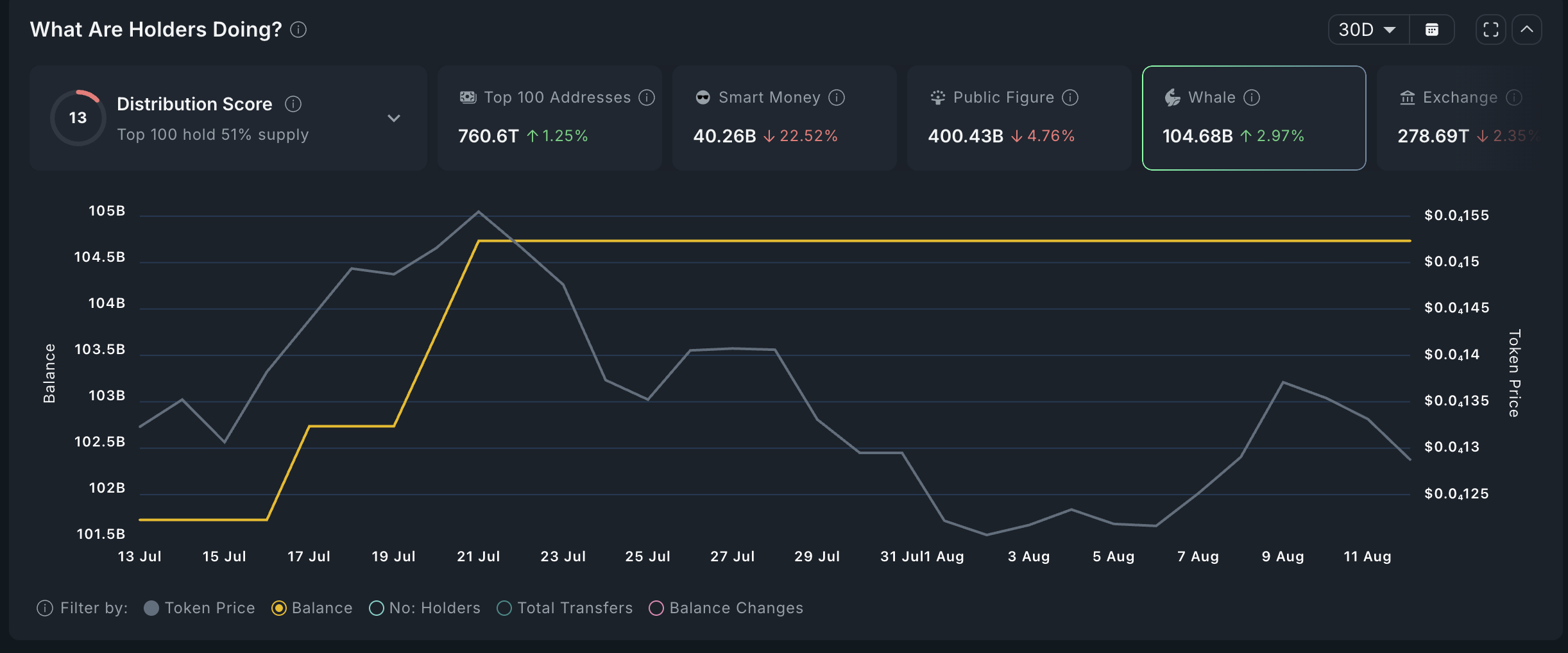

Nansen files indicates that whales and trim cash merchants are now no longer accumulating Shiba Inu. Whale holdings dwell at 104.68 billion tokens, unchanged since July 21, while trim cash holdings delight in fallen 22% in the past 30 days to 40.25 billion.

Whale and trim cash holdings are vital due to those merchants are idea to be more experienced and advanced than conventional retail merchants.

Shiba Inu’s feeble efficiency is partly attributable to merchants moving toward more recent meme cash, especially these in the Solana ecosystem, cutting again demand for SHIB.

One sure indicate is that alternate supply has continued to decline this 12 months, at the 2d at 278 billion SHIB, down from final month’s high of 285 trillion.

Shiba Inu model technical prognosis

The three-day chart reveals that SHIB has moved sideways since February, trading between improve at $0.00001070 and resistance at $0.00001750.

The coin has shaped a bearish flag pattern, consisting of a vertical decline adopted by a horizontal channel.

SHIB has moved below the 50-day and 100-day Exponential Transferring Averages, indicating that bears dwell unsleeping to the ticket for now.

A bearish breakdown will be confirmed if SHIB falls below the lower aspect of the flag at $0.00001070. A drop below this improve would signal more downside in the as regards to term.