- Shiba Inu’s mark hovers spherical $0.000021 on Tuesday after retesting and bouncing off from key strengthen the day prior to this.

- Sideline investors having a eye to procure SHIB can attain so within the $0.000019 to $0.000021 vary.

- A every day candlestick discontinuance below $0.000019 would invalidate the bullish thesis.

Shiba Inu (SHIB) mark hovers spherical $0.000021 on Tuesday after retesting and bouncing off from key strengthen the day prior to this. Sideline investors having a eye to procure SHIB can attain so at strengthen phases from $0.000019 to $0.000021.

Shiba Inu mark appears promising for a recovery rally

Shiba Inu’s mark declined to retest its every day strengthen level at $0.000019 on Monday. This strengthen level coincides with its 61.8% Fibonacci retracement (drawn from the August 5 low of $0.000010 to the December 8 excessive of $0.000033), making it a key reversal zone. When writing on Tuesday, it trades a little bit better, above its 200-day Exponential Transferring Moderate (EMA) at $0.000021.

Sideline investors having a eye to procure SHIB tokens can attain so spherical $0.000019.

If the $0.000019 holds as strengthen and SHIB closes above the $0.000022 weekly resistance, it can per chance per chance prolong the rally to retest its subsequent weekly resistance at $0.000028.

The Relative Energy Index (RSI) reads 44 within the every day chart, below its just level of 50, indicating a shrimp bearish momentum. On the opposite hand, the Transferring Moderate Convergence Divergence (MACD) indicator flattens spherical its just level of zero, suggesting indecisiveness amongst merchants.

SHIB/INU USDT every day chart

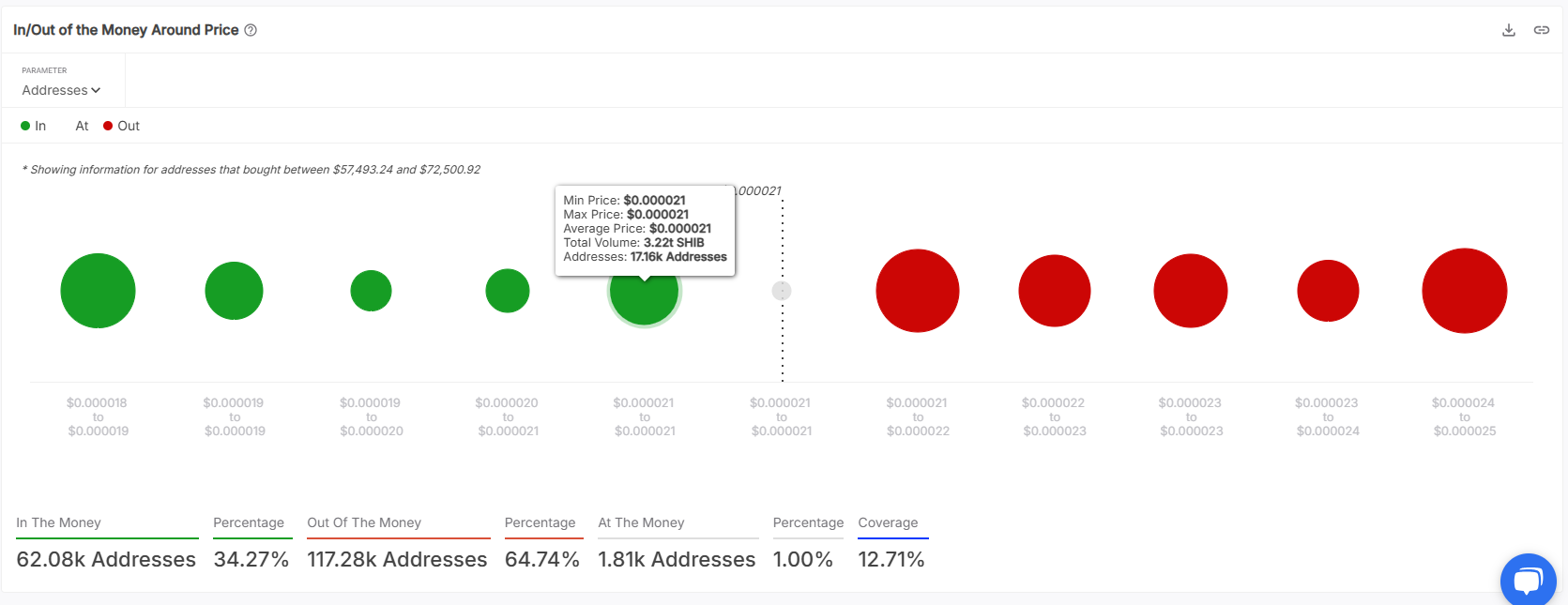

On the opposite hand, on-chain recordsdata formula to a bullish outlook for Shiba Inu mark. In response to IntoTheBlock’s In/Out of the Money Arrangement (IOMAP), approximately 17,160 addresses sold 3.22 trillion SHIB tokens at an moderate mark of $0.000021. If the mark falls at this level, many investors could per chance add more to their positions, making this a key reversal level to behold for.

From a technical diagnosis level of view, the $0.000019 to $0.000021 strengthen level aligns with the IOMAP findings, marking this zone as a necessary reversal divulge show screen.

SHIB IOMAP chart. Offer: IntoTheBlock

In response to Coinglass’s OI-Weighted Funding Charge recordsdata, the amount of merchants making a guess that the mark of SHIB will rally is better than that searching forward to a mark descend.

This index is according to the yields of futures contracts, which are weighted by their initiate hobby rates. Basically, a sure charge (longs pay shorts) signifies bullish sentiment, whereas unfavorable numbers (shorts pay longs) point out bearishness.

In the case of SHIB, this metric stands at 0.0103%, reflecting a sure charge. This scenario assuredly signifies bullish sentiment available within the market, suggesting doable upward pressure on Shiba Inu’s mark.

SHIB OI-Weighted Funding Charge chart. Offer: Coinglass

Even supposing on-chain metrics strengthen the bullish outlook, if Shiba Inu closes below $0.000019 on the every day chart, the bullish thesis would be invalidated by creating a lower low. This vogue could per chance see SHIB’s mark decline by a further 15% to retest its November 3 low of $0.000016.